MACD(移动平均收敛散度)作为经典的趋势与动量指标,其核心价值在于通过短期与长期价格趋势的差异,捕捉市场动量的变化。在实际交易中,MACD 的信号线与零轴的交叉常被视为趋势转折的信号 —— 上穿零轴暗示趋势由弱转强,下穿零轴则可能预示趋势走弱。

本文将解析一段基于 R 语言quantstrat包的 MACD 策略代码,该代码以 AAPL 为标的,通过信号线穿越零轴生成交易信号,实现趋势跟踪,并展示量化策略从环境搭建到回测评估的完整流程。

MACD 指标的核心构成与策略逻辑

在深入代码前,先明确 MACD 指标的组成与策略设计逻辑:

- 快速 EMA(12 日):基于收盘价计算的短期指数移动平均线,反映近期价格趋势。

- 慢速 EMA(26 日):长期指数移动平均线,反映中长期价格趋势。

- MACD 线:快速 EMA 与慢速 EMA 的差值,衡量短期与长期趋势的偏离程度。

- 信号线:MACD 线的 9 日 EMA,用于平滑 MACD 线的波动,减少噪音信号。

- 零轴:MACD 线与信号线围绕波动的基准线,代表多空力量的平衡点。

本策略的核心逻辑是:当信号线从下方穿越零轴(上穿)时,认为多头趋势确立,触发买入信号;当信号线从上方穿越零轴(下穿)时,认为空头趋势显现,触发卖出信号,通过这种方式跟踪中长期趋势。 策略代码与详细注释

以下是完整的策略代码,包含逐段注释以解释各环节的功能:

# Simple MACD strategy

#

# MACD可通过多种方式使用,本策略展示其作为趋势指标的应用。

#

# 传统上,当MACD信号线穿越零时,标志着正向趋势的确立

#

# 本策略将在“signal”列上穿零轴时买入,下穿零轴时卖出

#

# Author: brian

###############################################################################

# 加载quantstrat包,用于量化策略开发与回测

require(quantstrat)

# 清理旧策略数据,确保回测环境纯净(避免残留数据干扰结果)

suppressWarnings(rm("order_book.macd", pos=.strategy))

suppressWarnings(rm("account.macd", "portfolio.macd", pos=.blotter))

suppressWarnings(rm("account.st", "portfolio.st", "stock.str", "stratMACD", "startDate", "initEq", 'start_t', 'end_t'))

# 设定交易标的为苹果公司股票(AAPL)

stock.str <- 'AAPL'

# MACD指标参数:快速EMA周期、慢速EMA周期、信号线周期,均采用指数移动平均线(EMA)

fastMA = 12 # 快速EMA周期(传统参数为12日)

slowMA = 26 # 慢速EMA周期(传统参数为26日)

signalMA = 9 # 信号线周期(传统参数为9日)

maType = "EMA" # 移动平均线类型为指数移动平均(EMA)

# 定义货币单位为美元,并初始化标的属性(AAPL以美元计价,合约乘数为1)

currency('USD')## [1] "USD"stock(stock.str, currency='USD', multiplier=1)## [1] "AAPL"# 回测参数设置:回测起始日期、初始资金、组合与账户名称

startDate = '2006-12-31' # 数据起始日期

initEq = 1000000 # 初始资金100万美元

portfolio.st = 'macd' # 投资组合名称

account.st = 'macd' # 账户名称

# 初始化回测环境:创建组合、账户与订单簿

initPortf(portfolio.st, symbols=stock.str) # 初始化组合,包含AAPL## [1] "macd"initAcct(account.st, portfolios=portfolio.st) # 初始化账户,关联组合## [1] "macd"initOrders(portfolio=portfolio.st) # 初始化订单簿,记录交易订单

# 创建策略对象,命名为'macd'并存储到环境中

strat.st <- portfolio.st

strategy(strat.st, store=TRUE)

# 添加MACD指标:基于收盘价计算MACD线、信号线

add.indicator(

strat.st,

name = "MACD", # 使用TTR包中的MACD函数

arguments = list(x=quote(Cl(mktdata))) # 输入为收盘价(Cl(mktdata))

)## [1] "macd"# 生成交易信号:基于信号线与零轴的交叉

# 信号1:信号线上穿零轴(大于零且交叉),视为买入信号

add.signal(

strat.st,

name = "sigThreshold", # 阈值型信号函数

arguments = list(

column = "signal.MACD.ind", # 作用于MACD指标的信号线列

relationship = "gt", # 大于(greater than)

threshold = 0, # 阈值为0(零轴)

cross = TRUE # 必须穿越阈值(避免持续触发)

),

label = "signal.gt.zero" # 信号标签:上穿零轴

)## [1] "macd"# 信号2:信号线下穿零轴(小于零且交叉),视为卖出信号

add.signal(

strat.st,

name = "sigThreshold",

arguments = list(

column = "signal.MACD.ind",

relationship = "lt", # 小于(less than)

threshold = 0,

cross = TRUE

),

label = "signal.lt.zero" # 信号标签:下穿零轴

)## [1] "macd"# 定义交易规则:将信号转化为具体交易动作

# 入场规则:当出现上穿零轴信号时,买入(做多)

add.rule(

strat.st,

name = 'ruleSignal', # 基于信号的规则函数

arguments = list(

sigcol = "signal.gt.zero", # 触发信号列:上穿零轴

sigval = TRUE, # 信号值为TRUE时触发

orderqty = 1000000, # 订单数量(此处为大额,实际会由osMaxPos限制)

ordertype = 'market', # 市价单

orderside = 'long', # 做多方向

threshold = NULL,

osFUN = 'osMaxPos' # 使用最大仓位限制函数,避免超仓

),

type = 'enter', # 入场规则

label = 'enter'

)## [1] "macd"# 出场规则:当出现下穿零轴信号时,平仓(卖出所有持仓)

add.rule(

strat.st,

name = 'ruleSignal',

arguments = list(

sigcol = "signal.lt.zero", # 触发信号列:下穿零轴

sigval = TRUE,

orderqty = 'all', # 平仓全部持仓

ordertype = 'market',

orderside = 'long',

threshold = NULL,

orderset = 'exit2' # 订单集标签,用于管理出场订单

),

type = 'exit', # 出场规则

label = 'exit'

)## [1] "macd"# 再平衡规则:按月调整仓位,控制单只标的的资金占比

add.rule(

strat.st,

'rulePctEquity', # 基于权益比例的再平衡函数

arguments = list(

rebalance_on = 'months', # 再平衡周期:每月

trade.percent = .02, # 单只标的持仓占总权益的比例(2%)

refprice = quote(last(getPrice(mktdata)[paste('::', curIndex, sep='')])), # 参考价格为最新价格

digits = 0 # 订单数量取整

),

type = 'rebalance', # 再平衡规则

label = 'rebalance'

)## [1] "macd"# 获取历史数据:从雅虎财经下载AAPL的历史数据(起始日期为startDate)

getSymbols(stock.str, from=startDate, src='yahoo')## [1] "AAPL"# 执行策略回测:应用再平衡策略

start_t <- Sys.time() # 记录回测开始时间

out <- applyStrategy.rebalancing(

strat.st,

portfolios = portfolio.st,

parameters = list(nFast=fastMA, nSlow=slowMA, nSig=signalMA, maType=maType), # 传递MACD参数

verbose = TRUE # 输出详细过程

)## [1] "2007-03-16 00:00:00 AAPL 6619 @ 3.19964289665222"## [1] "2007-08-17 00:00:00 AAPL -6619 @ 4.35928583145142"## [1] "2007-09-05 00:00:00 AAPL 4075 @ 4.88428592681885"## [1] "2008-01-16 00:00:00 AAPL -4075 @ 5.70142889022827"## [1] "2008-03-31 00:00:00 AAPL 4529 @ 5.125"## [1] "2008-06-26 00:00:00 AAPL -4529 @ 6.00928592681885"## [1] "2008-08-20 00:00:00 AAPL 3576 @ 6.28000020980835"## [1] "2008-09-09 00:00:00 AAPL -3576 @ 5.41714286804199"## [1] "2009-02-06 00:00:00 AAPL 6287 @ 3.56142902374268"## [1] "2009-03-04 00:00:00 AAPL -6287 @ 3.25607109069824"

## [1] "2009-03-19 00:00:00 AAPL 6330 @ 3.62928605079651"## [1] "2009-12-15 00:00:00 AAPL -6330 @ 6.93464279174805"

## [1] "2009-12-29 00:00:00 AAPL 2892 @ 7.46785688400269"## [1] "2010-02-03 00:00:00 AAPL -2892 @ 7.11535692214966"## [1] "2010-03-04 00:00:00 AAPL 2819 @ 7.52535676956177"## [1] "2010-07-16 00:00:00 AAPL -2819 @ 8.92500019073486"## [1] "2010-08-03 00:00:00 AAPL 2251 @ 9.35464286804199"

## [1] "2010-08-17 00:00:00 AAPL -2251 @ 8.99892902374268"## [1] "2010-09-15 00:00:00 AAPL 2380 @ 9.65071392059326"## [1] "2011-03-22 00:00:00 AAPL -2380 @ 12.1857137680054"## [1] "2011-05-03 00:00:00 AAPL 1662 @ 12.4357137680054"

## [1] "2011-05-23 00:00:00 AAPL -1662 @ 11.9428567886353"## [1] "2011-07-11 00:00:00 AAPL 1732 @ 12.6428565979004"## [1] "2011-11-16 00:00:00 AAPL -1732 @ 13.7417860031128"## [1] "2011-12-27 00:00:00 AAPL 1524 @ 14.518928527832"## [1] "2012-05-09 00:00:00 AAPL -1524 @ 20.3278560638428"## [1] "2012-06-20 00:00:00 AAPL 1017 @ 20.9192867279053"## [1] "2012-10-12 00:00:00 AAPL -1017 @ 22.4896430969238"## [1] "2013-05-09 00:00:00 AAPL 1329 @ 16.3132133483887"## [1] "2013-06-19 00:00:00 AAPL -1329 @ 15.1071434020996"## [1] "2013-07-26 00:00:00 AAPL 1481 @ 15.7496433258057"## [1] "2014-01-22 00:00:00 AAPL -1481 @ 19.6967868804932"

## [1] "2014-01-24 00:00:00 AAPL 1053 @ 19.5025005340576"

## [1] "2014-01-29 00:00:00 AAPL -1053 @ 17.8839282989502"## [1] "2014-03-26 00:00:00 AAPL 1121 @ 19.2778568267822"## [1] "2014-04-15 00:00:00 AAPL -1121 @ 18.498571395874"

## [1] "2014-04-29 00:00:00 AAPL 1099 @ 21.1546421051025"## [1] "2014-10-17 00:00:00 AAPL -1099 @ 24.4174995422363"

## [1] "2014-10-27 00:00:00 AAPL 839 @ 26.2775001525879"## [1] "2015-01-06 00:00:00 AAPL -839 @ 26.5650005340576"## [1] "2015-02-02 00:00:00 AAPL 721 @ 29.6574993133545"## [1] "2015-06-19 00:00:00 AAPL -721 @ 31.6499996185303"## [1] "2015-10-27 00:00:00 AAPL 767 @ 28.6375007629395"## [1] "2015-12-16 00:00:00 AAPL -767 @ 27.8349990844727"## [1] "2016-03-09 00:00:00 AAPL 874 @ 25.2800006866455"## [1] "2016-05-02 00:00:00 AAPL -874 @ 23.4099998474121"## [1] "2016-07-20 00:00:00 AAPL 883 @ 24.9899997711182"## [1] "2016-11-09 00:00:00 AAPL -883 @ 27.7199993133545"## [1] "2016-12-15 00:00:00 AAPL 766 @ 28.9549999237061"## [1] "2017-06-20 00:00:00 AAPL -766 @ 36.252498626709"## [1] "2017-07-25 00:00:00 AAPL 591 @ 38.185001373291"## [1] "2017-09-27 00:00:00 AAPL -591 @ 38.5574989318848"## [1] "2017-10-24 00:00:00 AAPL 552 @ 39.2750015258789"## [1] "2018-02-02 00:00:00 AAPL -552 @ 40.125"## [1] "2018-03-01 00:00:00 AAPL 478 @ 43.75"## [1] "2018-04-02 00:00:00 AAPL -478 @ 41.6699981689453"

## [1] "2018-04-19 00:00:00 AAPL 507 @ 43.2000007629395"

## [1] "2018-04-25 00:00:00 AAPL -507 @ 40.9124984741211"## [1] "2018-05-09 00:00:00 AAPL 514 @ 46.8400001525879"## [1] "2018-07-06 00:00:00 AAPL -514 @ 46.9925003051758"

## [1] "2018-07-11 00:00:00 AAPL 459 @ 46.9700012207031"## [1] "2018-10-29 00:00:00 AAPL -459 @ 53.060001373291"## [1] "2019-02-08 00:00:00 AAPL 512 @ 42.6025009155273"## [1] "2019-05-21 00:00:00 AAPL -512 @ 46.6500015258789"## [1] "2019-06-21 00:00:00 AAPL 487 @ 49.6949996948242"## [1] "2020-03-02 00:00:00 AAPL -487 @ 74.7024993896484"## [1] "2020-04-23 00:00:00 AAPL 339 @ 68.7574996948242"## [1] "2020-09-25 00:00:00 AAPL -339 @ 112.279998779297"## [1] "2020-10-13 00:00:00 AAPL 189 @ 121.099998474121"## [1] "2020-11-03 00:00:00 AAPL -189 @ 110.440002441406"

## [1] "2020-11-16 00:00:00 AAPL 201 @ 120.300003051758"## [1] "2021-02-25 00:00:00 AAPL -201 @ 120.98999786377"## [1] "2021-04-14 00:00:00 AAPL 179 @ 132.029998779297"## [1] "2021-05-18 00:00:00 AAPL -179 @ 124.849998474121"## [1] "2021-06-21 00:00:00 AAPL 175 @ 132.300003051758"## [1] "2021-09-27 00:00:00 AAPL -175 @ 145.369995117188"## [1] "2021-10-27 00:00:00 AAPL 154 @ 148.850006103516"## [1] "2022-01-26 00:00:00 AAPL -154 @ 159.690002441406"## [1] "2022-02-10 00:00:00 AAPL 125 @ 172.119995117188"

## [1] "2022-02-24 00:00:00 AAPL -125 @ 162.740005493164"## [1] "2022-03-30 00:00:00 AAPL 132 @ 177.770004272461"## [1] "2022-04-26 00:00:00 AAPL -132 @ 156.800003051758"## [1] "2022-07-19 00:00:00 AAPL 160 @ 151"## [1] "2022-09-13 00:00:00 AAPL -160 @ 153.839996337891"## [1] "2022-11-23 00:00:00 AAPL 142 @ 151.070007324219"## [1] "2022-12-08 00:00:00 AAPL -142 @ 142.649993896484"## [1] "2023-01-30 00:00:00 AAPL 168 @ 143"## [1] "2023-08-14 00:00:00 AAPL -168 @ 179.460006713867"## [1] "2023-11-13 00:00:00 AAPL 128 @ 184.800003051758"## [1] "2024-01-10 00:00:00 AAPL -128 @ 186.190002441406"

## [1] "2024-01-30 00:00:00 AAPL 114 @ 188.039993286133"## [1] "2024-02-06 00:00:00 AAPL -114 @ 189.300003051758"## [1] "2024-05-08 00:00:00 AAPL 129 @ 182.740005493164"## [1] "2024-08-14 00:00:00 AAPL -129 @ 221.720001220703"

## [1] "2024-08-16 00:00:00 AAPL 99 @ 226.050003051758"## [1] "2024-11-11 00:00:00 AAPL -99 @ 224.229995727539"

## [1] "2024-11-27 00:00:00 AAPL 97 @ 234.929992675781"## [1] "2025-01-21 00:00:00 AAPL -97 @ 222.639999389648"## [1] "2025-02-24 00:00:00 AAPL 93 @ 247.100006103516"## [1] "2025-03-13 00:00:00 AAPL -93 @ 209.679992675781"## [1] "2025-07-07 00:00:00 AAPL 107 @ 209.949996948242"end_t <- Sys.time() # 记录回测结束时间

print(end_t - start_t) # 打印回测耗时## Time difference of 8.527371 secs# 更新组合数据:将交易记录同步到组合与账户

start_t <- Sys.time()

updatePortf(

Portfolio = portfolio.st,

Dates = paste('::', as.Date(Sys.time()), sep='') # 更新至当前日期

)## [1] "macd"end_t <- Sys.time()

print("trade blotter portfolio update:")## [1] "trade blotter portfolio update:"print(end_t - start_t) # 打印更新耗时## Time difference of 0.03819585 secs# 可视化回测结果:绘制持仓变化与MACD指标

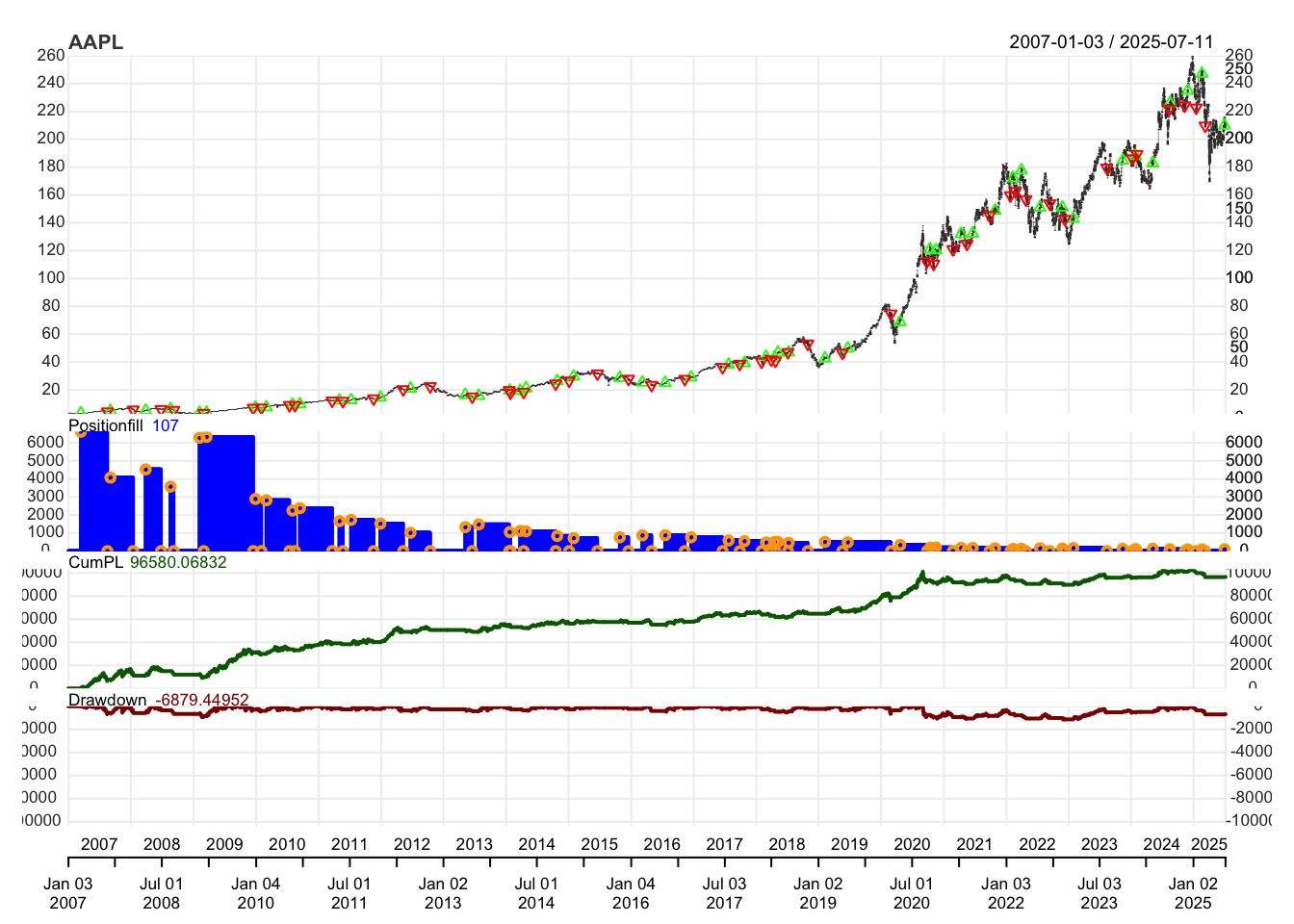

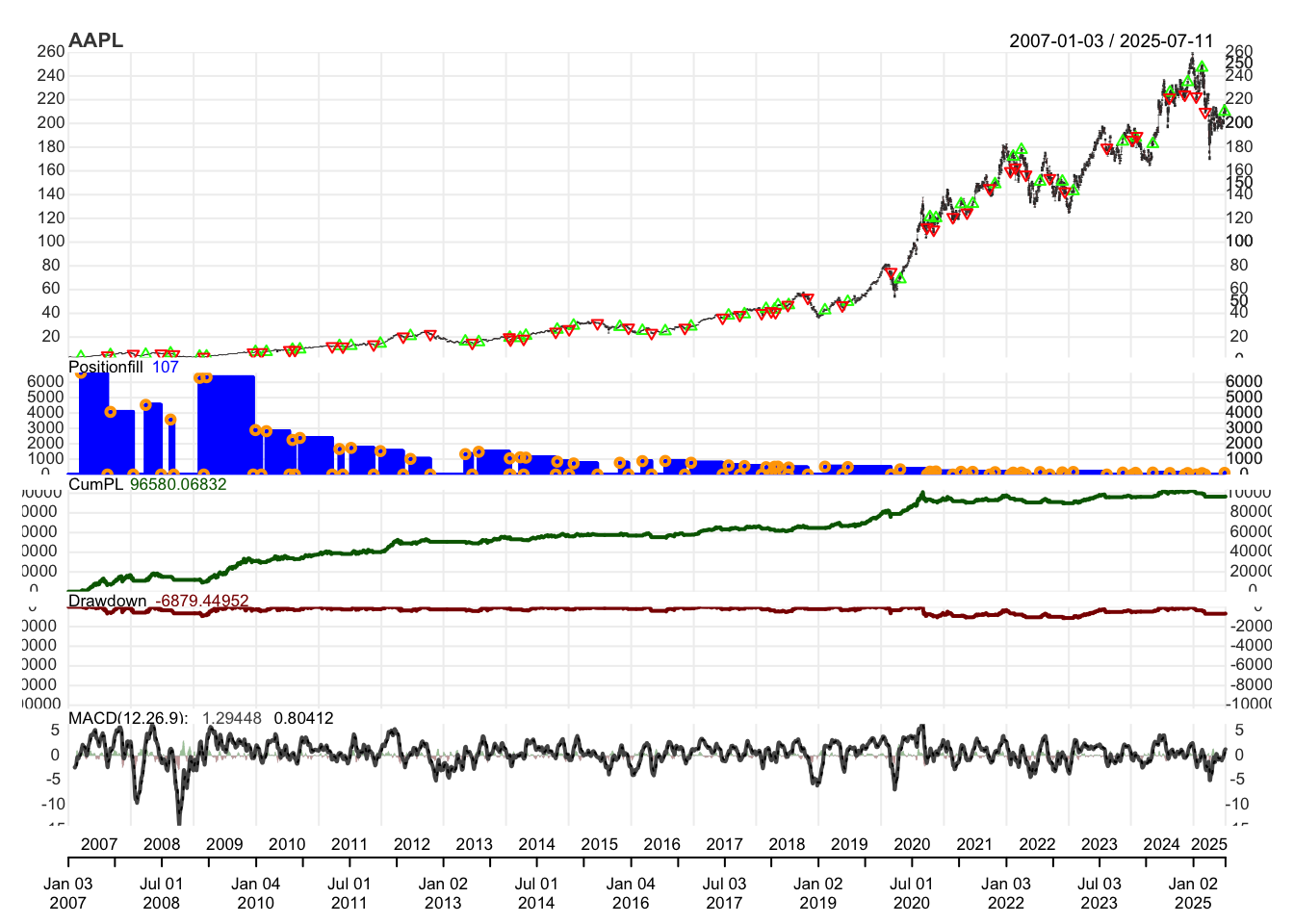

chart.Posn(Portfolio = portfolio.st, Symbol = stock.str) # 展示AAPL的持仓变化

plot(add_MACD(fast=fastMA, slow=slowMA, signal=signalMA, maType="EMA")) # 叠加MACD指标(快速EMA=12,慢速EMA=26,信号线=9)

# 查看订单簿:获取所有订单的详细记录(用于调试与分析)

getOrderBook('macd')## $macd

## $macd$AAPL

## Order.Qty Order.Price Order.Type Order.Side Order.Threshold

## 2007-03-15 6619 3.19892907142639 market long NA

## 2007-08-16 all 4.18035697937012 market long NA

## 2007-09-04 4075 5.1485710144043 market long NA

## 2008-01-15 all 6.03714323043823 market long NA

## 2008-03-28 4529 5.10750007629395 market long NA

## 2008-06-25 all 6.33535718917847 market long NA

## 2008-08-19 3576 6.19750022888184 market long NA

## 2008-09-08 all 5.6399998664856 market long NA

## 2009-02-05 6287 3.4449999332428 market long NA

## 2009-03-03 all 3.15607094764709 market long NA

## ...

## 2024-02-05 all 187.679992675781 market long NA

## 2024-05-07 129 182.399993896484 market long NA

## 2024-08-13 all 221.270004272461 market long NA

## 2024-08-15 99 224.720001220703 market long NA

## 2024-11-08 all 226.960006713867 market long NA

## 2024-11-26 97 235.059997558594 market long NA

## 2025-01-17 all 229.979995727539 market long NA

## 2025-02-21 93 245.550003051758 market long NA

## 2025-03-12 all 216.979995727539 market long NA

## 2025-07-03 107 213.550003051758 market long NA

## Order.Status Order.StatusTime Prefer Order.Set Txn.Fees Rule

## 2007-03-15 closed 2007-03-16 00:00:00 NA 0 enter

## 2007-08-16 closed 2007-08-17 00:00:00 exit2 0 exit

## 2007-09-04 closed 2007-09-05 00:00:00 NA 0 enter

## 2008-01-15 closed 2008-01-16 00:00:00 exit2 0 exit

## 2008-03-28 closed 2008-03-31 00:00:00 NA 0 enter

## 2008-06-25 closed 2008-06-26 00:00:00 exit2 0 exit

## 2008-08-19 closed 2008-08-20 00:00:00 NA 0 enter

## 2008-09-08 closed 2008-09-09 00:00:00 exit2 0 exit

## 2009-02-05 closed 2009-02-06 00:00:00 NA 0 enter

## 2009-03-03 closed 2009-03-04 00:00:00 exit2 0 exit

## ...

## 2024-02-05 closed 2024-02-06 00:00:00 exit2 0 exit

## 2024-05-07 closed 2024-05-08 00:00:00 NA 0 enter

## 2024-08-13 closed 2024-08-14 00:00:00 exit2 0 exit

## 2024-08-15 closed 2024-08-16 00:00:00 NA 0 enter

## 2024-11-08 closed 2024-11-11 00:00:00 exit2 0 exit

## 2024-11-26 closed 2024-11-27 00:00:00 NA 0 enter

## 2025-01-17 closed 2025-01-21 00:00:00 exit2 0 exit

## 2025-02-21 closed 2025-02-24 00:00:00 NA 0 enter

## 2025-03-12 closed 2025-03-13 00:00:00 exit2 0 exit

## 2025-07-03 closed 2025-07-07 00:00:00 NA 0 enter

## Time.In.Force

## 2007-03-15

## 2007-08-16

## 2007-09-04

## 2008-01-15

## 2008-03-28

## 2008-06-25

## 2008-08-19

## 2008-09-08

## 2009-02-05

## 2009-03-03

## ...

## 2024-02-05

## 2024-05-07

## 2024-08-13

## 2024-08-15

## 2024-11-08

## 2024-11-26

## 2025-01-17

## 2025-02-21

## 2025-03-12

## 2025-07-03

##

##

## attr(,"class")

## [1] "order_book"策略核心思路

该策略的实现遵循量化交易的经典流程,从环境初始化到信号生成,再到交易执行与结果可视化,各环节紧密衔接,核心思路可总结为以下几点:

环境与参数的标准化搭建:

代码首先清理旧有策略数据,避免残留信息干扰回测;随后定义交易标的(AAPL)、货币单位(USD)及初始资金(100 万美元),通过initPortf、initAcct等函数初始化组合、账户与订单簿,为策略运行创建纯净的环境。同时,设定 MACD 的核心参数(快速 EMA=12、慢速 EMA=26、信号线 = 9),这些参数是指标计算的基础,也是后续策略优化的关键变量。

指标与信号的逻辑闭环:

策略通过add.indicator添加 MACD 指标,基于收盘价计算 MACD 线与信号线;再通过add.signal定义信号规则 —— 当信号线从下方穿越零轴(signal.gt.zero)时,认为多头趋势确立,生成买入信号;当信号线从上方穿越零轴(signal.lt.zero)时,认为趋势转弱,生成卖出信号。这种 “指标计算→信号触发” 的逻辑,是趋势跟踪策略的核心。

交易规则的风险控制:

为避免盲目交易,策略通过多重规则控制风险: 入场时使用osMaxPos函数限制最大仓位,防止单次下单量过大; 出场时采用 “平仓全部持仓”(orderqty=‘all’),确保趋势反转时及时离场; 每月再平衡(rulePctEquity)控制单只标的的持仓占比(2%),避免过度集中风险。

回测与可视化的结果验证:

策略通过applyStrategy.rebalancing执行回测,记录耗时以评估效率;随后更新组合数据,确保交易记录与账户权益同步;最后通过chart.Posn与add_MACD可视化持仓变化与指标走势,直观展示交易时机与 MACD 信号的对应关系,为策略分析提供依据。

策略的优势与局限性

该 MACD 趋势跟踪策略的优势在于逻辑清晰、实现简单,且具备明确的风险控制机制: - 基于信号线与零轴的交叉信号,避免了主观判断,规则可量化、可复现; - 再平衡机制与仓位限制有效控制了单一标的的风险暴露,适合资金管理; - 兼容量化回测框架,便于后续参数优化(如调整 EMA 周期)或策略扩展(如添加止损)。

但策略也存在趋势跟踪类策略的共性局限:

- 滞后性:EMA 基于历史价格计算,信号可能滞后于实际趋势转折,导致入场过晚或出场延迟;

- 震荡市失效:在横盘震荡行情中,信号线可能频繁穿越零轴,产生大量虚假信号,导致频繁交易与成本累积;

- 参数敏感性:过度依赖传统参数(12/26/9)可能无法适配不同市场环境,需结合标的特性优化。