方差-协方差法

方差-协方差法是一种基于资产收益率正态性假设的VaR计算方法。其核心思想是通过历史数据估计资产收益率的均值、方差和协方差矩阵,构建投资组合收益率的概率分布,继而计算VaR值。

具体流程可分为以下三步:

首先,计算资产收益率的协方差矩阵以衡量风险关联;其次,根据投资组合权重计算组合收益率的期望值和标准差;最后,在给定置信水平下,利用正态分布分位数确定VaR值。例如,在95%置信水平下,单日VaR可表示为组合市值的绝对值乘以其标准差再乘1.645(对应正态分布左尾5%分位数)。该方法计算效率高,但对非线性风险和非正态分布敏感。多日VaR可通过时间平方根法则调整,即单日VaR乘 \(\sqrt{T}\) 得到。

R代码实现

# 加载必要包

library(quantmod)

## 载入需要的程序包:xts

## 载入需要的程序包:zoo

##

## 载入程序包:'zoo'

## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric

## 载入需要的程序包:TTR

## Registered S3 method overwritten by 'quantmod':

## method from

## as.zoo.data.frame zoo

library(PerformanceAnalytics)

##

## 载入程序包:'PerformanceAnalytics'

## The following object is masked from 'package:graphics':

##

## legend

library(ggplot2)

library(dplyr)

##

## ######################### Warning from 'xts' package ##########################

## # #

## # The dplyr lag() function breaks how base R's lag() function is supposed to #

## # work, which breaks lag(my_xts). Calls to lag(my_xts) that you type or #

## # source() into this session won't work correctly. #

## # #

## # Use stats::lag() to make sure you're not using dplyr::lag(), or you can add #

## # conflictRules('dplyr', exclude = 'lag') to your .Rprofile to stop #

## # dplyr from breaking base R's lag() function. #

## # #

## # Code in packages is not affected. It's protected by R's namespace mechanism #

## # Set `options(xts.warn_dplyr_breaks_lag = FALSE)` to suppress this warning. #

## # #

## ###############################################################################

##

## 载入程序包:'dplyr'

## The following objects are masked from 'package:xts':

##

## first, last

## The following objects are masked from 'package:stats':

##

## filter, lag

## The following objects are masked from 'package:base':

##

## intersect, setdiff, setequal, union

# 1. 下载股票数据(示例使用苹果、微软、亚马逊)

symbols <- c("AAPL", "MSFT", "AMZN")

getSymbols(symbols, src = "yahoo", from = "2022-01-01", to = Sys.Date())

## [1] "AAPL" "MSFT" "AMZN"

# 2. 提取收盘价并合并

prices <- merge(Cl(AAPL), Cl(MSFT), Cl(AMZN)) %>% na.omit()

colnames(prices) <- symbols

# 3. 计算对数收益率

returns <- na.omit(Return.calculate(prices, method = "log"))

# 4. 设定投资组合参数

weights <- c(0.3, 0.4, 0.3) # 组合权重

conf_level <- 0.95 # 置信水平

portfolio_value <- 1e6 # 组合价值(美元)

# 5. 计算协方差矩阵与组合标准差

cov_matrix <- cov(returns)

port_sd <- sqrt(t(weights) %*% cov_matrix %*% weights)

# 6. 计算单日VaR

var_1d <- abs(portfolio_value * qnorm(1 - conf_level) * port_sd)

# 7. 计算5日VaR(时间平方根法则)

var_5d <- var_1d * sqrt(5)

# 8. 可视化VaR分布

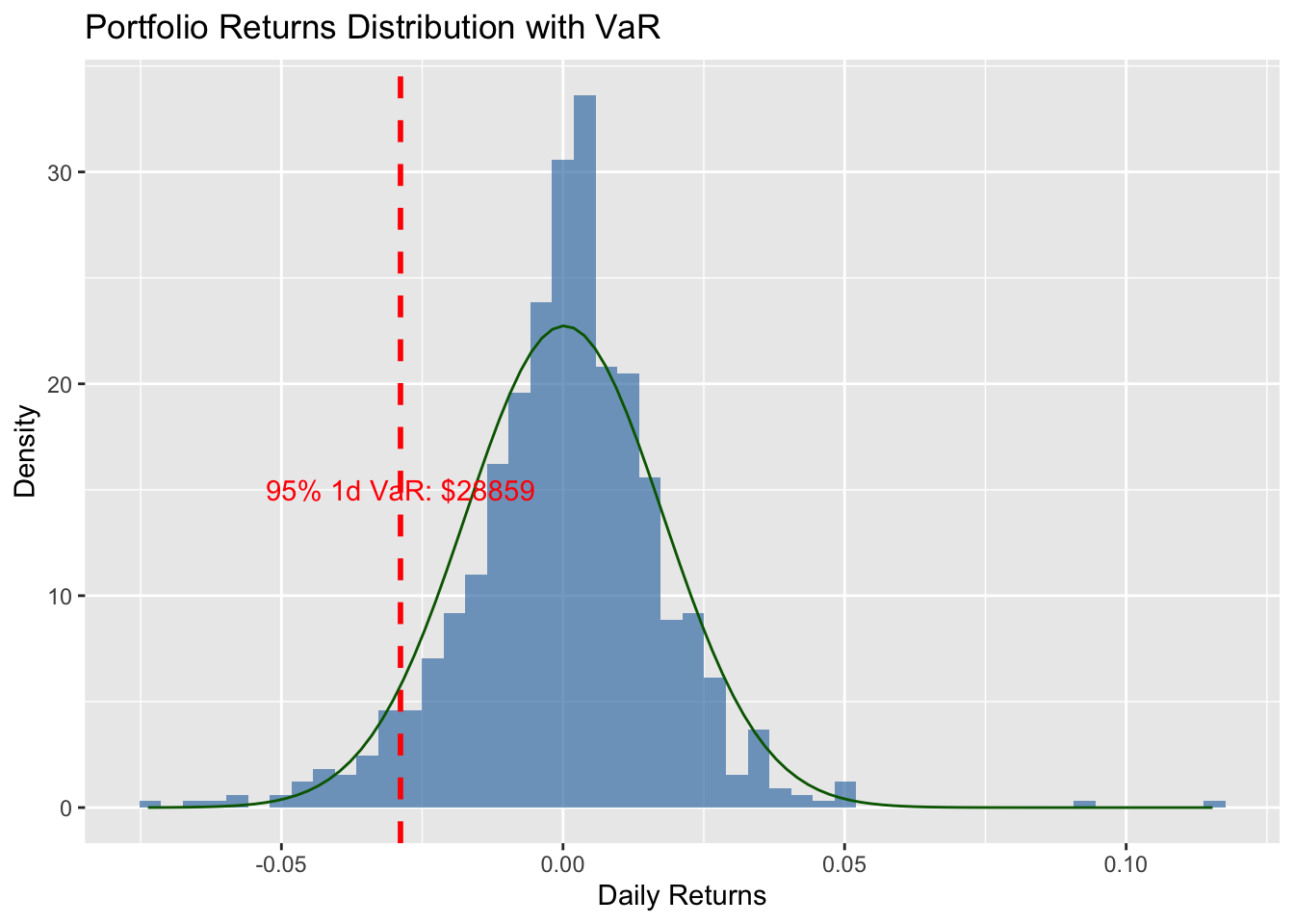

ggplot(data = data.frame(Returns = as.numeric(returns %*% weights)),

aes(x = Returns)) +

geom_histogram(aes(y = ..density..), bins = 50, fill = "steelblue", alpha = 0.7) +

geom_vline(xintercept = -var_1d/portfolio_value, color = "red",

linetype = "dashed", size = 1) +

stat_function(fun = dnorm, args = list(mean = mean(returns %*% weights),

sd = sd(returns %*% weights)), color = "darkgreen") +

labs(title = "Portfolio Returns Distribution with VaR",

x = "Daily Returns", y = "Density") +

annotate("text", x = -var_1d/portfolio_value, y = 15,

label = paste0("95% 1d VaR: $", round(var_1d)), color = "red")

## Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

## ℹ Please use `linewidth` instead.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

## generated.

## Warning: The dot-dot notation (`..density..`) was deprecated in ggplot2 3.4.0.

## ℹ Please use `after_stat(density)` instead.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

## generated.

# 输出结果

cat("单日VaR(95%置信度):", round(var_1d), "美元\n")

## 单日VaR(95%置信度): 28894 美元

cat("5日VaR(95%置信度):", round(var_5d), "美元")

## 5日VaR(95%置信度): 64609 美元