配对交易是一种基于统计套利的量化策略,其核心逻辑是通过识别价格走势高度相关的两只股票,当它们的价格偏离历史正常关系时建立对冲头寸,等待关系回归时获利。

本文将解析一段基于 R 语言 quantstrat 包的配对交易策略代码,展示其实现思路与核心意义。

策略核心逻辑与代码框架

这段代码以 SPY 和 DIA 两只 ETF 为交易标的,通过构建价格比率的均值回归模型实现配对交易。策略的核心步骤包括:数据同步与准备、策略环境初始化、指标与信号构建、自定义订单规模控制、交易规则设置,以及回测与绩效分析。

以下是完整代码实现:

# Kindly contributed to quantstrat by Garrett See

# code borrowed heavily from existing quantstrat demos

# 这是一个简单的配对交易示例,旨在展示如何扩展现有 quantstrat 功能。

# 它使用 addPosLimits 指定头寸水平和限制,并演示如何将自定义订单规模函数传递给 osFUN

# 注意:先构建价差并将其视为单一工具,比处理股票组合更简单

## 给定两只股票,计算其名义价值比率。如果比率低于 2 标准差区间,

# 当它回升穿过区间时,买入股票 1 并卖出股票 2。如果比率高于 2 标准差区间,

# 当它回落穿过区间时,卖出股票 1 并买入股票 2。如果比率穿过其移动平均线,则平仓所有头寸。

# 股票 A 的买入(卖出)数量 = MaxPos / lvls

# 股票 B 的卖出(买入)数量 = MaxPos * 比率 / lvls

require(quantstrat)## Loading required package: quantstrat## Loading required package: quantmod## Loading required package: xts## Loading required package: zoo##

## Attaching package: 'zoo'## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric## Loading required package: TTR## Registered S3 method overwritten by 'quantmod':

## method from

## as.zoo.data.frame zoo## Loading required package: blotter## Loading required package: FinancialInstrument## Loading required package: PerformanceAnalytics##

## Attaching package: 'PerformanceAnalytics'## The following object is masked from 'package:graphics':

##

## legend## Loading required package: foreachsuppressWarnings(rm("order_book.pair1",pos=.strategy))

suppressWarnings(rm("account.pairs", "portfolio.pair1", pos=.blotter))

suppressWarnings(rm("startDate", "endDate", "startDate", "initEq", "SD", "N",

"symb1", "symb2", "portfolio1.st", "account.st",

"pairStrat", "out1"))

initDate <- '2013-12-31'

startDate <- '2014-01-01'

endDate <- '2015-05-01'

initEq <- 100000

SD <- 2 # 标准差倍数

N <- 20 # 移动平均线周期

MaxPos <- 1500 # 股票 A 的最大头寸;

# 股票 B 的最大头寸将是 max * 比率,即对股票 B 没有硬性头寸限制

lvls <- 3 # 分几步建仓;每笔订单数量 = MaxPos/lvls

symb1 <- 'SPY' # 可更改这些标的以尝试其他配对

symb2 <- 'DIA' # 如果更改,需确保头寸限制仍然合理

portfolio1.st <- 'pair1'

account.st <- 'pairs'

# 获取历史数据

getSymbols(c(symb1, symb2), from=startDate, to=endDate, adjust=TRUE) ## [1] "SPY" "DIA"# 以下函数用于确保所有标的的时间戳相同,删除其中一只股票数据缺失的行

alignSymbols <- function(symbols, env=.GlobalEnv) {

# 这是 qmao::alignSymbols() 的简化版本

if (length(symbols) < 2)

stop("必须提供至少 2 个标的")

if (any(!is.character(symbols)))

stop("标的必须是字符向量。")

ff <- get(symbols[1],env=env)

for (sym in symbols[-1]) {

tmp.sym <- get(sym,env=env)

ff <- merge(ff, tmp.sym, all=FALSE) # 只保留双方都有数据的行

}

for (sym in symbols) {

assign(sym,ff[,grep(sym, colnames(ff))], env=env) # 更新标的数据

}

symbols

}

alignSymbols(c(symb1, symb2)) # 对齐两只股票的时间戳## [1] "SPY" "DIA"# 定义金融工具

currency("USD") # 基础货币为美元## [1] "USD"stock(symb1, currency="USD", multiplier=1) # 定义股票 1 的属性## [1] "SPY"stock(symb2, currency="USD", multiplier=1) # 定义股票 2 的属性## [1] "DIA"# 初始化投资组合、账户和订单

initPortf(name=portfolio1.st, c(symb1,symb2)) # 创建包含两只股票的组合## [1] "pair1"initAcct(account.st, portfolios=portfolio1.st, initEq=initEq) # 初始化账户,初始资金 10 万美元## [1] "pairs"initOrders(portfolio=portfolio1.st) # 初始化订单簿

# osFUN 需要知道哪个标的是第一腿、哪个是第二腿,以及 MaxPos 和 lvls 的值。

# 因此,在投资组合中创建一个插槽来存储这些信息。

pair <- c(1, 2, MaxPos, lvls)

names(pair) <- c(symb1, symb2, "MaxPos", "lvls")

.blotter[[paste('portfolio', portfolio1.st, sep='.')]]$pair <- pair # 存储到组合属性中

# 按标的创建初始头寸限制和水平

# 如果 lvls=3,则允许多空各 3 次建仓。

addPosLimit(portfolio=portfolio1.st, timestamp=startDate, symbol=symb1,

maxpos=MaxPos, longlevels=lvls, minpos=-MaxPos, shortlevels=lvls)

addPosLimit(portfolio=portfolio1.st, timestamp=startDate, symbol=symb2,

maxpos=MaxPos, longlevels=lvls, minpos=-MaxPos, shortlevels=lvls)

# 创建策略对象

pairStrat <- strategy('pairStrat')

# 指标函数:计算两只股票的价格比率

calcRatio <- function(x) {

# 返回两只股票的名义收盘价比率

x1 <- get(x[1])

x2 <- get(x[2])

mult1 <- getInstrument(x[1])$multiplier # 合约乘数

mult2 <- getInstrument(x[2])$multiplier

rat <- (mult1 * Cl(x1)) / (mult2 * Cl(x2)) # 收盘价比率

colnames(rat) <- 'Ratio'

rat

}

# 用于确定入场/出场的指标:比率及其布林带

Ratio <- calcRatio(c(symb1[1], symb2[1]))

# 将对冲比率存储在投资组合中,以便订单规模函数使用。

# 在本示例中,对冲比率与 Ratio 指标相同。

.blotter[[paste('portfolio',portfolio1.st,sep='.')]]$HedgeRatio <- Ratio

# 创建获取最新对冲比率的函数

getHedgeRatio <- function(portfolio, timestamp) {

portf <- getPortfolio(portfolio)

timestamp <- format(timestamp,"%Y-%m-%d %H:%M:%S") # 格式化时间戳

# 上述行确保在使用日内数据且时间戳为午夜时,不会获取次日的最后一个值

toDate <- paste("::", timestamp, sep="")

Ratio <- last(portf$HedgeRatio[toDate]) # 获取该时间点的最新比率

as.numeric(Ratio)

}

# 添加指标:比率的布林带

pairStrat <- add.indicator(strategy=pairStrat, name = "calcRatio",

arguments=list(x=c(symb1,symb2)))

pairStrat <- add.indicator(strategy=pairStrat, name = "BBands",

arguments=list(HLC=quote(Ratio), sd=SD, n=N,

maType='SMA')) # 基于 20 日 SMA 计算布林带

# 生成信号:当比率从下方穿过下轨时买入,从上方穿过上轨时卖出,穿过中轨时平仓

pairStrat <- add.signal(strategy=pairStrat, name="sigCrossover",

arguments=list(columns=c("Ratio","up"),

relationship="lt"), # 比率 < 上轨(从上方穿过)

label="cross.up")

pairStrat <- add.signal(strategy=pairStrat, name="sigCrossover",

arguments=list(columns=c("Ratio","dn"),

relationship="gt"), # 比率 > 下轨(从下方穿过)

label="cross.dn")

pairStrat <- add.signal(strategy=pairStrat, name="sigCrossover",

arguments=list(columns=c("Ratio","mavg"),

relationship="lt"), # 比率 < 中轨(从上方穿过)

label="cross.mid.fa")

pairStrat <- add.signal(strategy=pairStrat, name="sigCrossover",

arguments=list(columns=c("Ratio","mavg"),

relationship="gt"), # 比率 > 中轨(从下方穿过)

label="cross.mid.fb")

# 自定义订单规模函数

#######################_ORDER SIZING FUNCTION_##################################

osSpreadMaxPos <- function (data, timestamp, orderqty, ordertype, orderside,

portfolio, symbol, ruletype, ..., orderprice) {

portf <- getPortfolio(portfolio)

# 检查 pair 插槽是否包含该函数所需的内容

if (!any(portf$pair == 1) && !(any(portf$pair == 2)))

stop('pair 必须包含值 1 和 2')

if (!any(names(portf$pair) == "MaxPos") || !any(names(portf$pair) == "lvls"))

stop('pair 必须包含 MaxPos 和 lvls')

if (portf$pair[symbol] == 1) legside <- "long" # 第一腿

if (portf$pair[symbol] == 2) legside <- "short" # 第二腿(与第一腿方向相反)

MaxPos <- portf$pair["MaxPos"]

lvls <- portf$pair["lvls"]

ratio <- getHedgeRatio(portfolio, timestamp) # 获取当前对冲比率

pos <- getPosQty(portfolio, symbol, timestamp) # 当前头寸

PosLimit <- getPosLimit(portfolio, symbol, timestamp) # 头寸限制

qty <- orderqty

if (legside == "short") {# 标的是第二腿

## 注释掉下一行可使每只股票的订单规模相等。

addPosLimit(portfolio=portfolio, timestamp=timestamp, symbol=symbol,

maxpos=round(MaxPos*ratio,0), longlevels=lvls,

minpos=round(-MaxPos*ratio,0), shortlevels=lvls) # 调整第二腿的头寸限制

##

qty <- -orderqty # 反转股票 B 的订单数量(多空相反)

}

if (qty > 0) orderside = 'long' # 确定订单方向

if (qty < 0) orderside = 'short'

# 调用 osMaxPos 计算符合头寸限制的订单数量

orderqty <- osMaxPos(data=data,timestamp=timestamp, orderqty=qty,

ordertype=ordertype, orderside=orderside,

portfolio=portfolio, symbol=symbol, ruletype=ruletype,

...)

# 在规则信号函数中添加订单

if (!is.null(orderqty) & !orderqty == 0 & !is.null(orderprice)) {

addOrder(portfolio=portfolio, symbol=symbol,

timestamp=timestamp, qty=orderqty, price=as.numeric(orderprice),

ordertype=ordertype, side=orderside, replace=FALSE,

status="open", ...=...)

}

return(0) # 使 ruleSignal 函数不会尝试下单

}

################################################################################

# 为多空方向创建入场和出场规则。两个标的将获得相同的买卖信号,

# 但 osMaxPos 会为第二个标的反转这些信号。

# orderqty 大于头寸限制允许的值。osMaxPos 会将订单数量调整为最大允许值的 1/3。

# (1/3 是因为我们在 PosLimit 中使用了 3 个水平)

pairStrat <- add.rule(strategy=pairStrat, name='ruleSignal',

arguments=list(sigcol="cross.dn", sigval=TRUE,

orderqty=1e6, ordertype='market',

orderside=NULL, osFUN='osSpreadMaxPos'),

type='enter') # cross.dn 信号触发入场

pairStrat <- add.rule(strategy=pairStrat, name='ruleSignal',

arguments=list(sigcol="cross.up", sigval=TRUE,

orderqty=-1e6, ordertype='market',

orderside=NULL, osFUN='osSpreadMaxPos'),

type='enter') # cross.up 信号触发入场

pairStrat <- add.rule(strategy=pairStrat, name='ruleSignal',

arguments=list(sigcol="cross.mid.fb", sigval=TRUE,

orderqty='all', ordertype='market',

orderside=NULL),

type='exit') # cross.mid.fb 信号触发出场

pairStrat <- add.rule(strategy=pairStrat, name='ruleSignal',

arguments=list(sigcol="cross.mid.fa", sigval=TRUE,

orderqty='all', ordertype='market',

orderside=NULL),

type='exit') # cross.mid.fa 信号触发出场

# 执行策略回测

out1<-applyStrategy(strategy=pairStrat, portfolios=portfolio1.st)## [1] "2014-02-04 00:00:00 DIA 500 @ 150.182621296714"

## [1] "2014-03-07 00:00:00 DIA 568 @ 160.616223229789"

## [1] "2014-03-17 00:00:00 DIA 573 @ 158.690860184405"

## [1] "2014-03-25 00:00:00 DIA -1641 @ 159.963991320726"

## [1] "2014-03-31 00:00:00 DIA -574 @ 160.796174254035"

## [1] "2014-04-22 00:00:00 DIA 574 @ 161.4743809578"

## [1] "2014-05-22 00:00:00 DIA 571 @ 162.261848260392"

## [1] "2014-06-02 00:00:00 DIA 572 @ 164.246166224292"

## [1] "2014-06-27 00:00:00 DIA 576 @ 165.51814455118"

## [1] "2014-07-02 00:00:00 DIA 27 @ 166.728744615667"

## [1] "2014-07-15 00:00:00 DIA -1746 @ 167.69330191996"

## [1] "2014-07-21 00:00:00 DIA -583 @ 167.676368799237"

## [1] "2014-07-24 00:00:00 DIA 583 @ 167.932553399241"

## [1] "2014-09-17 00:00:00 DIA -580 @ 169.355777408222"

## [1] "2014-09-24 00:00:00 DIA -584 @ 169.969729387294"

## [1] "2014-10-15 00:00:00 DIA -582 @ 159.57109738308"

## [1] "2014-10-21 00:00:00 DIA 1746 @ 164.043208292008"

## [1] "2014-10-27 00:00:00 DIA 576 @ 166.101170700567"

## [1] "2014-11-05 00:00:00 DIA -576 @ 172.700494456876"

## [1] "2014-12-03 00:00:00 DIA -586 @ 177.512433609148"

## [1] "2014-12-10 00:00:00 DIA -579 @ 173.872106214788"

## [1] "2014-12-18 00:00:00 DIA 1165 @ 176.351884195197"

## [1] "2015-01-15 00:00:00 DIA -579 @ 172.030741759151"

## [1] "2015-01-21 00:00:00 DIA 579 @ 174.456324855292"

## [1] "2015-01-29 00:00:00 DIA 578 @ 173.013702717688"

## [1] "2015-02-05 00:00:00 DIA -578 @ 177.640012837652"

## [1] "2015-04-21 00:00:00 DIA 583 @ 179.259994506836"

## [1] "2015-04-28 00:00:00 DIA 583 @ 180.839996337891"

## [1] "2014-02-04 00:00:00 SPY -500 @ 171.264049909226"

## [1] "2014-03-07 00:00:00 SPY -500 @ 183.831285747939"

## [1] "2014-03-17 00:00:00 SPY -500 @ 181.946695046646"

## [1] "2014-03-25 00:00:00 SPY 1500 @ 182.730103228311"

## [1] "2014-03-31 00:00:00 SPY 500 @ 183.416649931591"

## [1] "2014-04-22 00:00:00 SPY -500 @ 184.279745767482"

## [1] "2014-05-22 00:00:00 SPY -500 @ 185.94707775133"

## [1] "2014-06-02 00:00:00 SPY -500 @ 189.193474635518"

## [1] "2014-06-27 00:00:00 SPY -500 @ 192.977678507185"

## [1] "2014-07-15 00:00:00 SPY 1500 @ 194.367200918673"

## [1] "2014-07-21 00:00:00 SPY 500 @ 194.475604869373"

## [1] "2014-07-24 00:00:00 SPY -500 @ 195.766587803966"

## [1] "2014-09-17 00:00:00 SPY 500 @ 197.83611230376"

## [1] "2014-09-24 00:00:00 SPY 500 @ 197.582667853886"

## [1] "2014-10-15 00:00:00 SPY 500 @ 184.582760931563"

## [1] "2014-10-21 00:00:00 SPY -1500 @ 192.147074898032"

## [1] "2014-10-27 00:00:00 SPY -500 @ 194.216362617501"

## [1] "2014-11-05 00:00:00 SPY 500 @ 200.335121161983"

## [1] "2014-12-03 00:00:00 SPY 500 @ 205.830132301385"

## [1] "2014-12-10 00:00:00 SPY 500 @ 201.147003486903"

## [1] "2014-12-18 00:00:00 SPY -1000 @ 204.731130073504"

## [1] "2015-01-15 00:00:00 SPY 500 @ 198.135576473045"

## [1] "2015-01-21 00:00:00 SPY -500 @ 202.177531751319"

## [1] "2015-01-29 00:00:00 SPY -500 @ 201.092379263502"

## [1] "2015-02-05 00:00:00 SPY 500 @ 205.204015568481"

## [1] "2015-04-21 00:00:00 SPY -500 @ 209.600006103516"

## [1] "2015-04-28 00:00:00 SPY -500 @ 211.440002441406"# 更新组合和账户数据

updatePortf(Portfolio=portfolio1.st,

Dates=paste("::", as.Date(Sys.time()), sep=''))## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-07-13 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2014-01-02/2015-04-30. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-07-13 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2014-01-02/2015-04-30. Using all data

## instead.## [1] "pair1"updateAcct(account.st, Dates=paste(startDate, endDate, sep="::")) ## [1] "pairs"updateEndEq(account.st, Dates=paste(startDate, endDate, sep="::"))## [1] "pairs"getEndEq(account.st, Sys.time()) # 查看最终权益## [1] 103576.8# 绘制持仓图表

# dev.new()

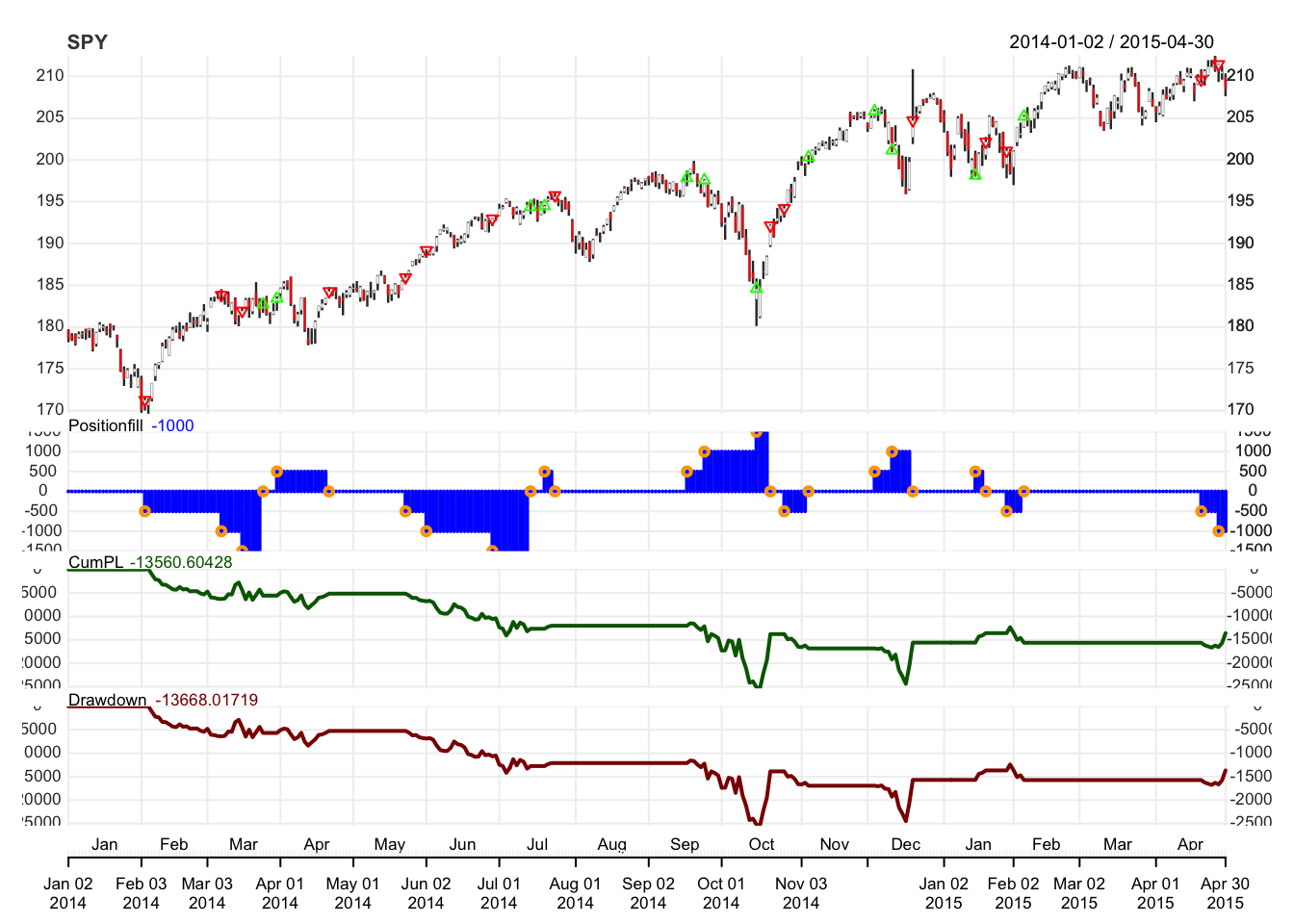

chart.Posn(Portfolio=portfolio1.st, Symbol=symb1) # 股票 1 的持仓图

# dev.new()

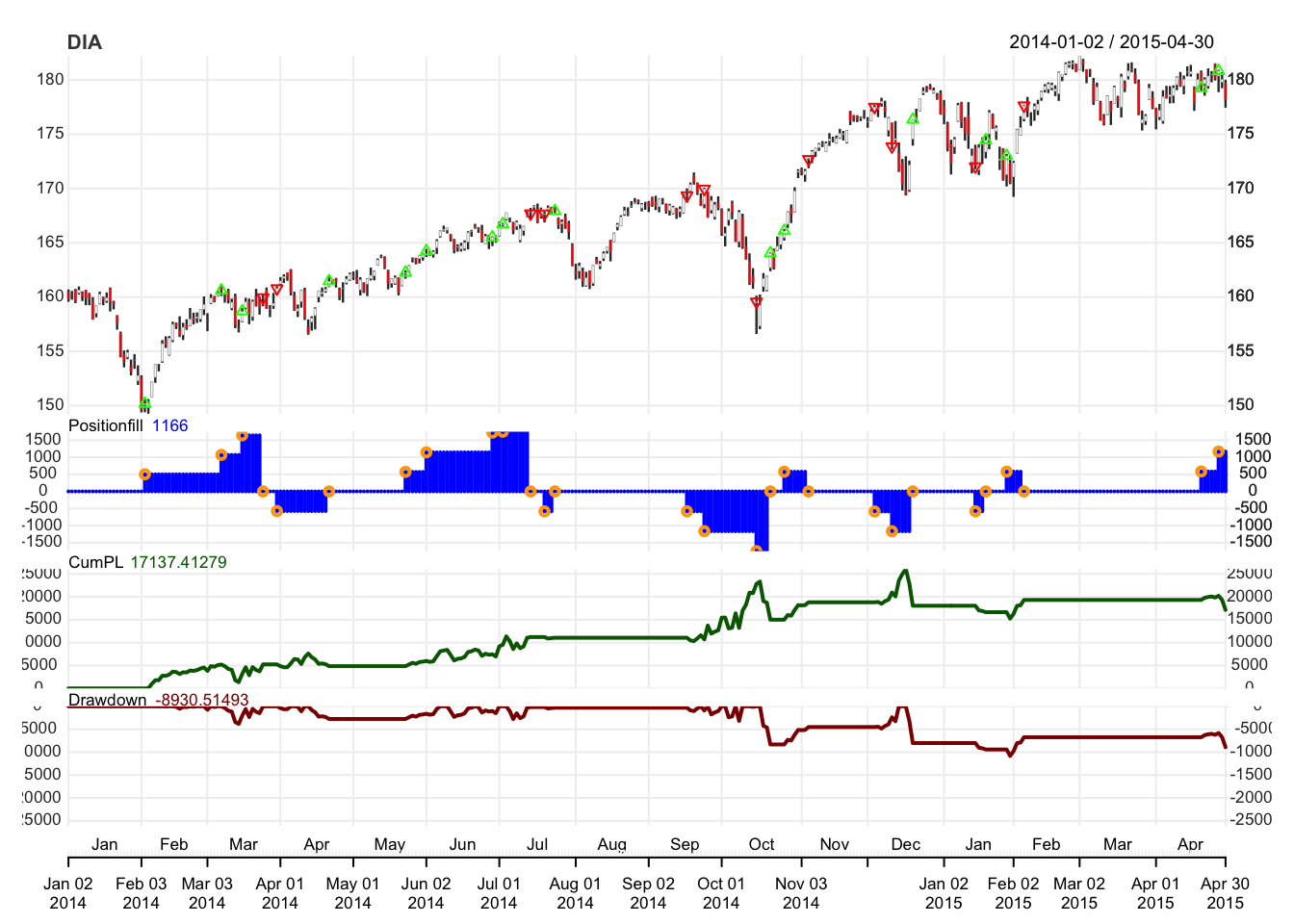

chart.Posn(Portfolio=portfolio1.st, Symbol=symb2) # 股票 2 的持仓图

# dev.new()

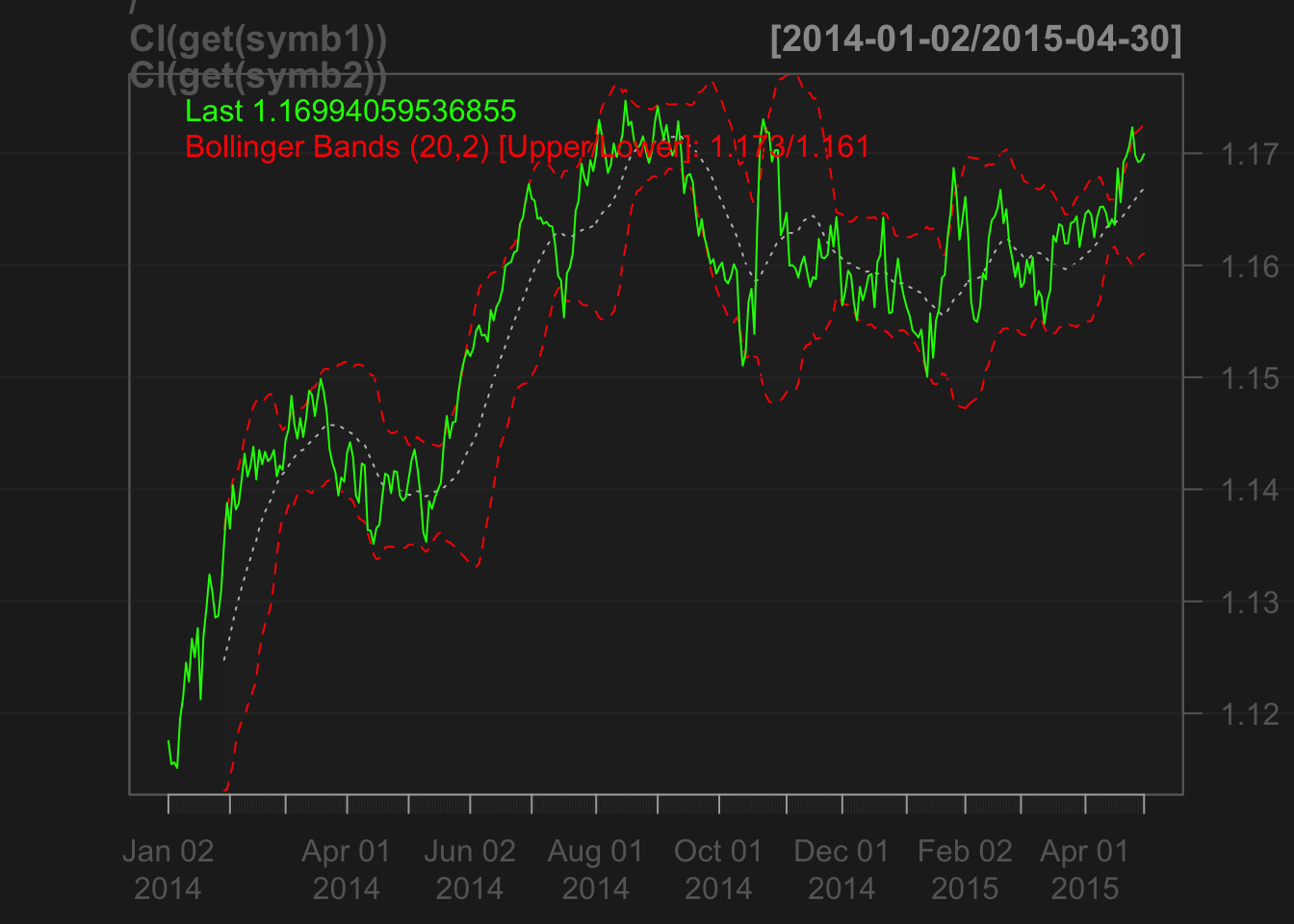

chartSeries(Cl(get(symb1))/Cl(get(symb2)), TA="addBBands(n=N,sd=SD)") # 比率与布林带图

# 绩效分析

ret1 <- PortfReturns(account.st) # 组合收益

ret1$total <- rowSums(ret1) # 总收益

# 绘制绩效摘要

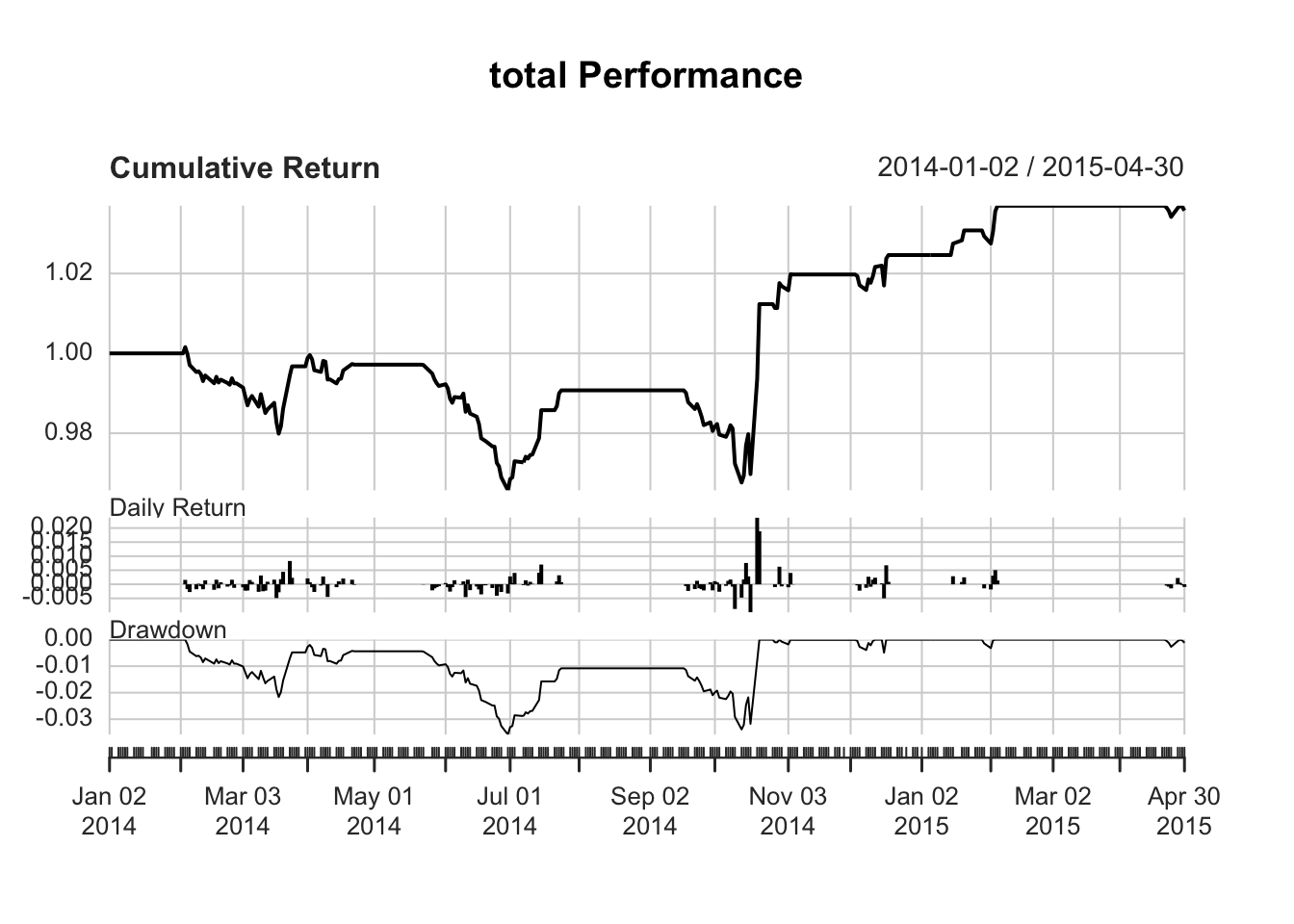

if("package:PerformanceAnalytics" %in% search() ||

require("PerformanceAnalytics",quietly=TRUE)) {

# dev.new()

charts.PerformanceSummary(ret1$total, geometric=FALSE, wealth.index=TRUE) # 收益摘要图

}

策略实现的核心思路

这段代码的核心是通过量化手段实现配对交易的均值回归逻辑,具体可分为以下几个关键环节:

首先是数据预处理。配对交易对数据同步性要求极高,因此代码通过alignSymbols函数对齐两只股票的时间戳,删除存在数据缺失的时间点,确保价格比率的计算基于完整的共同数据。这种预处理是后续指标准确性的基础,避免因数据不同步导致的错误信号。

其次是指标与信号体系。策略的核心指标是两只股票的价格比率(由calcRatio函数计算),并通过布林带(BBands)分析该比率的波动特征。布林带由中轨(20 日移动平均线)和上下轨(中轨 ±2 倍标准差)构成,反映比率的正常波动区间。当比率从下方突破下轨(cross.dn信号)时,认为两只股票的价格偏离过大且即将回归,此时买入第一只股票、卖出第二只;当比率从上方向下突破上轨(cross.up信号)时,则反向操作;当比率回归至中轨时(cross.mid信号),平仓获利。这种基于统计偏离的信号逻辑,是均值回归策略的典型应用。

再者是头寸管理与订单规模控制。代码通过addPosLimits设置了最大头寸(MaxPos)和建仓层级(lvls),允许分 3 步建仓,避免单次入场风险过高。更关键的是自定义的osSpreadMaxPos函数,它根据两只股票的对冲比率动态调整订单数量,确保多空头寸的风险对冲平衡 —— 第一只股票的头寸为MaxPos/lvls,第二只则为其相反数乘以价格比率,使整体组合对市场系统性风险的暴露最小化。这种精细化的头寸控制,是配对交易实现风险对冲的核心。

最后是回测与绩效评估。代码通过applyStrategy执行回测,更新组合和账户数据后,利用chart.Posn展示两只股票的持仓变化,通过charts.PerformanceSummary分析策略的收益曲线、最大回撤等关键指标,全面评估策略效果。 策略的意义与价值

这段代码的意义不仅在于实现了一个可运行的配对交易策略,更展示了如何在 quantstrat 框架下扩展自定义功能:通过addPosLimits灵活设置头寸规则,借助osFUN传递自定义订单规模函数,为复杂策略的实现提供了范例。对于量化研究者而言,它演示了均值回归思想在配对交易中的具体应用 —— 通过价格比率的统计特征捕捉套利机会,同时通过多空对冲控制风险。

此外,代码也为策略优化提供了方向:例如调整布林带的周期(N)和标准差倍数(SD)以适应不同市场环境,或修改osSpreadMaxPos函数优化头寸调整逻辑。这种模块化的实现方式,使得策略易于维护和扩展,为量化交易的实践提供了有价值的参考。