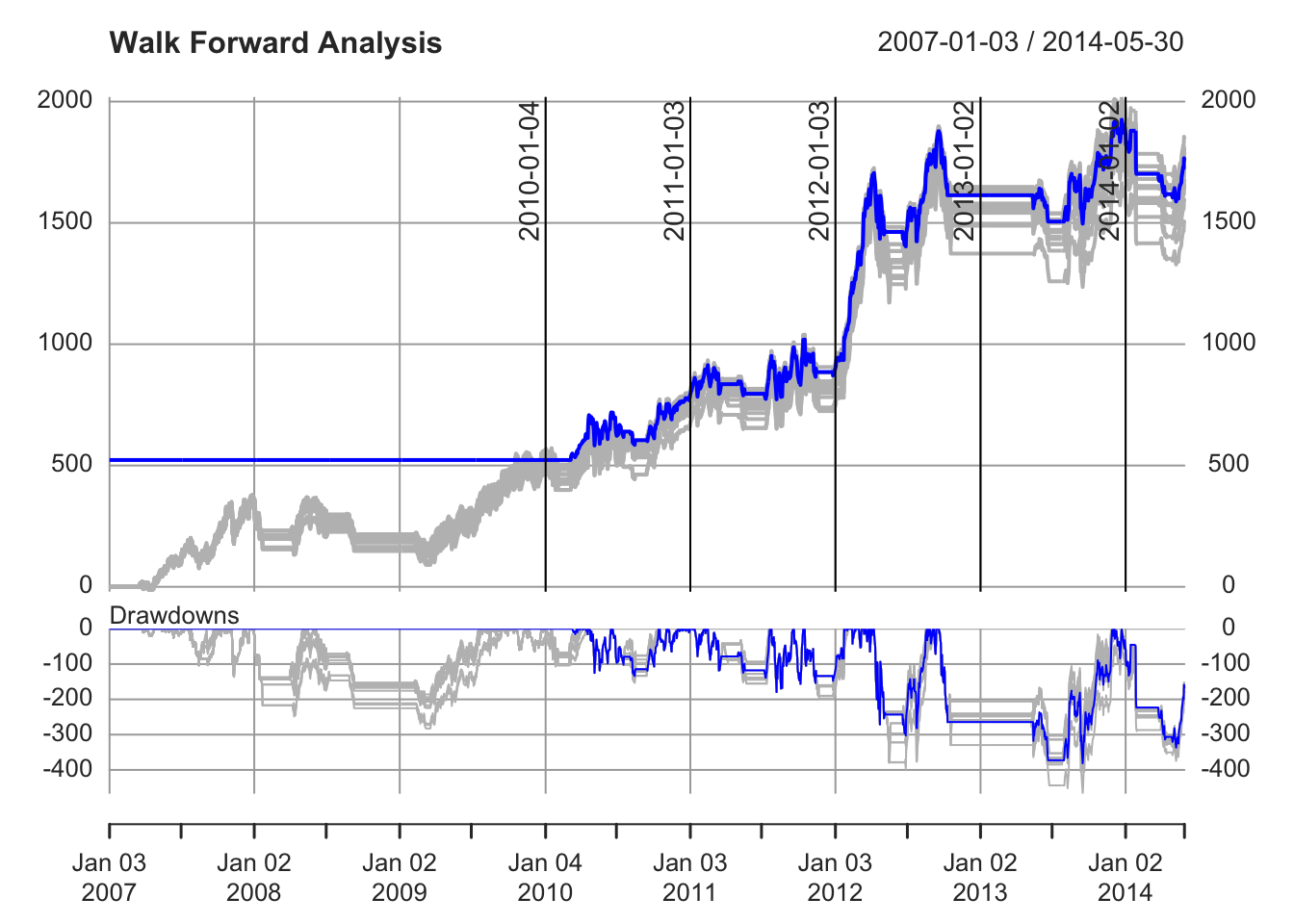

在量化交易中,策略的稳健性往往取决于其在不同市场周期的适应性。一次性回测容易因参数过拟合导致 “历史表现优异但未来失效” 的问题,而前进测试(Walk Forward Testing)通过滚动优化参数并验证,能有效降低过拟合风险。

本文将解析一段基于quantstrat包的 MACD 策略前进测试代码,展示其实现思路与核心价值,并结合 MACD 指标的原理说明策略设计逻辑。

代码实现与注释

以下是完整的前进测试代码,包含详细注释以解释各环节功能:

# Walk Forward demo for MACD

###############################################################################

# 加载必要的包:foreach用于并行迭代,iterators支持迭代器,quantstrat用于量化策略开发

require(foreach, quietly=TRUE)

require(iterators)

require(quantstrat)

# 运行内置的MACD策略演示代码,初始化策略环境(包含策略定义、标的数据等)

# 使用source而非demo确保所有变量在当前会话中可见

source(system.file('demo/macd.R', package='quantstrat'), echo = TRUE)##

## > require(quantstrat)

##

## > suppressWarnings(rm("order_book.macd", pos = .strategy))

##

## > suppressWarnings(rm("account.macd", "portfolio.macd",

## + pos = .blotter))

##

## > suppressWarnings(rm("account.st", "portfolio.st",

## + "stock.str", "stratMACD", "startDate", "initEq", "start_t",

## + "end_t"))

##

## > oldtz <- Sys.getenv("TZ")

##

## > if (oldtz == "") {

## + Sys.setenv(TZ = "GMT")

## + }

##

## > stock.str = "AAPL"

##

## > fastMA = 12

##

## > slowMA = 26

##

## > signalMA = 9

##

## > maType = "EMA"

##

## > currency("USD")

## [1] "USD"

##

## > stock(stock.str, currency = "USD", multiplier = 1)

## [1] "AAPL"

##

## > startDate = "2006-12-31"

##

## > initEq = 1e+06

##

## > portfolio.st = "macd"

##

## > account.st = "macd"

##

## > initPortf(portfolio.st, symbols = stock.str)

## [1] "macd"

##

## > initAcct(account.st, portfolios = portfolio.st)

## [1] "macd"

##

## > initOrders(portfolio = portfolio.st)

##

## > strat.st <- portfolio.st

##

## > strategy(strat.st, store = TRUE)

##

## > add.indicator(strat.st, name = "MACD", arguments = list(x = quote(Cl(mktdata)),

## + nFast = fastMA, nSlow = slowMA), label = "_")

## [1] "macd"

##

## > add.signal(strat.st, name = "sigThreshold", arguments = list(column = "signal._",

## + relationship = "gt", threshold = 0, cross = TRUE), label = .... [TRUNCATED]

## [1] "macd"

##

## > add.signal(strat.st, name = "sigThreshold", arguments = list(column = "signal._",

## + relationship = "lt", threshold = 0, cross = TRUE), label = .... [TRUNCATED]

## [1] "macd"

##

## > add.rule(strat.st, name = "ruleSignal", arguments = list(sigcol = "signal.gt.zero",

## + sigval = TRUE, orderqty = 100, ordertype = "market", orde .... [TRUNCATED]

## [1] "macd"

##

## > add.rule(strat.st, name = "ruleSignal", arguments = list(sigcol = "signal.lt.zero",

## + sigval = TRUE, orderqty = "all", ordertype = "market", or .... [TRUNCATED]

## [1] "macd"

##

## > getSymbols(stock.str, from = startDate, to = "2014-06-01",

## + src = "yahoo")

## [1] "AAPL"

##

## > start_t <- Sys.time()

##

## > out <- applyStrategy(strat.st, portfolios = portfolio.st,

## + parameters = list(nFast = fastMA, nSlow = slowMA, nSig = signalMA,

## + maTyp .... [TRUNCATED]

## [1] "2007-03-16 00:00:00 AAPL 100 @ 3.19964289665222"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-31 00:00:00 AAPL 100 @ 5.125"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-20 00:00:00 AAPL 100 @ 6.28000020980835"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-15 00:00:00 AAPL -100 @ 6.93464279174805"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-03 00:00:00 AAPL -100 @ 7.11535692214966"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-16 00:00:00 AAPL -100 @ 8.92500019073486"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2011-03-22 00:00:00 AAPL -100 @ 12.1857137680054"

## [1] "2011-05-03 00:00:00 AAPL 100 @ 12.4357137680054"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-16 00:00:00 AAPL -100 @ 13.7417860031128"

## [1] "2011-12-27 00:00:00 AAPL 100 @ 14.518928527832"

## [1] "2012-05-09 00:00:00 AAPL -100 @ 20.3278560638428"

## [1] "2012-06-20 00:00:00 AAPL 100 @ 20.9192867279053"

## [1] "2012-10-12 00:00:00 AAPL -100 @ 22.4896430969238"

## [1] "2013-05-09 00:00:00 AAPL 100 @ 16.3132133483887"

## [1] "2013-06-19 00:00:00 AAPL -100 @ 15.1071434020996"

## [1] "2013-07-26 00:00:00 AAPL 100 @ 15.7496433258057"

## [1] "2014-01-22 00:00:00 AAPL -100 @ 19.6967868804932"

## [1] "2014-01-24 00:00:00 AAPL 100 @ 19.5025005340576"

## [1] "2014-01-29 00:00:00 AAPL -100 @ 17.8839282989502"

## [1] "2014-03-26 00:00:00 AAPL 100 @ 19.2778568267822"

## [1] "2014-04-15 00:00:00 AAPL -100 @ 18.498571395874"

## [1] "2014-04-29 00:00:00 AAPL 100 @ 21.1546421051025"

##

## > end_t <- Sys.time()

##

## > print(end_t - start_t)

## Time difference of 0.4237199 secs

##

## > start_t <- Sys.time()

##

## > updatePortf(Portfolio = portfolio.st, Dates = paste("::",

## + as.Date(Sys.time()), sep = ""))## [1] "macd"

##

## > end_t <- Sys.time()

##

## > print("trade blotter portfolio update:")

## [1] "trade blotter portfolio update:"

##

## > print(end_t - start_t)

## Time difference of 0.02946806 secs

##

## > chart.Posn(Portfolio = portfolio.st, Symbol = stock.str)

##

## > plot(add_MACD(fast = fastMA, slow = slowMA, signal = signalMA,

## + maType = "EMA"))

##

## > obook <- getOrderBook("macd")

##

## > Sys.setenv(TZ = oldtz)# 并行计算初始化(可选):doParallel、doMC等并行包可加速参数搜索

# 此处以doParallel为例,默认使用物理核心数-1的线程

# require(doParallel)

# registerDoParallel()

# 从环境中获取策略对象(MACD策略在定义时设置了store=TRUE,因此可直接调用)

strategy.st <- 'macd'

### 设置参数搜索范围

.FastMA = (1:10) # MACD快速EMA周期候选值(1到10)

.SlowMA = (5:25) # MACD慢速EMA周期候选值(5到25)

.nsamples = 15 # 随机抽样的参数组合数量(并行计算时可减少迭代次数,提高效率)

### 定义参数分布(用于参数优化)

# 为策略添加快速EMA周期的参数分布

add.distribution(

strategy.st, # 策略名称

paramset.label = 'MA', # 参数集标签(用于标识该组参数)

component.type = 'indicator', # 组件类型:指标(此处为MACD的EMA参数)

component.label = '_', # 指标在策略中的标签(对应MACD指标的默认标识)

variable = list(n = .FastMA), # 变量:快速EMA周期,取值范围为.FastMA

label = 'nFAST' # 该参数的标签(用于后续约束和结果识别)

)## [1] "macd"# 为策略添加慢速EMA周期的参数分布

add.distribution(

strategy.st,

paramset.label = 'MA',

component.type = 'indicator',

component.label = '_',

variable = list(n = .SlowMA), # 变量:慢速EMA周期,取值范围为.SlowMA

label = 'nSLOW' # 该参数的标签

)## [1] "macd"# 添加参数约束:确保快速EMA周期小于慢速EMA周期(MACD计算的必要条件)

add.distribution.constraint(

strategy.st,

paramset.label = 'MA',

distribution.label.1 = 'nFAST', # 第一个参数(快速周期)

distribution.label.2 = 'nSLOW', # 第二个参数(慢速周期)

operator = '<', # 约束关系:快速周期 < 慢速周期

label = 'MA' # 约束标签

)## [1] "macd"### 初始化前进测试环境

wfportfolio <- "wf.macd" # 前进测试的组合名称

initPortf(wfportfolio, symbols = stock.str) # 初始化组合(stock.str来自MACD演示代码中的标的)## [1] "wf.macd"initOrders(portfolio = wfportfolio) # 初始化订单簿

# 执行前进测试

wf_start <- Sys.time() # 记录开始时间

wfresults <- walk.forward(

strategy.st, # 策略名称

paramset.label = 'MA', # 使用的参数集标签

portfolio.st = wfportfolio, # 组合名称

account.st = account.st, # 账户名称(来自MACD演示代码)

nsamples = .nsamples, # 每次迭代随机抽样的参数组合数量

period = 'months', # 滚动周期:按月划分训练期和测试期

k.training = 36, # 训练期长度:36个月(用于参数优化)

k.testing = 12, # 测试期长度:12个月(用于验证优化后的参数)

verbose = TRUE, # 输出详细过程信息

anchored = TRUE, # 固定起始点:训练期从最开始滚动(而非滑动窗口)

include.insamples = TRUE, # 结果中包含训练期数据

savewf = FALSE # 不保存中间结果

)## [1] "=== training MA on 2007-01-03/2009-12-31"## [1] "2007-03-14 00:00:00 AAPL 100 @ 3.21428608894348"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-26 00:00:00 AAPL -100 @ 6.16214323043823"

## [1] "2007-11-30 00:00:00 AAPL 100 @ 6.50785684585571"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-27 00:00:00 AAPL 100 @ 5.00892877578735"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-18 00:00:00 AAPL 100 @ 6.26392889022827"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-05 00:00:00 AAPL 100 @ 3.4449999332428"

## [1] "2009-03-03 00:00:00 AAPL -100 @ 3.15607094764709"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-11 00:00:00 AAPL -100 @ 6.9524998664856"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2007-03-15 00:00:00 AAPL 100 @ 3.19892907142639"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-27 00:00:00 AAPL -100 @ 6.24321413040161"

## [1] "2007-11-29 00:00:00 AAPL 100 @ 6.58178615570068"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-28 00:00:00 AAPL 100 @ 5.10750007629395"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-19 00:00:00 AAPL 100 @ 6.19750022888184"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-14 00:00:00 AAPL -100 @ 7.03499984741211"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-02 00:00:00 AAPL 100 @ 5.26749992370605"

## [1] "2008-07-01 00:00:00 AAPL -100 @ 6.23857116699219"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-22 00:00:00 AAPL -100 @ 7.15571403503418"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-03 00:00:00 AAPL 100 @ 5.41464281082153"

## [1] "2008-07-02 00:00:00 AAPL -100 @ 6.00642919540405"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2007-03-15 00:00:00 AAPL 100 @ 3.19892907142639"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-27 00:00:00 AAPL -100 @ 6.24321413040161"

## [1] "2007-11-29 00:00:00 AAPL 100 @ 6.58178615570068"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-28 00:00:00 AAPL 100 @ 5.10750007629395"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-19 00:00:00 AAPL 100 @ 6.19750022888184"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-14 00:00:00 AAPL -100 @ 7.03499984741211"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2007-03-20 00:00:00 AAPL 100 @ 3.26714301109314"

## [1] "2007-08-21 00:00:00 AAPL -100 @ 4.55607080459595"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-02 00:00:00 AAPL 100 @ 5.26749992370605"

## [1] "2008-06-30 00:00:00 AAPL -100 @ 5.98000001907349"

## [1] "2008-08-22 00:00:00 AAPL 100 @ 6.31392908096313"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-18 00:00:00 AAPL -100 @ 6.97964286804199"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2007-08-28 00:00:00 AAPL -100 @ 4.52928590774536"

## [1] "2007-09-04 00:00:00 AAPL 100 @ 5.1485710144043"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-08 00:00:00 AAPL -100 @ 6.41249990463257"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-08 00:00:00 AAPL -100 @ 6.41249990463257"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2007-03-27 00:00:00 AAPL 100 @ 3.40928602218628"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-11 00:00:00 AAPL -100 @ 6.16357088088989"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-13 00:00:00 AAPL 100 @ 3.54142904281616"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2007-08-27 00:00:00 AAPL -100 @ 4.7232141494751"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2007-03-16 00:00:00 AAPL 100 @ 3.19964289665222"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-31 00:00:00 AAPL 100 @ 5.125"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-20 00:00:00 AAPL 100 @ 6.28000020980835"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-15 00:00:00 AAPL -100 @ 6.93464279174805"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2007-03-16 00:00:00 AAPL 100 @ 3.19964289665222"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-31 00:00:00 AAPL 100 @ 5.125"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-20 00:00:00 AAPL 100 @ 6.28000020980835"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-15 00:00:00 AAPL -100 @ 6.93464279174805"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2007-03-20 00:00:00 AAPL 100 @ 3.26714301109314"

## [1] "2007-08-21 00:00:00 AAPL -100 @ 4.55607080459595"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-02 00:00:00 AAPL 100 @ 5.26749992370605"

## [1] "2008-07-01 00:00:00 AAPL -100 @ 6.23857116699219"

## [1] "2008-08-22 00:00:00 AAPL 100 @ 6.31392908096313"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-21 00:00:00 AAPL -100 @ 7.07964277267456"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-02 00:00:00 AAPL 100 @ 5.26749992370605"

## [1] "2008-07-01 00:00:00 AAPL -100 @ 6.23857116699219"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-22 00:00:00 AAPL -100 @ 7.15571403503418"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-08 00:00:00 AAPL -100 @ 6.41249990463257"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "=== testing param.combo 90 on 2010-01-04/2010-12-31"

## nFAST nSLOW

## 90 1 16

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-20 00:00:00 AAPL -100 @ 8.99607086181641"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "=== training MA on 2007-01-03/2010-12-31"

## [1] "2007-03-22 00:00:00 AAPL 100 @ 3.3557140827179"

## [1] "2007-08-24 00:00:00 AAPL -100 @ 4.83214282989502"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-04 00:00:00 AAPL 100 @ 5.46714305877686"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-30 00:00:00 AAPL -100 @ 5.98000001907349"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-18 00:00:00 AAPL -100 @ 6.97964286804199"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-30 00:00:00 AAPL -100 @ 5.98000001907349"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-18 00:00:00 AAPL -100 @ 6.97964286804199"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2007-03-14 00:00:00 AAPL 100 @ 3.21428608894348"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-26 00:00:00 AAPL -100 @ 6.16214323043823"

## [1] "2007-11-30 00:00:00 AAPL 100 @ 6.50785684585571"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-27 00:00:00 AAPL 100 @ 5.00892877578735"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-18 00:00:00 AAPL 100 @ 6.26392889022827"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-05 00:00:00 AAPL 100 @ 3.4449999332428"

## [1] "2009-03-03 00:00:00 AAPL -100 @ 3.15607094764709"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-11 00:00:00 AAPL -100 @ 6.9524998664856"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2010-02-02 00:00:00 AAPL -100 @ 6.99499988555908"

## [1] "2010-03-03 00:00:00 AAPL 100 @ 7.47607088088989"

## [1] "2010-05-28 00:00:00 AAPL -100 @ 9.17428588867188"

## [1] "2010-06-02 00:00:00 AAPL 100 @ 9.42678642272949"

## [1] "2010-07-14 00:00:00 AAPL -100 @ 9.0260705947876"

## [1] "2010-08-02 00:00:00 AAPL 100 @ 9.35178565979004"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2007-03-15 00:00:00 AAPL 100 @ 3.19892907142639"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-28 00:00:00 AAPL 100 @ 5.10750007629395"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-19 00:00:00 AAPL 100 @ 6.19750022888184"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-14 00:00:00 AAPL -100 @ 7.03499984741211"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-03 00:00:00 AAPL -100 @ 7.11535692214966"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-15 00:00:00 AAPL -100 @ 8.98035717010498"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-02 00:00:00 AAPL 100 @ 5.26749992370605"

## [1] "2008-07-01 00:00:00 AAPL -100 @ 6.23857116699219"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-22 00:00:00 AAPL -100 @ 7.15571403503418"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2010-02-05 00:00:00 AAPL -100 @ 6.98071384429932"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-20 00:00:00 AAPL -100 @ 8.99607086181641"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2007-03-16 00:00:00 AAPL 100 @ 3.19964289665222"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-31 00:00:00 AAPL 100 @ 5.125"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-20 00:00:00 AAPL 100 @ 6.28000020980835"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-15 00:00:00 AAPL -100 @ 6.93464279174805"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-03 00:00:00 AAPL -100 @ 7.11535692214966"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-16 00:00:00 AAPL -100 @ 8.92500019073486"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-03 00:00:00 AAPL 100 @ 5.41464281082153"

## [1] "2008-07-02 00:00:00 AAPL -100 @ 6.00642919540405"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2010-02-08 00:00:00 AAPL -100 @ 6.93285703659058"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-20 00:00:00 AAPL -100 @ 8.99607086181641"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2007-03-22 00:00:00 AAPL 100 @ 3.3557140827179"

## [1] "2007-08-24 00:00:00 AAPL -100 @ 4.83214282989502"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-04 00:00:00 AAPL 100 @ 5.46714305877686"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2007-03-15 00:00:00 AAPL 100 @ 3.19892907142639"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-28 00:00:00 AAPL 100 @ 5.10750007629395"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-19 00:00:00 AAPL 100 @ 6.19750022888184"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-14 00:00:00 AAPL -100 @ 7.03499984741211"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-03 00:00:00 AAPL -100 @ 7.11535692214966"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-15 00:00:00 AAPL -100 @ 8.98035717010498"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-27 00:00:00 AAPL -100 @ 6.0746431350708"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-05 00:00:00 AAPL -100 @ 3.17285704612732"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-17 00:00:00 AAPL -100 @ 6.85214281082153"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2007-03-22 00:00:00 AAPL 100 @ 3.3557140827179"

## [1] "2007-08-24 00:00:00 AAPL -100 @ 4.83214282989502"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-04 00:00:00 AAPL 100 @ 5.46714305877686"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-03 00:00:00 AAPL 100 @ 5.41464281082153"

## [1] "2008-07-03 00:00:00 AAPL -100 @ 6.07571411132812"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-08 00:00:00 AAPL -100 @ 6.93285703659058"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-03 00:00:00 AAPL 100 @ 5.41464281082153"

## [1] "2008-07-02 00:00:00 AAPL -100 @ 6.00642919540405"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2010-02-08 00:00:00 AAPL -100 @ 6.93285703659058"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-20 00:00:00 AAPL -100 @ 8.99607086181641"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2007-03-26 00:00:00 AAPL 100 @ 3.42321395874023"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-09 00:00:00 AAPL -100 @ 6.2232141494751"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-23 00:00:00 AAPL -100 @ 9.28357124328613"

## [1] "2010-07-29 00:00:00 AAPL 100 @ 9.21821403503418"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "=== testing param.combo 21 on 2011-01-03/2011-12-30"

## nFAST nSLOW

## 21 6 8

## [1] "2011-03-22 00:00:00 AAPL -100 @ 12.1857137680054"

## [1] "2011-05-02 00:00:00 AAPL 100 @ 12.3671426773071"

## [1] "2011-05-20 00:00:00 AAPL -100 @ 11.9721431732178"

## [1] "2011-07-08 00:00:00 AAPL 100 @ 12.8467855453491"

## [1] "2011-11-16 00:00:00 AAPL -100 @ 13.7417860031128"

## [1] "2011-12-27 00:00:00 AAPL 100 @ 14.518928527832"

## [1] "=== training MA on 2007-01-03/2011-12-30"

## [1] "2007-03-20 00:00:00 AAPL 100 @ 3.26714301109314"

## [1] "2007-08-21 00:00:00 AAPL -100 @ 4.55607080459595"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-02 00:00:00 AAPL 100 @ 5.26749992370605"

## [1] "2008-06-30 00:00:00 AAPL -100 @ 5.98000001907349"

## [1] "2008-08-22 00:00:00 AAPL 100 @ 6.31392908096313"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-18 00:00:00 AAPL -100 @ 6.97964286804199"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2010-02-05 00:00:00 AAPL -100 @ 6.98071384429932"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2011-03-24 00:00:00 AAPL -100 @ 12.3203573226929"

## [1] "2011-05-05 00:00:00 AAPL 100 @ 12.3839292526245"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-18 00:00:00 AAPL -100 @ 13.3907136917114"

## [1] "2011-12-28 00:00:00 AAPL 100 @ 14.3800001144409"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2007-08-27 00:00:00 AAPL -100 @ 4.7232141494751"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-22 00:00:00 AAPL -100 @ 9.25071430206299"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-05 00:00:00 AAPL -100 @ 12.103214263916"

## [1] "2011-05-06 00:00:00 AAPL 100 @ 12.3807144165039"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-29 00:00:00 AAPL 100 @ 14.4685707092285"

## [1] "2007-03-27 00:00:00 AAPL 100 @ 3.40928602218628"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-11 00:00:00 AAPL -100 @ 6.16357088088989"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-13 00:00:00 AAPL 100 @ 3.54142904281616"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-08-20 00:00:00 AAPL -100 @ 8.91571426391602"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-08 00:00:00 AAPL -100 @ 11.9664287567139"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-14 00:00:00 AAPL 100 @ 12.7775001525879"

## [1] "2011-11-23 00:00:00 AAPL -100 @ 13.106785774231"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2007-03-15 00:00:00 AAPL 100 @ 3.19892907142639"

## [1] "2007-08-17 00:00:00 AAPL -100 @ 4.35928583145142"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-16 00:00:00 AAPL -100 @ 5.70142889022827"

## [1] "2008-03-28 00:00:00 AAPL 100 @ 5.10750007629395"

## [1] "2008-06-26 00:00:00 AAPL -100 @ 6.00928592681885"

## [1] "2008-08-19 00:00:00 AAPL 100 @ 6.19750022888184"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-14 00:00:00 AAPL -100 @ 7.03499984741211"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-03 00:00:00 AAPL -100 @ 7.11535692214966"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-15 00:00:00 AAPL -100 @ 8.98035717010498"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2011-03-22 00:00:00 AAPL -100 @ 12.1857137680054"

## [1] "2011-05-02 00:00:00 AAPL 100 @ 12.3671426773071"

## [1] "2011-05-20 00:00:00 AAPL -100 @ 11.9721431732178"

## [1] "2011-07-08 00:00:00 AAPL 100 @ 12.8467855453491"

## [1] "2011-11-16 00:00:00 AAPL -100 @ 13.7417860031128"

## [1] "2011-12-27 00:00:00 AAPL 100 @ 14.518928527832"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-03 00:00:00 AAPL 100 @ 5.41464281082153"

## [1] "2008-07-02 00:00:00 AAPL -100 @ 6.00642919540405"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2010-02-08 00:00:00 AAPL -100 @ 6.93285703659058"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-20 00:00:00 AAPL -100 @ 8.99607086181641"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2011-03-25 00:00:00 AAPL -100 @ 12.5550003051758"

## [1] "2011-05-05 00:00:00 AAPL 100 @ 12.3839292526245"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-12 00:00:00 AAPL 100 @ 12.6339292526245"

## [1] "2011-11-21 00:00:00 AAPL -100 @ 13.1789293289185"

## [1] "2011-12-28 00:00:00 AAPL 100 @ 14.3800001144409"

## [1] "2007-03-27 00:00:00 AAPL 100 @ 3.40928602218628"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-11 00:00:00 AAPL -100 @ 6.16357088088989"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-13 00:00:00 AAPL 100 @ 3.54142904281616"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-08-20 00:00:00 AAPL -100 @ 8.91571426391602"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-08 00:00:00 AAPL -100 @ 11.9664287567139"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-14 00:00:00 AAPL 100 @ 12.7775001525879"

## [1] "2011-11-23 00:00:00 AAPL -100 @ 13.106785774231"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2007-03-14 00:00:00 AAPL 100 @ 3.21428608894348"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-26 00:00:00 AAPL -100 @ 6.16214323043823"

## [1] "2007-11-30 00:00:00 AAPL 100 @ 6.50785684585571"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-27 00:00:00 AAPL 100 @ 5.00892877578735"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-18 00:00:00 AAPL 100 @ 6.26392889022827"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-05 00:00:00 AAPL 100 @ 3.4449999332428"

## [1] "2009-03-03 00:00:00 AAPL -100 @ 3.15607094764709"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-11 00:00:00 AAPL -100 @ 6.9524998664856"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2010-02-02 00:00:00 AAPL -100 @ 6.99499988555908"

## [1] "2010-03-03 00:00:00 AAPL 100 @ 7.47607088088989"

## [1] "2010-05-28 00:00:00 AAPL -100 @ 9.17428588867188"

## [1] "2010-06-02 00:00:00 AAPL 100 @ 9.42678642272949"

## [1] "2010-07-14 00:00:00 AAPL -100 @ 9.0260705947876"

## [1] "2010-08-02 00:00:00 AAPL 100 @ 9.35178565979004"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2011-03-21 00:00:00 AAPL -100 @ 12.1178569793701"

## [1] "2011-05-02 00:00:00 AAPL 100 @ 12.3671426773071"

## [1] "2011-05-20 00:00:00 AAPL -100 @ 11.9721431732178"

## [1] "2011-07-08 00:00:00 AAPL 100 @ 12.8467855453491"

## [1] "2011-10-11 00:00:00 AAPL -100 @ 14.2960710525513"

## [1] "2011-10-14 00:00:00 AAPL 100 @ 15.0714292526245"

## [1] "2011-11-15 00:00:00 AAPL -100 @ 13.8867864608765"

## [1] "2011-12-23 00:00:00 AAPL 100 @ 14.4046430587769"

## [1] "2007-03-26 00:00:00 AAPL 100 @ 3.42321395874023"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-10 00:00:00 AAPL -100 @ 6.30821418762207"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-27 00:00:00 AAPL -100 @ 9.43142890930176"

## [1] "2010-07-28 00:00:00 AAPL 100 @ 9.31999969482422"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-08 00:00:00 AAPL -100 @ 11.9664287567139"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2007-08-28 00:00:00 AAPL -100 @ 4.52928590774536"

## [1] "2007-09-04 00:00:00 AAPL 100 @ 5.1485710144043"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-08 00:00:00 AAPL -100 @ 6.41249990463257"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-22 00:00:00 AAPL -100 @ 9.25071430206299"

## [1] "2010-08-02 00:00:00 AAPL 100 @ 9.35178565979004"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-06 00:00:00 AAPL -100 @ 12.0728569030762"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-29 00:00:00 AAPL 100 @ 14.4685707092285"

## [1] "2007-03-26 00:00:00 AAPL 100 @ 3.42321395874023"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-09 00:00:00 AAPL -100 @ 6.2232141494751"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-23 00:00:00 AAPL -100 @ 9.28357124328613"

## [1] "2010-07-29 00:00:00 AAPL 100 @ 9.21821403503418"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-07 00:00:00 AAPL -100 @ 12.0742864608765"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2007-03-27 00:00:00 AAPL 100 @ 3.40928602218628"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-11 00:00:00 AAPL -100 @ 6.16357088088989"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-13 00:00:00 AAPL 100 @ 3.54142904281616"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-08-20 00:00:00 AAPL -100 @ 8.91571426391602"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-08 00:00:00 AAPL -100 @ 11.9664287567139"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-14 00:00:00 AAPL 100 @ 12.7775001525879"

## [1] "2011-11-23 00:00:00 AAPL -100 @ 13.106785774231"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2007-03-23 00:00:00 AAPL 100 @ 3.33999991416931"

## [1] "2007-08-28 00:00:00 AAPL -100 @ 4.52928590774536"

## [1] "2007-09-04 00:00:00 AAPL 100 @ 5.1485710144043"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-07 00:00:00 AAPL 100 @ 5.56750011444092"

## [1] "2008-07-08 00:00:00 AAPL -100 @ 6.41249990463257"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-22 00:00:00 AAPL -100 @ 9.25071430206299"

## [1] "2010-08-02 00:00:00 AAPL 100 @ 9.35178565979004"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-06 00:00:00 AAPL -100 @ 12.0728569030762"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-29 00:00:00 AAPL 100 @ 14.4685707092285"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-27 00:00:00 AAPL -100 @ 6.0746431350708"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-05 00:00:00 AAPL -100 @ 3.17285704612732"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-17 00:00:00 AAPL -100 @ 6.85214281082153"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2011-03-23 00:00:00 AAPL -100 @ 12.1139287948608"

## [1] "2011-05-04 00:00:00 AAPL 100 @ 12.4846429824829"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-17 00:00:00 AAPL -100 @ 13.478928565979"

## [1] "2011-12-27 00:00:00 AAPL 100 @ 14.518928527832"

## [1] "2007-03-22 00:00:00 AAPL 100 @ 3.3557140827179"

## [1] "2007-08-23 00:00:00 AAPL -100 @ 4.68107080459595"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-04 00:00:00 AAPL 100 @ 5.46714305877686"

## [1] "2008-07-03 00:00:00 AAPL -100 @ 6.07571411132812"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-08 00:00:00 AAPL -100 @ 6.93285703659058"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2011-03-28 00:00:00 AAPL -100 @ 12.5157136917114"

## [1] "2011-05-06 00:00:00 AAPL 100 @ 12.3807144165039"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-12 00:00:00 AAPL 100 @ 12.6339292526245"

## [1] "2011-11-21 00:00:00 AAPL -100 @ 13.1789293289185"

## [1] "2011-12-29 00:00:00 AAPL 100 @ 14.4685707092285"

## [1] "2007-03-22 00:00:00 AAPL 100 @ 3.3557140827179"

## [1] "2007-08-24 00:00:00 AAPL -100 @ 4.83214282989502"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-04 00:00:00 AAPL 100 @ 5.46714305877686"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-03-29 00:00:00 AAPL -100 @ 12.5342855453491"

## [1] "2011-05-06 00:00:00 AAPL 100 @ 12.3807144165039"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-21 00:00:00 AAPL -100 @ 13.1789293289185"

## [1] "2011-12-29 00:00:00 AAPL 100 @ 14.4685707092285"

## [1] "=== testing param.combo 17 on 2012-01-03/2012-12-31"

## nFAST nSLOW

## 17 2 8

## [1] "2012-05-08 00:00:00 AAPL -100 @ 20.292142868042"

## [1] "2012-06-20 00:00:00 AAPL 100 @ 20.9192867279053"

## [1] "2012-10-11 00:00:00 AAPL -100 @ 22.4321422576904"

## [1] "=== training MA on 2007-01-03/2012-12-31"

## [1] "2007-03-16 00:00:00 AAPL 100 @ 3.19964289665222"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-03-31 00:00:00 AAPL 100 @ 5.125"

## [1] "2008-06-27 00:00:00 AAPL -100 @ 6.0746431350708"

## [1] "2008-08-20 00:00:00 AAPL 100 @ 6.28000020980835"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-05 00:00:00 AAPL -100 @ 3.17285704612732"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-16 00:00:00 AAPL -100 @ 6.96535682678223"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-16 00:00:00 AAPL -100 @ 8.92500019073486"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2011-03-22 00:00:00 AAPL -100 @ 12.1857137680054"

## [1] "2011-05-03 00:00:00 AAPL 100 @ 12.4357137680054"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-17 00:00:00 AAPL -100 @ 13.478928565979"

## [1] "2011-12-27 00:00:00 AAPL 100 @ 14.518928527832"

## [1] "2012-05-09 00:00:00 AAPL -100 @ 20.3278560638428"

## [1] "2012-06-20 00:00:00 AAPL 100 @ 20.9192867279053"

## [1] "2012-10-12 00:00:00 AAPL -100 @ 22.4896430969238"

## [1] "2007-03-26 00:00:00 AAPL 100 @ 3.42321395874023"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-10 00:00:00 AAPL -100 @ 6.30821418762207"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-27 00:00:00 AAPL -100 @ 9.43142890930176"

## [1] "2010-07-28 00:00:00 AAPL 100 @ 9.31999969482422"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-08 00:00:00 AAPL -100 @ 11.9664287567139"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2012-05-21 00:00:00 AAPL -100 @ 20.0457134246826"

## [1] "2012-06-27 00:00:00 AAPL 100 @ 20.5178565979004"

## [1] "2012-10-22 00:00:00 AAPL -100 @ 22.643928527832"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-27 00:00:00 AAPL -100 @ 6.0746431350708"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-05 00:00:00 AAPL -100 @ 3.17285704612732"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-17 00:00:00 AAPL -100 @ 6.85214281082153"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2011-03-23 00:00:00 AAPL -100 @ 12.1139287948608"

## [1] "2011-05-04 00:00:00 AAPL 100 @ 12.4846429824829"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-17 00:00:00 AAPL -100 @ 13.478928565979"

## [1] "2011-12-27 00:00:00 AAPL 100 @ 14.518928527832"

## [1] "2012-05-10 00:00:00 AAPL -100 @ 20.3757133483887"

## [1] "2012-06-21 00:00:00 AAPL 100 @ 20.6310710906982"

## [1] "2012-10-15 00:00:00 AAPL -100 @ 22.6700000762939"

## [1] "2007-03-26 00:00:00 AAPL 100 @ 3.42321395874023"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-09 00:00:00 AAPL -100 @ 6.2232141494751"

## [1] "2008-08-27 00:00:00 AAPL 100 @ 6.23821401596069"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-12 00:00:00 AAPL 100 @ 3.54535698890686"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-23 00:00:00 AAPL -100 @ 9.28357124328613"

## [1] "2010-07-29 00:00:00 AAPL 100 @ 9.21821403503418"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-07 00:00:00 AAPL -100 @ 12.0742864608765"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-22 00:00:00 AAPL -100 @ 13.4467859268188"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2012-05-18 00:00:00 AAPL -100 @ 18.9421424865723"

## [1] "2012-06-27 00:00:00 AAPL 100 @ 20.5178565979004"

## [1] "2012-10-22 00:00:00 AAPL -100 @ 22.643928527832"

## [1] "2007-03-14 00:00:00 AAPL 100 @ 3.21428608894348"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-26 00:00:00 AAPL -100 @ 6.16214323043823"

## [1] "2007-11-30 00:00:00 AAPL 100 @ 6.50785684585571"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-27 00:00:00 AAPL 100 @ 5.00892877578735"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-18 00:00:00 AAPL 100 @ 6.26392889022827"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-05 00:00:00 AAPL 100 @ 3.4449999332428"

## [1] "2009-03-03 00:00:00 AAPL -100 @ 3.15607094764709"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-11 00:00:00 AAPL -100 @ 6.9524998664856"

## [1] "2009-12-28 00:00:00 AAPL 100 @ 7.55749988555908"

## [1] "2010-02-02 00:00:00 AAPL -100 @ 6.99499988555908"

## [1] "2010-03-03 00:00:00 AAPL 100 @ 7.47607088088989"

## [1] "2010-05-28 00:00:00 AAPL -100 @ 9.17428588867188"

## [1] "2010-06-02 00:00:00 AAPL 100 @ 9.42678642272949"

## [1] "2010-07-14 00:00:00 AAPL -100 @ 9.0260705947876"

## [1] "2010-08-02 00:00:00 AAPL 100 @ 9.35178565979004"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2011-03-21 00:00:00 AAPL -100 @ 12.1178569793701"

## [1] "2011-05-02 00:00:00 AAPL 100 @ 12.3671426773071"

## [1] "2011-05-20 00:00:00 AAPL -100 @ 11.9721431732178"

## [1] "2011-07-08 00:00:00 AAPL 100 @ 12.8467855453491"

## [1] "2011-10-11 00:00:00 AAPL -100 @ 14.2960710525513"

## [1] "2011-10-14 00:00:00 AAPL 100 @ 15.0714292526245"

## [1] "2011-11-15 00:00:00 AAPL -100 @ 13.8867864608765"

## [1] "2011-12-23 00:00:00 AAPL 100 @ 14.4046430587769"

## [1] "2012-05-07 00:00:00 AAPL -100 @ 20.3385715484619"

## [1] "2012-06-19 00:00:00 AAPL 100 @ 20.9789295196533"

## [1] "2012-10-11 00:00:00 AAPL -100 @ 22.4321422576904"

## [1] "2007-03-22 00:00:00 AAPL 100 @ 3.3557140827179"

## [1] "2007-08-24 00:00:00 AAPL -100 @ 4.83214282989502"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2008-01-22 00:00:00 AAPL -100 @ 5.55857086181641"

## [1] "2008-04-04 00:00:00 AAPL 100 @ 5.46714305877686"

## [1] "2008-07-07 00:00:00 AAPL -100 @ 6.25571393966675"

## [1] "2008-08-26 00:00:00 AAPL 100 @ 6.20142889022827"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-11 00:00:00 AAPL 100 @ 3.45785689353943"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-09 00:00:00 AAPL -100 @ 7.00678586959839"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-21 00:00:00 AAPL -100 @ 9.07999992370605"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-19 00:00:00 AAPL -100 @ 8.92428588867188"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-03-29 00:00:00 AAPL -100 @ 12.5342855453491"

## [1] "2011-05-06 00:00:00 AAPL 100 @ 12.3807144165039"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-13 00:00:00 AAPL 100 @ 12.7864294052124"

## [1] "2011-11-21 00:00:00 AAPL -100 @ 13.1789293289185"

## [1] "2011-12-29 00:00:00 AAPL 100 @ 14.4685707092285"

## [1] "2012-05-16 00:00:00 AAPL -100 @ 19.502857208252"

## [1] "2012-06-26 00:00:00 AAPL 100 @ 20.4296436309814"

## [1] "2012-10-18 00:00:00 AAPL -100 @ 22.5942859649658"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"

## [1] "2007-08-22 00:00:00 AAPL -100 @ 4.73250007629395"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-18 00:00:00 AAPL -100 @ 5.76285696029663"

## [1] "2008-04-03 00:00:00 AAPL 100 @ 5.41464281082153"

## [1] "2008-07-02 00:00:00 AAPL -100 @ 6.00642919540405"

## [1] "2008-08-25 00:00:00 AAPL 100 @ 6.16249990463257"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-10 00:00:00 AAPL 100 @ 3.49392890930176"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2010-02-08 00:00:00 AAPL -100 @ 6.93285703659058"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-07-20 00:00:00 AAPL -100 @ 8.99607086181641"

## [1] "2010-08-04 00:00:00 AAPL 100 @ 9.39214324951172"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-16 00:00:00 AAPL 100 @ 9.8774995803833"

## [1] "2011-03-25 00:00:00 AAPL -100 @ 12.5550003051758"

## [1] "2011-05-05 00:00:00 AAPL 100 @ 12.3839292526245"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-12 00:00:00 AAPL 100 @ 12.6339292526245"

## [1] "2011-11-21 00:00:00 AAPL -100 @ 13.1789293289185"

## [1] "2011-12-28 00:00:00 AAPL 100 @ 14.3800001144409"

## [1] "2012-05-15 00:00:00 AAPL -100 @ 19.7560710906982"

## [1] "2012-06-25 00:00:00 AAPL 100 @ 20.3846435546875"

## [1] "2012-10-17 00:00:00 AAPL -100 @ 23.021785736084"

## [1] "2007-03-15 00:00:00 AAPL 100 @ 3.19892907142639"

## [1] "2007-08-16 00:00:00 AAPL -100 @ 4.18035697937012"

## [1] "2007-09-05 00:00:00 AAPL 100 @ 4.88428592681885"

## [1] "2007-11-27 00:00:00 AAPL -100 @ 6.24321413040161"

## [1] "2007-11-29 00:00:00 AAPL 100 @ 6.58178615570068"

## [1] "2008-01-15 00:00:00 AAPL -100 @ 6.03714323043823"

## [1] "2008-03-28 00:00:00 AAPL 100 @ 5.10750007629395"

## [1] "2008-06-25 00:00:00 AAPL -100 @ 6.33535718917847"

## [1] "2008-08-19 00:00:00 AAPL 100 @ 6.19750022888184"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-06 00:00:00 AAPL 100 @ 3.56142902374268"

## [1] "2009-03-04 00:00:00 AAPL -100 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-14 00:00:00 AAPL -100 @ 7.03499984741211"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-03 00:00:00 AAPL -100 @ 7.11535692214966"

## [1] "2010-03-04 00:00:00 AAPL 100 @ 7.52535676956177"

## [1] "2010-07-14 00:00:00 AAPL -100 @ 9.0260705947876"

## [1] "2010-08-02 00:00:00 AAPL 100 @ 9.35178565979004"

## [1] "2010-08-17 00:00:00 AAPL -100 @ 8.99892902374268"

## [1] "2010-09-14 00:00:00 AAPL 100 @ 9.57357120513916"

## [1] "2011-03-21 00:00:00 AAPL -100 @ 12.1178569793701"

## [1] "2011-05-02 00:00:00 AAPL 100 @ 12.3671426773071"

## [1] "2011-05-20 00:00:00 AAPL -100 @ 11.9721431732178"

## [1] "2011-07-08 00:00:00 AAPL 100 @ 12.8467855453491"

## [1] "2011-10-12 00:00:00 AAPL -100 @ 14.3639287948608"

## [1] "2011-10-13 00:00:00 AAPL 100 @ 14.5867862701416"

## [1] "2011-11-16 00:00:00 AAPL -100 @ 13.7417860031128"

## [1] "2011-12-23 00:00:00 AAPL 100 @ 14.4046430587769"

## [1] "2012-05-08 00:00:00 AAPL -100 @ 20.292142868042"

## [1] "2012-06-19 00:00:00 AAPL 100 @ 20.9789295196533"

## [1] "2012-10-11 00:00:00 AAPL -100 @ 22.4321422576904"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-30 00:00:00 AAPL -100 @ 5.98000001907349"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-18 00:00:00 AAPL -100 @ 6.97964286804199"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2011-03-23 00:00:00 AAPL -100 @ 12.1139287948608"

## [1] "2011-05-04 00:00:00 AAPL 100 @ 12.4846429824829"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-17 00:00:00 AAPL -100 @ 13.478928565979"

## [1] "2011-12-28 00:00:00 AAPL 100 @ 14.3800001144409"

## [1] "2012-05-10 00:00:00 AAPL -100 @ 20.3757133483887"

## [1] "2012-06-21 00:00:00 AAPL 100 @ 20.6310710906982"

## [1] "2012-10-15 00:00:00 AAPL -100 @ 22.6700000762939"

## [1] "2007-03-27 00:00:00 AAPL 100 @ 3.40928602218628"

## [1] "2008-01-23 00:00:00 AAPL -100 @ 4.96678590774536"

## [1] "2008-04-08 00:00:00 AAPL 100 @ 5.45857095718384"

## [1] "2008-07-11 00:00:00 AAPL -100 @ 6.16357088088989"

## [1] "2008-08-28 00:00:00 AAPL 100 @ 6.20499992370605"

## [1] "2008-09-09 00:00:00 AAPL -100 @ 5.41714286804199"

## [1] "2009-02-13 00:00:00 AAPL 100 @ 3.54142904281616"

## [1] "2009-03-09 00:00:00 AAPL -100 @ 2.96821403503418"

## [1] "2009-03-20 00:00:00 AAPL 100 @ 3.62821388244629"

## [1] "2010-02-10 00:00:00 AAPL -100 @ 6.96857118606567"

## [1] "2010-03-08 00:00:00 AAPL 100 @ 7.82428598403931"

## [1] "2010-08-20 00:00:00 AAPL -100 @ 8.91571426391602"

## [1] "2010-09-17 00:00:00 AAPL 100 @ 9.83464336395264"

## [1] "2011-04-08 00:00:00 AAPL -100 @ 11.9664287567139"

## [1] "2011-05-09 00:00:00 AAPL 100 @ 12.41428565979"

## [1] "2011-05-24 00:00:00 AAPL -100 @ 11.8639287948608"

## [1] "2011-07-14 00:00:00 AAPL 100 @ 12.7775001525879"

## [1] "2011-11-23 00:00:00 AAPL -100 @ 13.106785774231"

## [1] "2011-12-30 00:00:00 AAPL 100 @ 14.4642858505249"

## [1] "2012-05-21 00:00:00 AAPL -100 @ 20.0457134246826"

## [1] "2012-06-27 00:00:00 AAPL 100 @ 20.5178565979004"

## [1] "2012-10-22 00:00:00 AAPL -100 @ 22.643928527832"

## [1] "2007-03-19 00:00:00 AAPL 100 @ 3.25464296340942"

## [1] "2007-08-20 00:00:00 AAPL -100 @ 4.36499977111816"

## [1] "2007-09-06 00:00:00 AAPL 100 @ 4.82178592681885"

## [1] "2008-01-17 00:00:00 AAPL -100 @ 5.74607086181641"

## [1] "2008-04-01 00:00:00 AAPL 100 @ 5.34035682678223"

## [1] "2008-06-30 00:00:00 AAPL -100 @ 5.98000001907349"

## [1] "2008-08-21 00:00:00 AAPL 100 @ 6.22464323043823"

## [1] "2008-09-10 00:00:00 AAPL -100 @ 5.41464281082153"

## [1] "2009-02-09 00:00:00 AAPL 100 @ 3.66107106208801"

## [1] "2009-03-06 00:00:00 AAPL -100 @ 3.0464289188385"

## [1] "2009-03-19 00:00:00 AAPL 100 @ 3.62928605079651"

## [1] "2009-12-18 00:00:00 AAPL -100 @ 6.97964286804199"

## [1] "2009-12-29 00:00:00 AAPL 100 @ 7.46785688400269"

## [1] "2010-02-04 00:00:00 AAPL -100 @ 6.85892915725708"

## [1] "2010-03-05 00:00:00 AAPL 100 @ 7.81964302062988"

## [1] "2010-07-19 00:00:00 AAPL -100 @ 8.77071380615234"

## [1] "2010-08-03 00:00:00 AAPL 100 @ 9.35464286804199"

## [1] "2010-08-18 00:00:00 AAPL -100 @ 9.0382137298584"

## [1] "2010-09-15 00:00:00 AAPL 100 @ 9.65071392059326"

## [1] "2011-03-23 00:00:00 AAPL -100 @ 12.1139287948608"

## [1] "2011-05-04 00:00:00 AAPL 100 @ 12.4846429824829"

## [1] "2011-05-23 00:00:00 AAPL -100 @ 11.9428567886353"

## [1] "2011-07-11 00:00:00 AAPL 100 @ 12.6428565979004"

## [1] "2011-11-17 00:00:00 AAPL -100 @ 13.478928565979"

## [1] "2011-12-28 00:00:00 AAPL 100 @ 14.3800001144409"

## [1] "2012-05-10 00:00:00 AAPL -100 @ 20.3757133483887"

## [1] "2012-06-21 00:00:00 AAPL 100 @ 20.6310710906982"

## [1] "2012-10-15 00:00:00 AAPL -100 @ 22.6700000762939"

## [1] "2007-03-21 00:00:00 AAPL 100 @ 3.35249996185303"