引言

技术指标是基于历史价格和成交量数据构建的分析工具,用于研判市场趋势及买卖时机。常见类型包括趋势指标(如移动平均线)、动量指标(如RSI)、波动率指标(布林带)和成交量指标(OBV)。其中,相对强弱指数(RSI)由韦尔斯·怀尔德于1978年提出,通过计算特定周期(通常14日)内平均涨幅与总波动的比值,衡量价格变化强度。其公式为:RSI = 100 - 100/(1 + 平均涨幅/平均跌幅),数值在0-100间波动。应用时,70以上视为超买信号,提示潜在回调可能;30以下为超卖信号,暗示反弹机会。进阶用法包括:观察RSI与价格背离判断趋势反转;结合趋势线突破确认交易信号;在30-70区间内运用中位线(50)判断多空力道。

需注意,在单边行情中RSI易出现钝化,应与趋势指标配合使用以提高准确性。该指标广泛应用于股票、外汇及加密货币市场的短线交易策略。

策略实现

下面我们用R实现一个基于RSI指标的量化交易策略,我们基于quantstrat包实现相关策略,完整代码及注释如下:

# ======================================================

# 量化交易策略框架搭建(基于quantstrat包)

# 策略逻辑:基于RSI指标的双向交易系统

# 核心流程:环境初始化 -> 策略定义 -> 数据准备 -> 回测执行

# ======================================================

# ---------------------------

# 1. 包加载与环境清理

# ---------------------------

# 安装必要包(已注释,按需启用)

# install.packages("devtools")

# install.packages("FinancialInstrument")

# install.packages("PerformanceAnalytics")

# devtools::install_github("braverock/blotter")

# devtools::install_github("braverock/quantstrat")

# 加载量化策略包

require(quantstrat)

## Loading required package: quantstrat

## Loading required package: quantmod

## Loading required package: xts

## Loading required package: zoo

##

## Attaching package: 'zoo'

## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric

## Loading required package: TTR

## Registered S3 method overwritten by 'quantmod':

## method from

## as.zoo.data.frame zoo

## Loading required package: blotter

## Loading required package: FinancialInstrument

## Loading required package: PerformanceAnalytics

##

## Attaching package: 'PerformanceAnalytics'

## The following object is masked from 'package:graphics':

##

## legend

## Loading required package: foreach

# 清理历史策略数据(避免残留数据干扰)

suppressWarnings(rm("order_book.RSI",pos=.strategy))

suppressWarnings(rm("account.RSI","portfolio.RSI",pos=.blotter))

suppressWarnings(rm("account.st",

"portfolio.st",

"stock.str",

"stratRSI",

"initDate",

"initEq",

'start_t',

'end_t'

)

)

# ---------------------------

# 2. 策略主体构建

# ---------------------------

# 创建策略容器

stratRSI <- strategy("RSI")

n=2 # 参数示例

# 2.1 添加技术指标

# 使用经典RSI指标(默认周期14)

stratRSI <- add.indicator(

strategy = stratRSI,

name = "RSI", # 内置RSI函数

arguments = list(price = quote(getPrice(mktdata))), # 获取价格数据

label = "RSI"

)

# 2.2 定义交易信号

# 信号1:RSI上穿70(超买信号)

stratRSI <- add.signal(

strategy = stratRSI,

name = "sigThreshold",

arguments = list(

threshold = 70,

column = "RSI",

relationship = "gt", # greater than

cross = TRUE # 要求穿越阈值

),

label = "RSI.gt.70"

)

# 信号2:RSI下穿30(超卖信号)

stratRSI <- add.signal(

strategy = stratRSI,

name = "sigThreshold",

arguments = list(

threshold = 30,

column = "RSI",

relationship = "lt", # less than

cross = TRUE

),

label = "RSI.lt.30"

)

# 2.3 设置交易规则

# 规则组1:做空规则

# 入场规则:RSI>70时建立空头仓位

stratRSI <- add.rule(

strategy = stratRSI,

name = 'ruleSignal',

arguments = list(

sigcol = "RSI.gt.70", # 触发信号列

sigval = TRUE, # 信号有效值

orderqty = -1000, # 卖出数量

ordertype = 'market', # 市价单

orderside = 'short', # 空头方向

pricemethod = 'market',

replace = FALSE, # 不替换现有订单

osFUN = osMaxPos # 使用最大仓位函数

),

type = 'enter', # 入场规则

path.dep = TRUE # 路径依赖

)

# 离场规则:RSI<30时平空仓

stratRSI <- add.rule(

strategy = stratRSI,

name = 'ruleSignal',

arguments = list(

sigcol = "RSI.lt.30",

sigval = TRUE,

orderqty = 'all', # 平掉全部仓位

ordertype = 'market',

orderside = 'short',

pricemethod = 'market',

replace = FALSE

),

type = 'exit',

path.dep = TRUE

)

# 规则组2:做多规则

# 入场规则:RSI<30时建立多头仓位

stratRSI <- add.rule(

strategy = stratRSI,

name = 'ruleSignal',

arguments = list(

sigcol = "RSI.lt.30",

sigval = TRUE,

orderqty = 1000, # 买入数量

ordertype = 'market',

orderside = 'long', # 多头方向

pricemethod = 'market',

replace = FALSE,

osFUN = osMaxPos

),

type = 'enter',

path.dep = TRUE

)

# 离场规则:RSI>70时平多仓

stratRSI <- add.rule(

strategy = stratRSI,

name = 'ruleSignal',

arguments = list(

sigcol = "RSI.gt.70",

sigval = TRUE,

orderqty = 'all',

ordertype = 'market',

orderside = 'long',

pricemethod = 'market',

replace = FALSE

),

type = 'exit',

path.dep = TRUE

)

# ---------------------------

# 3. 市场数据准备

# ---------------------------

# 设置基础货币

currency("USD")

## [1] "USD"

currency("EUR")

## [1] "EUR"

# 定义交易标的(美国行业ETF)

symbols = c("XLF", "XLP", "XLE", "XLY", "XLV", "XLI", "XLB", "XLK", "XLU")

# 初始化交易品种数据

for(symbol in symbols){

# 注册金融工具

stock(symbol, currency="USD",multiplier=1)

# 下载历史数据(默认从Yahoo Finance)

getSymbols(symbol)

}

# 保存数据

# 遍历所有符号

# for (symbol in symbols) {

# # 检查对象是否存在

# if (exists(symbol)) {

# # 生成文件名

# file_name <- paste0(symbol, ".rds")

# # 保存为RDS文件

# saveRDS(get(symbol), file = file_name)

# # 打印保存信息

# message("已保存: ", symbol, " -> ", file_name)

# } else {

# warning("对象 ", symbol, " 不存在")

# }

#}

# 可以用类似以下方式测试:

# applySignals(strategy=stratRSI, mktdata=applyIndicators(strategy=stratRSI, mktdata=symbols[1]))

##### 在此放置演示和测试日期 #################

#

#if(isTRUE(options('in_test')$in_test))

# # 使用测试日期

# {initDate="2000-01-01"

# endDate="2024-12-31"

# } else

# # 使用演示默认值

# {initDate="2000-01-01"

# endDate=Sys.Date()}

# ---------------------------

# 4. 回测系统初始化

# ---------------------------

# 设置回测参数

initDate = '2000-01-01' # 初始化日期

initEq = 100000 # 初始资金(美元)

port.st = 'RSI' # 组合名称

# 初始化投资组合

initPortf(port.st,

symbols=symbols,

initDate=initDate)

## [1] "RSI"

# 初始化账户

initAcct(port.st,

portfolios=port.st,

initDate=initDate,

initEq=initEq)

## [1] "RSI"

# 初始化订单簿

initOrders(portfolio=port.st,

initDate=initDate)

# 设置仓位限制(每个品种最大300股,最多3个品种)

for(symbol in symbols){

addPosLimit(port.st,

symbol,

initDate,

300,

3 )

}

print("初始化完成")

## [1] "初始化完成"

end_t<-Sys.time()

print(paste0("策略循环耗时:",end_t-start_t))

## [1] "策略循环耗时:6.13126289844513"

# 查看订单簿

#print(getOrderBook(port.st))

start_t<-Sys.time()

# 更新组合净值

updatePortf(Portfolio=port.st,Dates=paste('::',as.Date(Sys.time()),sep=''))

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## Warning in .updatePosPL(Portfolio = pname, Symbol = as.character(symbol), :

## Could not parse ::2025-05-08 as ISO8601 string, or one/bothends of the range

## were outside the available prices: 2007-01-03/2025-05-07. Using all data

## instead.

## [1] "RSI"

end_t<-Sys.time()

print(paste0("更新交易账簿耗时:",end_t-start_t))

## [1] "更新交易账簿耗时:0.747688055038452"

# 临时修改quantmod图形参数

themelist<-chart_theme()

themelist$col$up.col<-'lightgreen'

themelist$col$dn.col<-'pink'

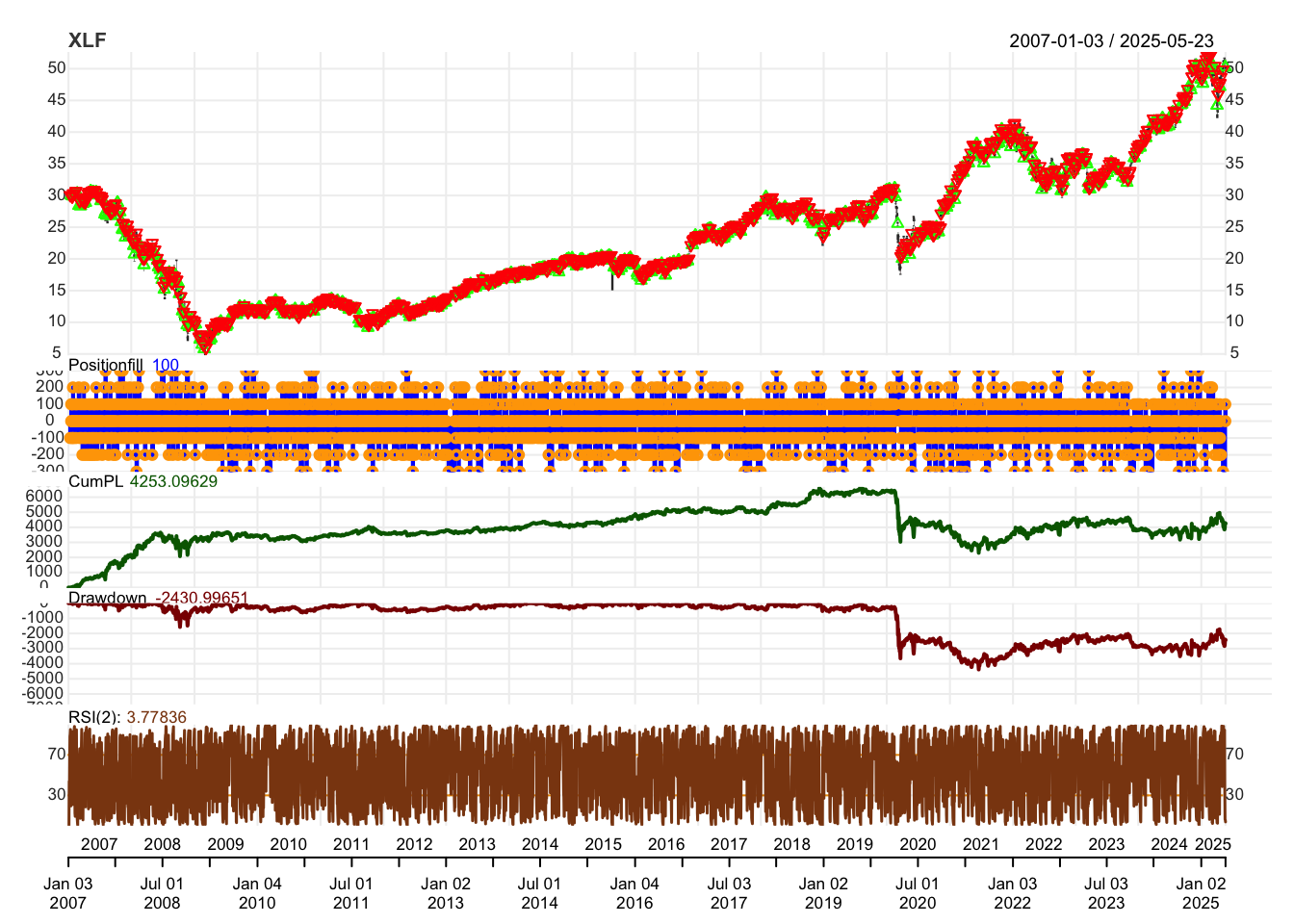

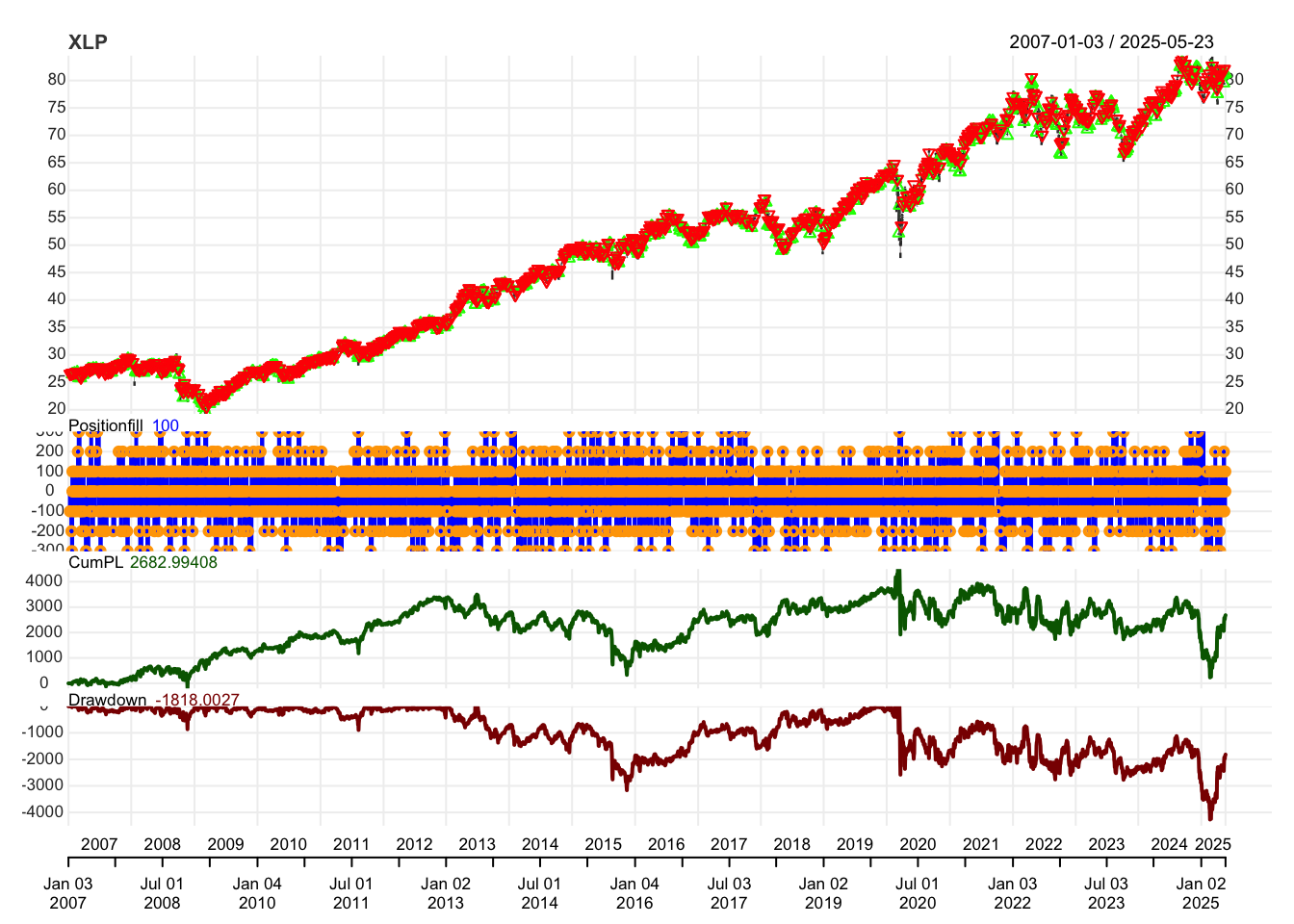

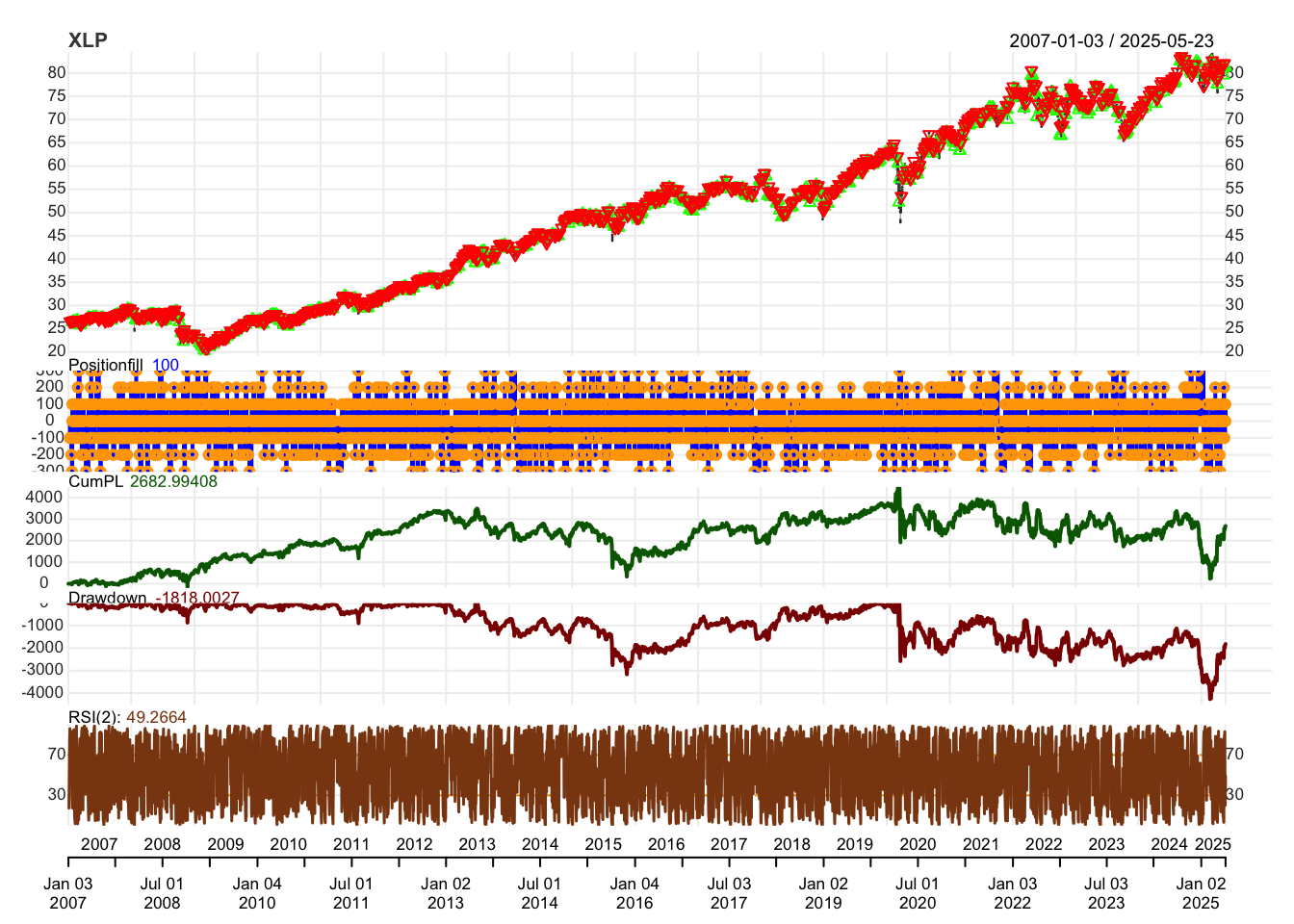

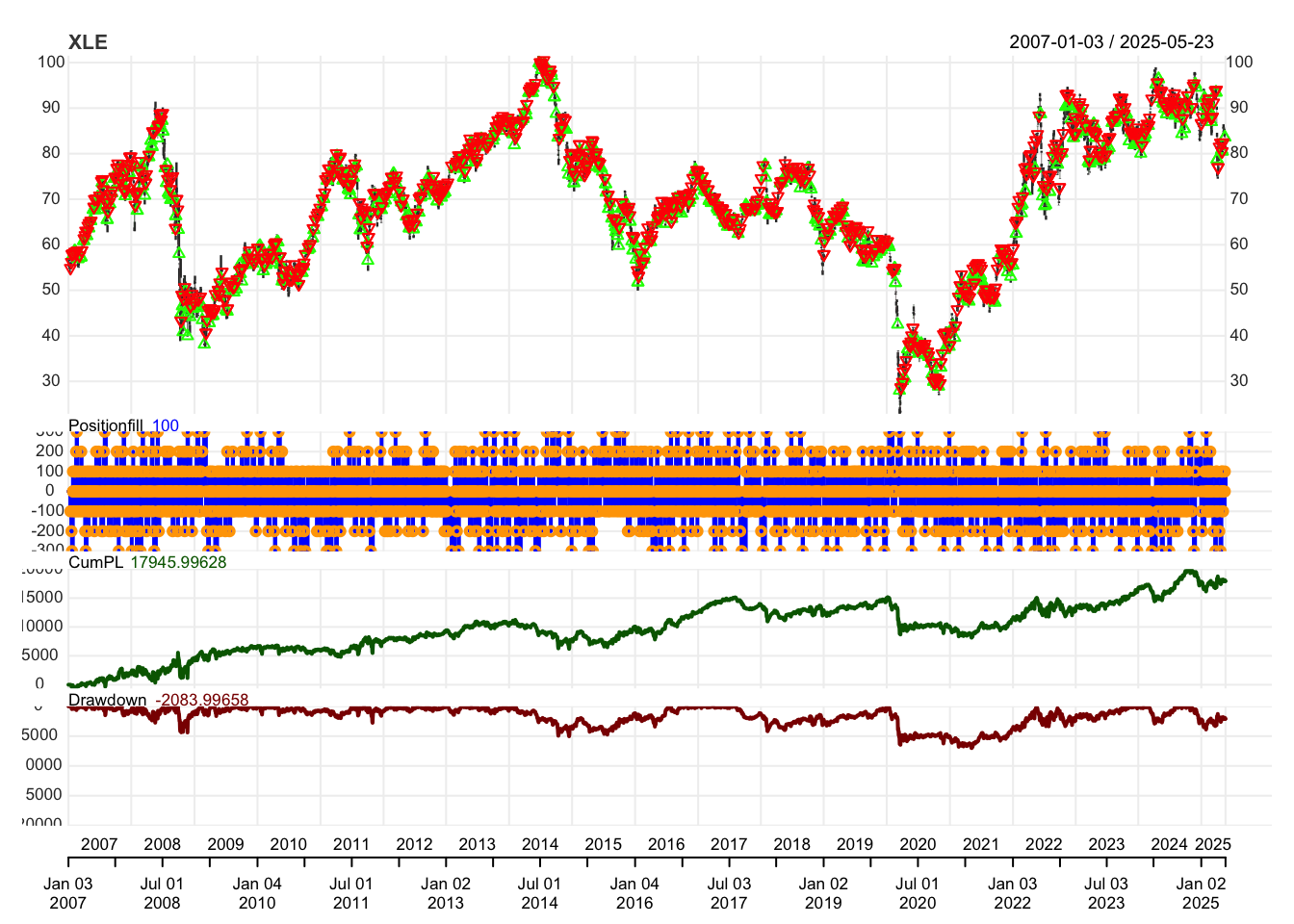

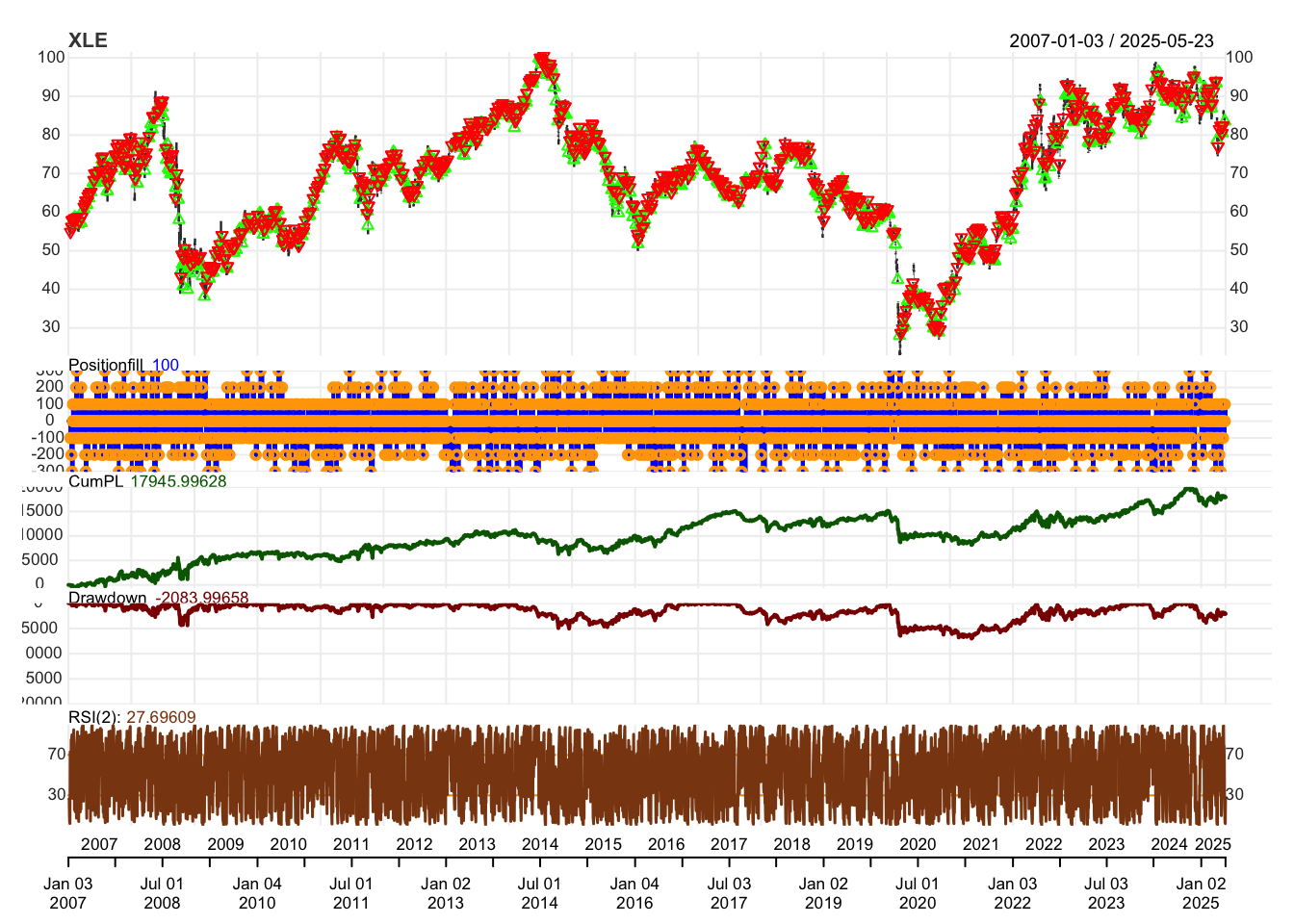

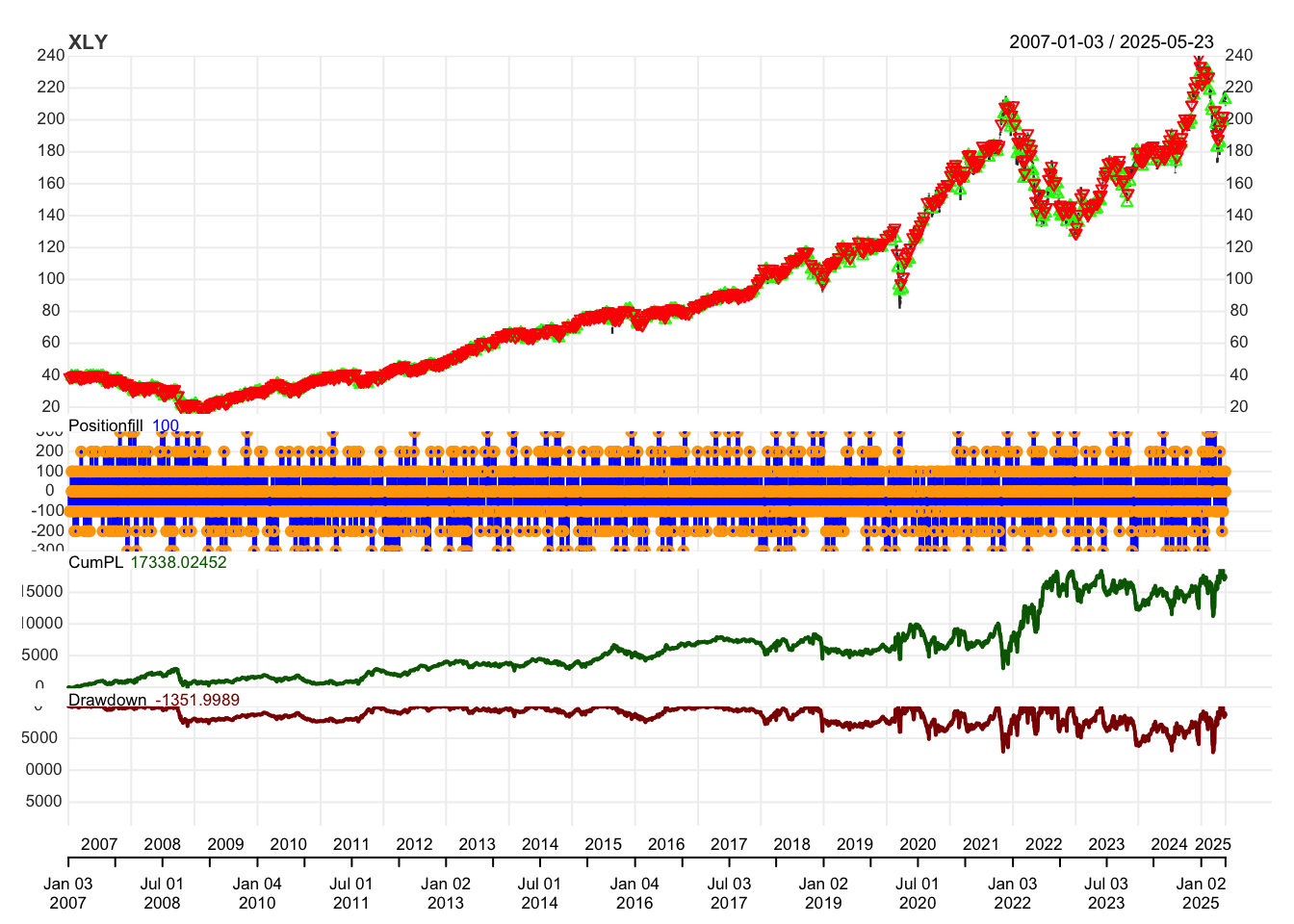

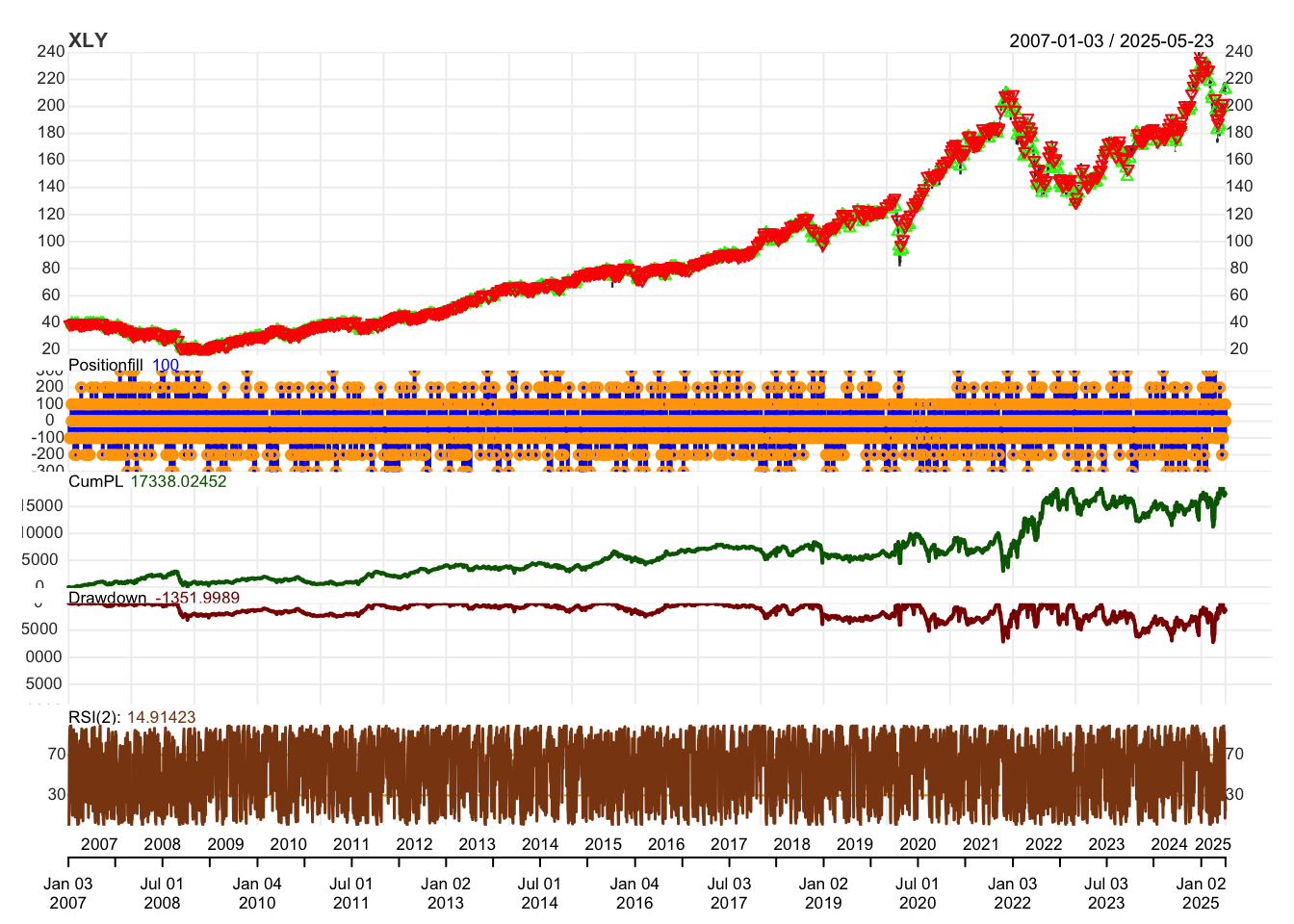

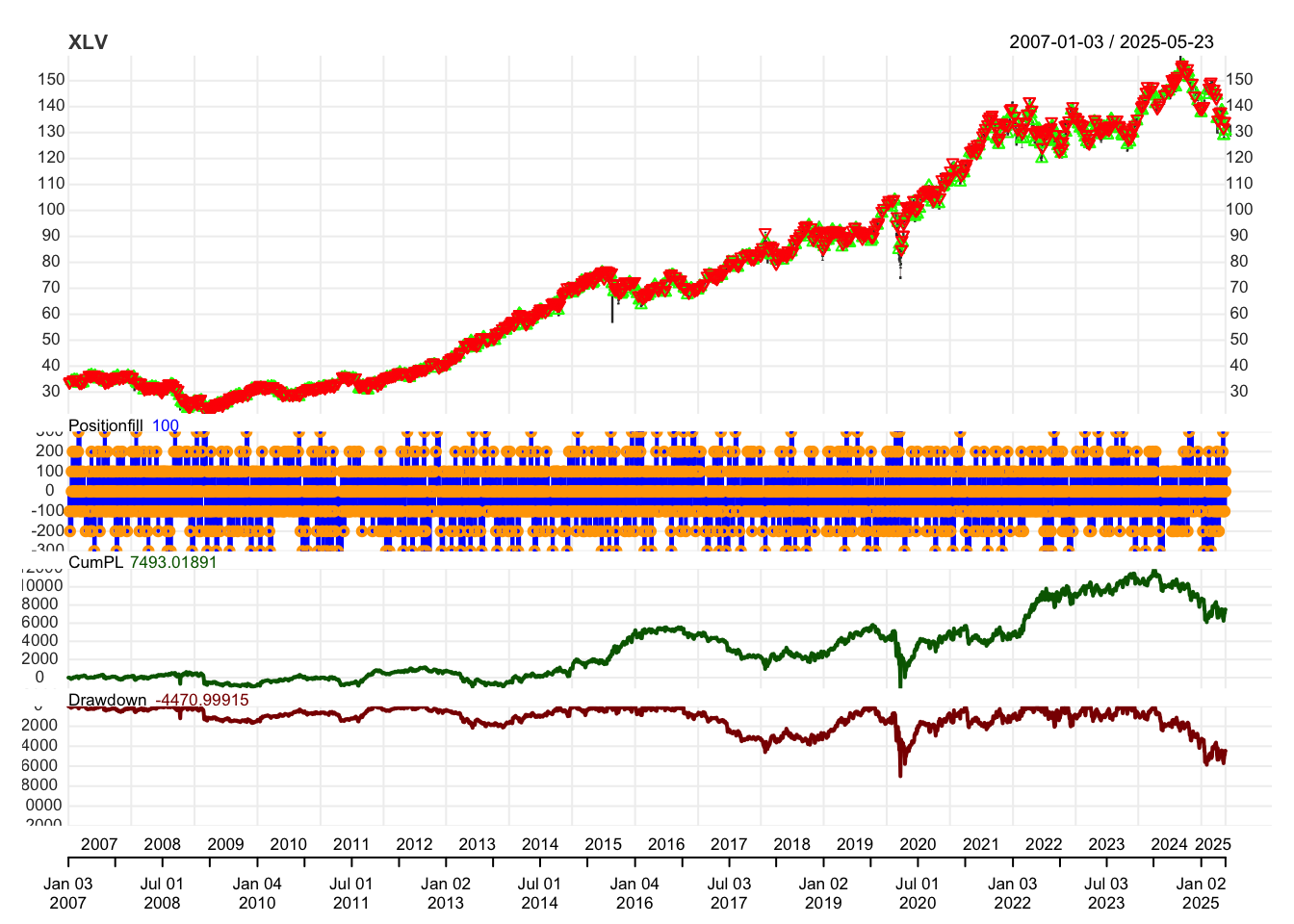

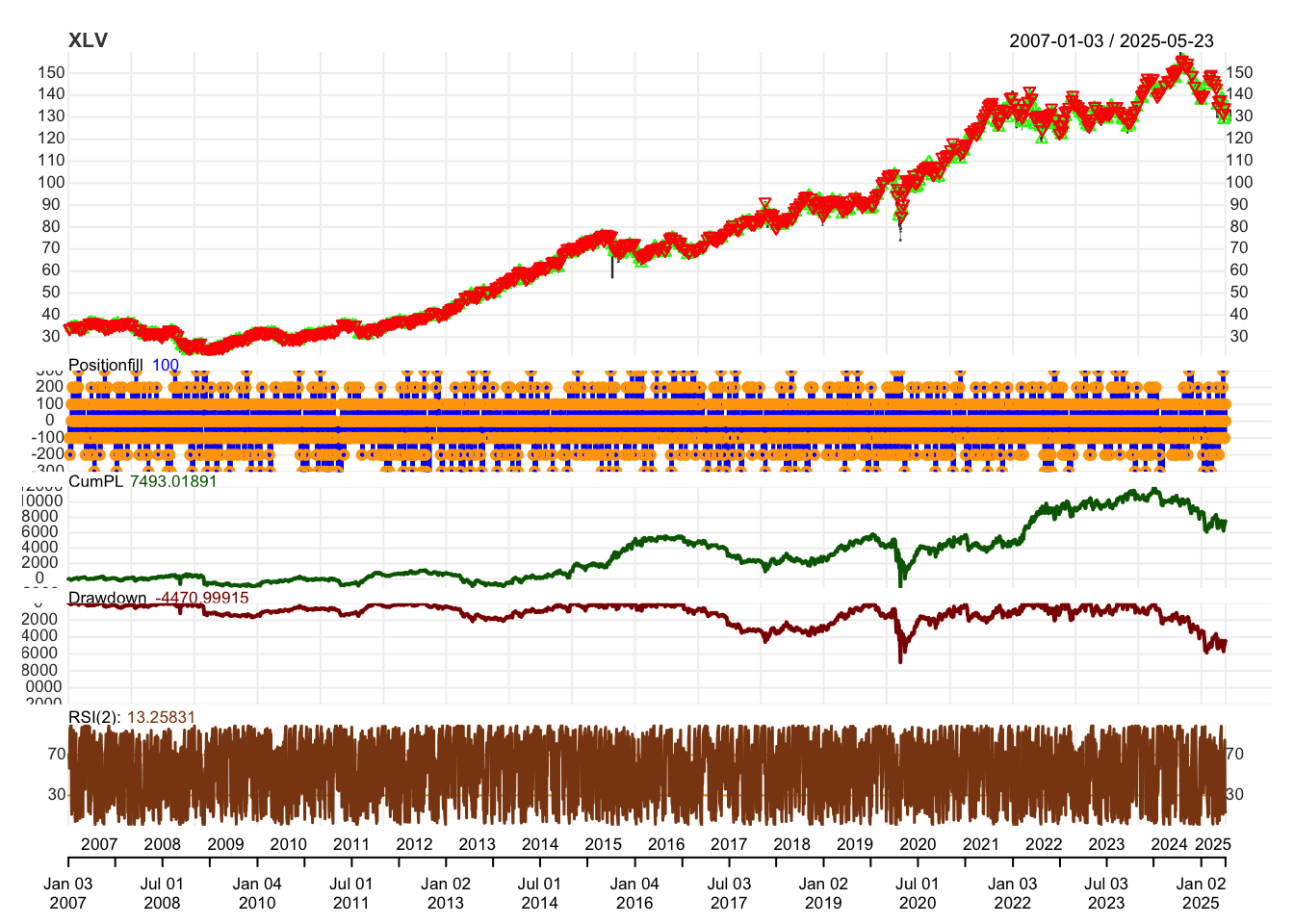

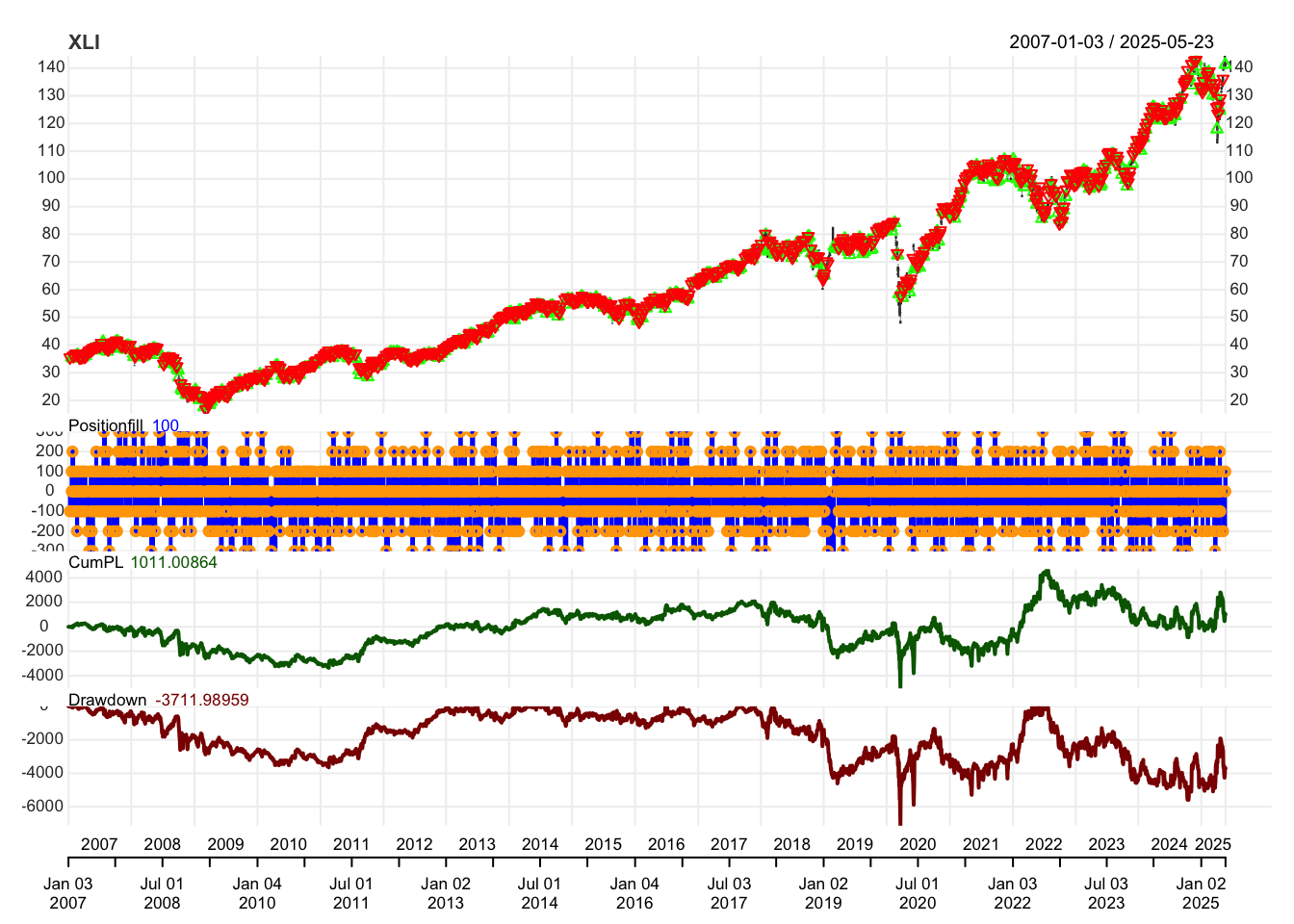

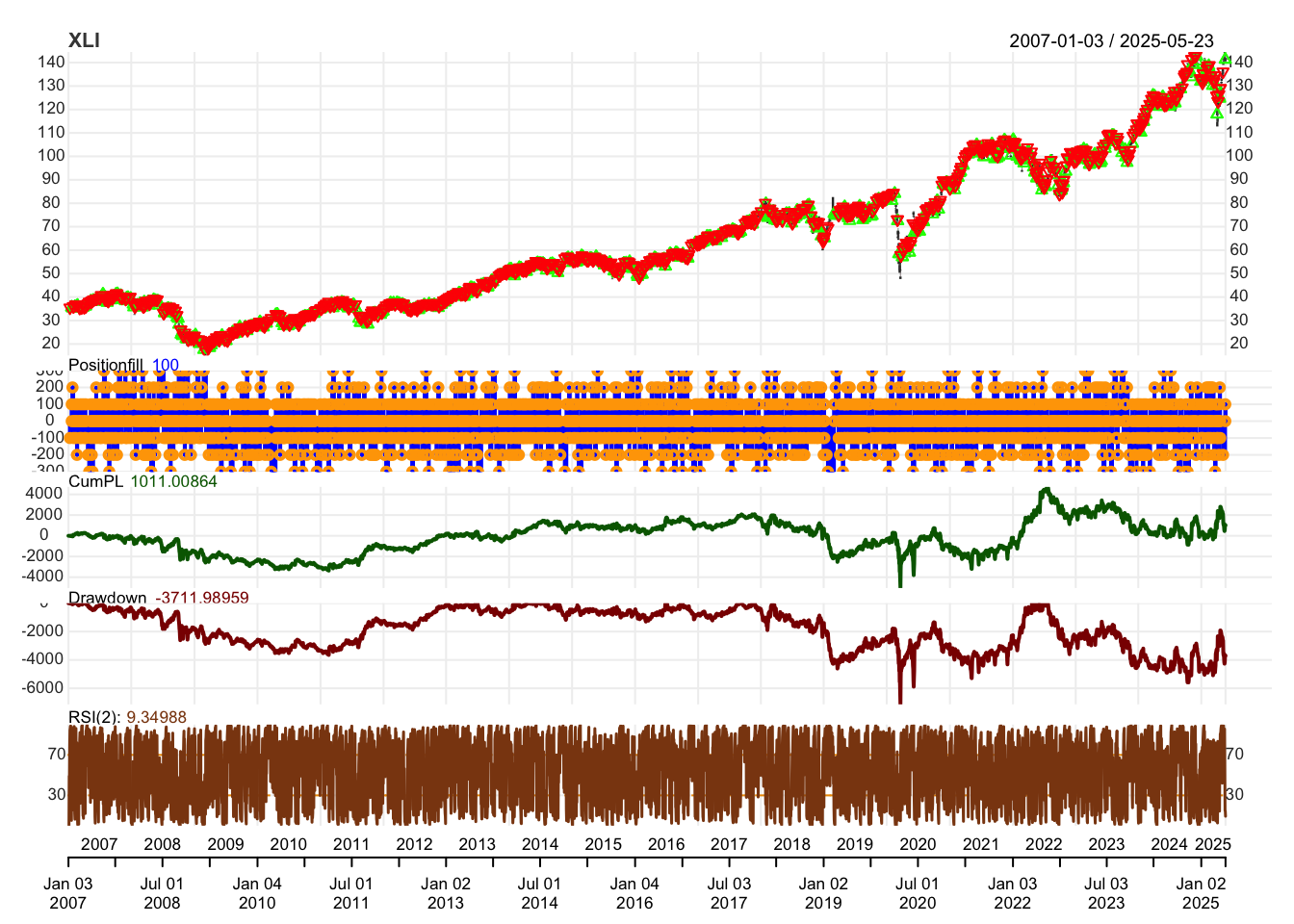

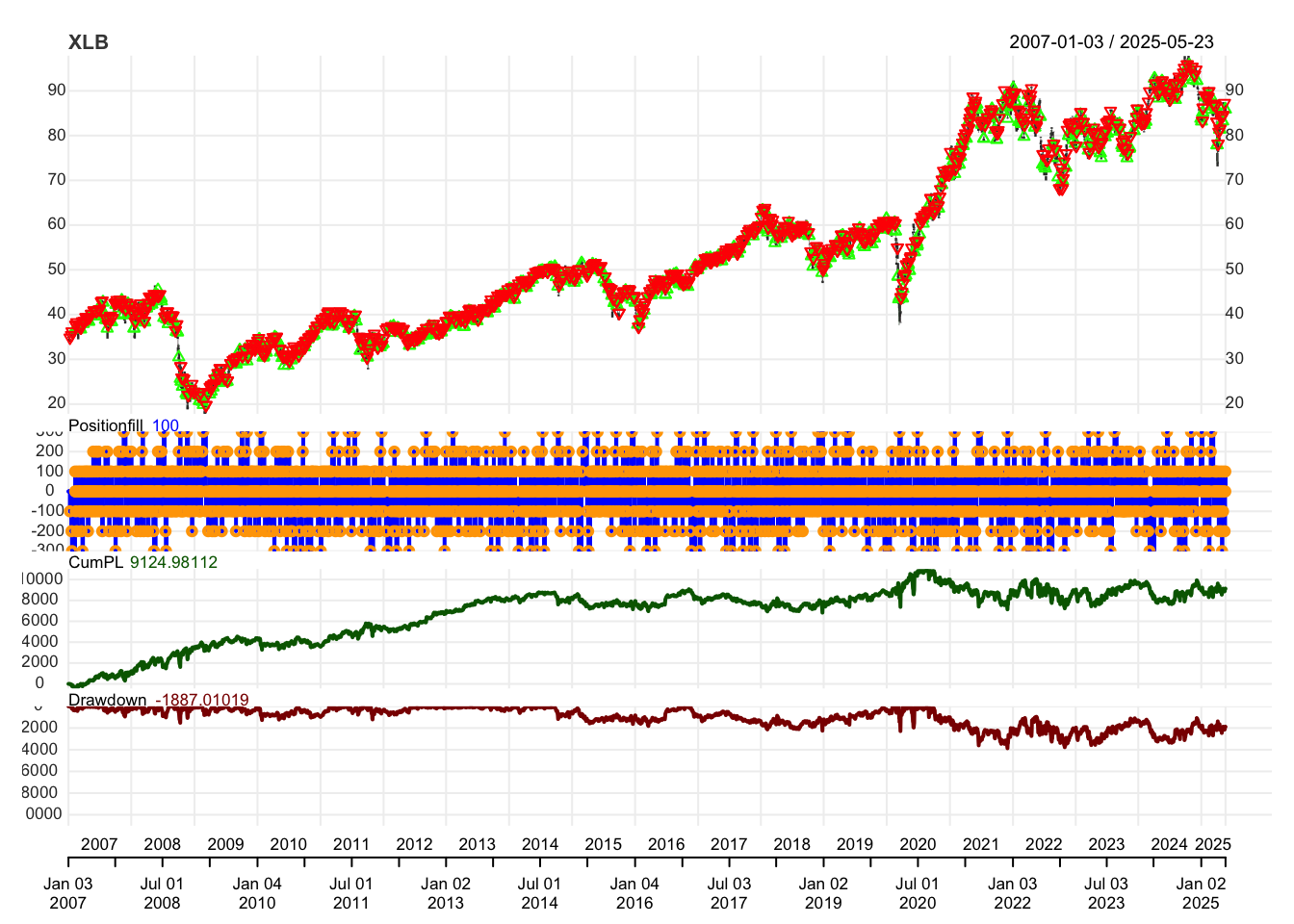

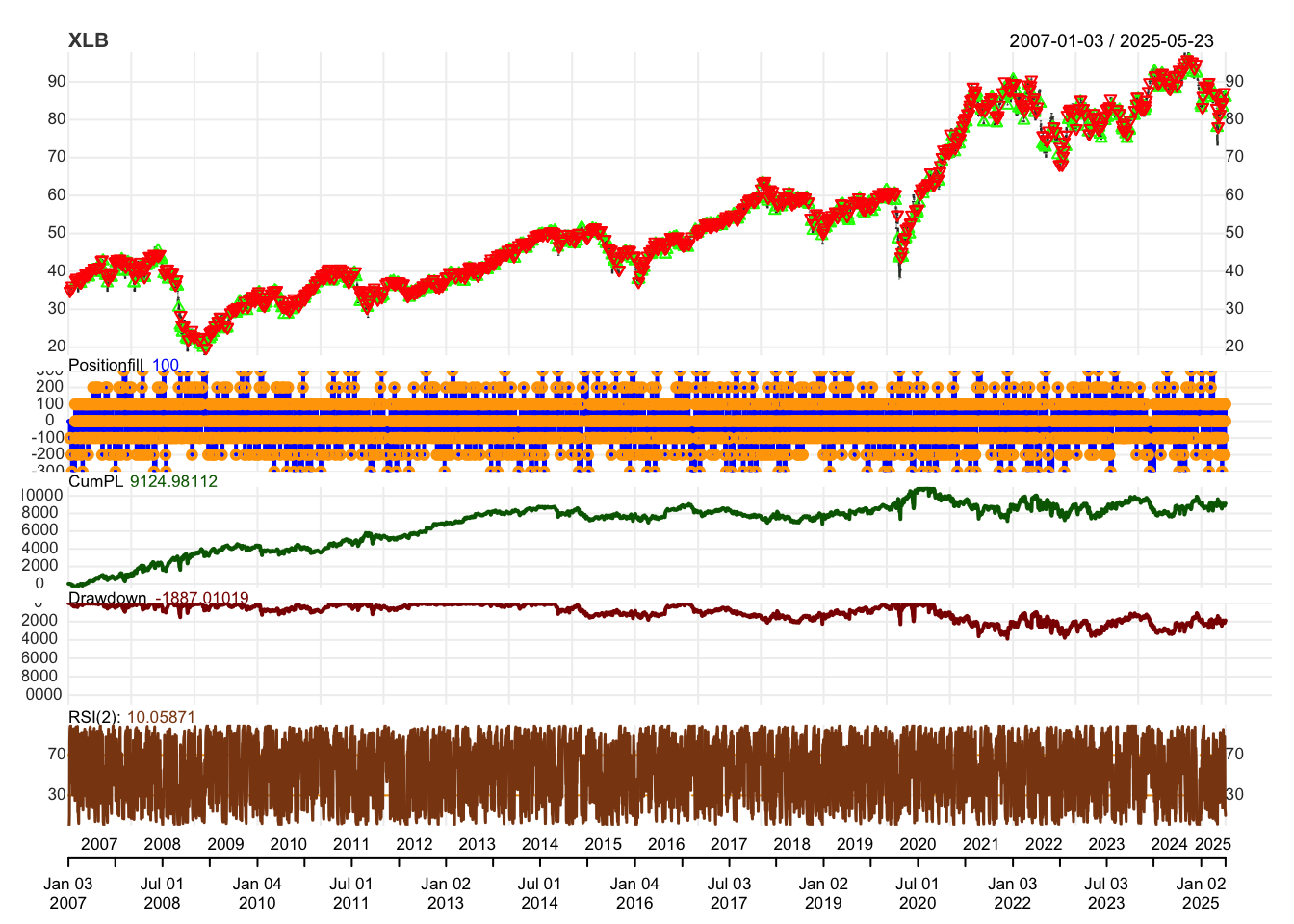

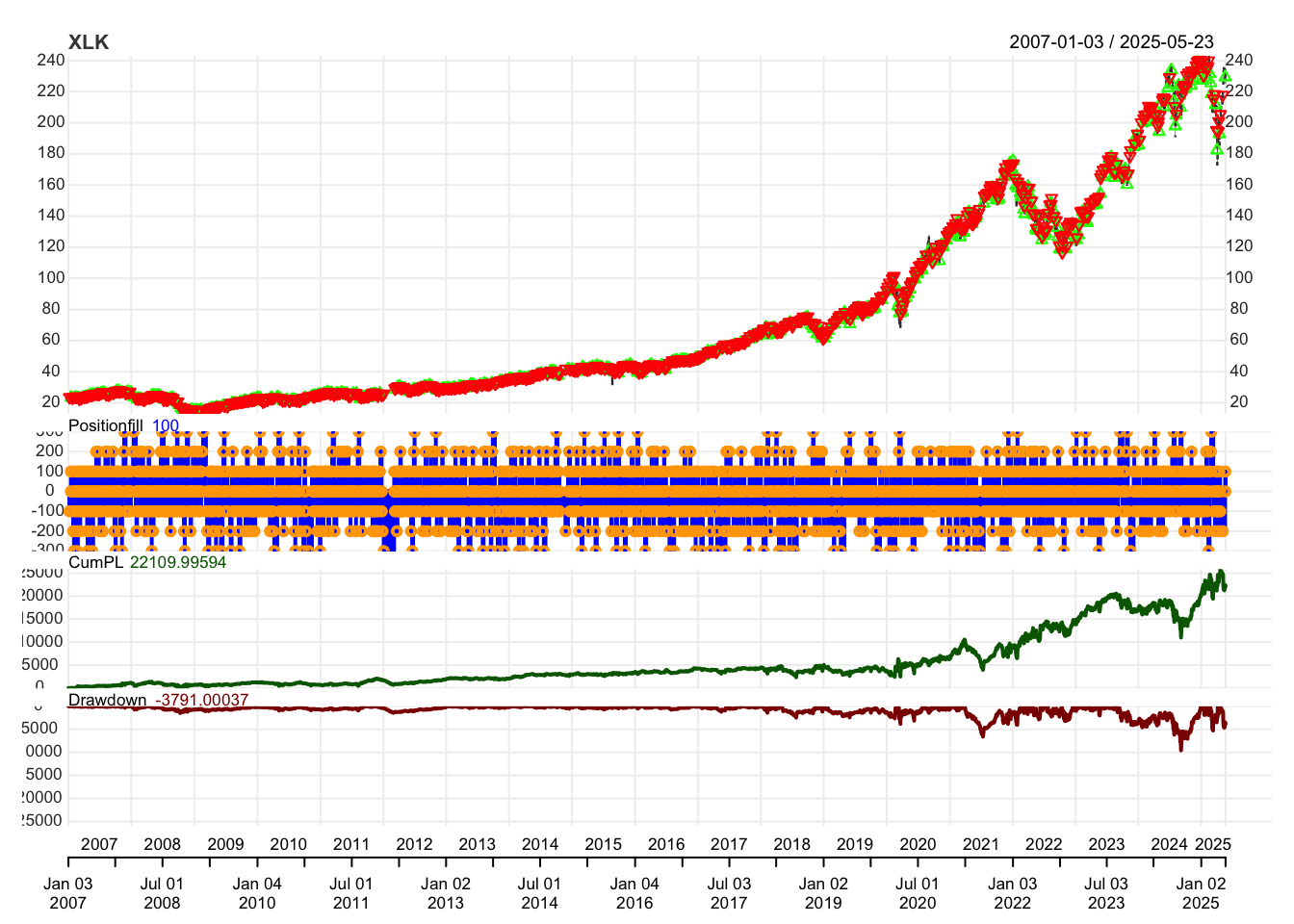

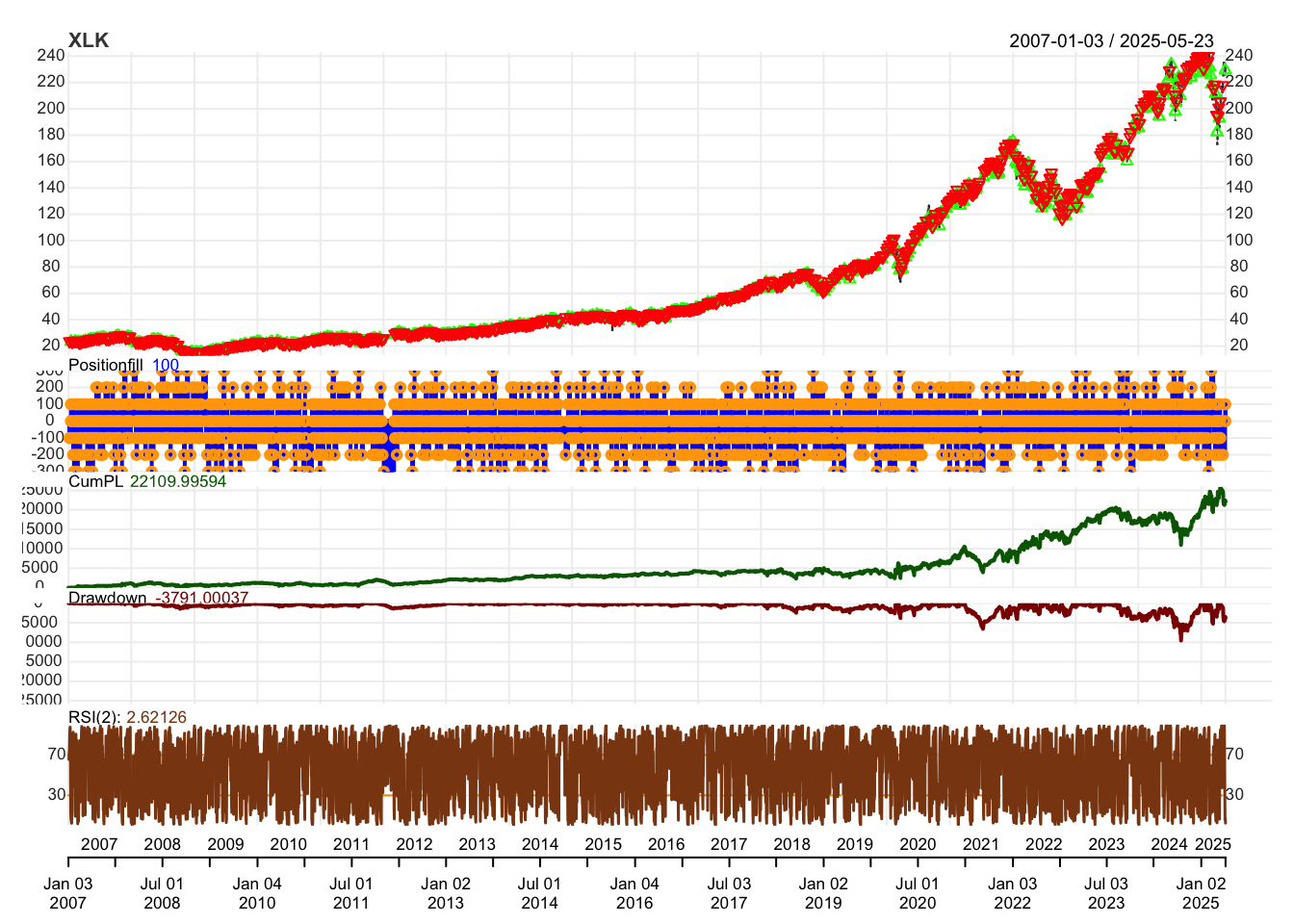

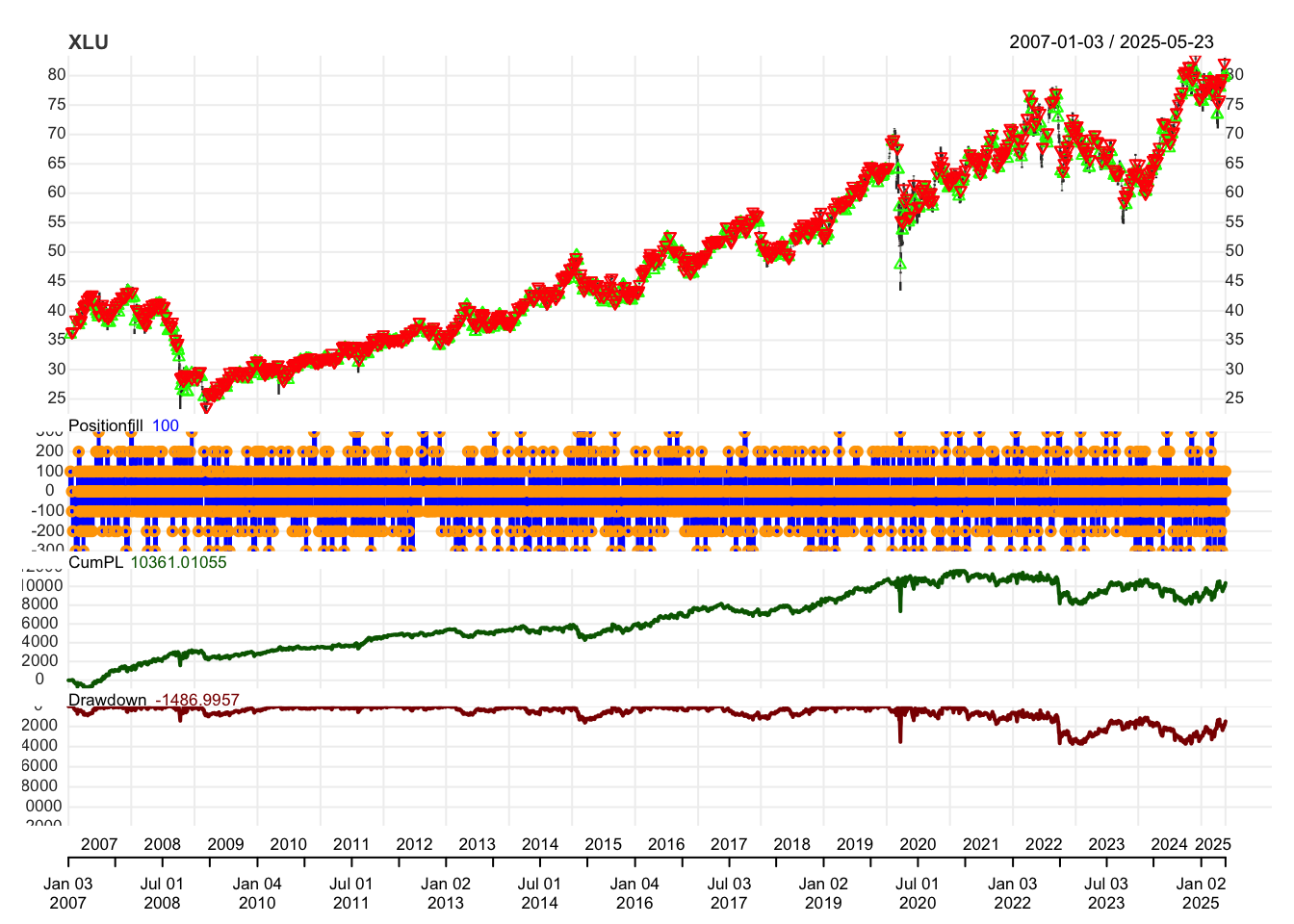

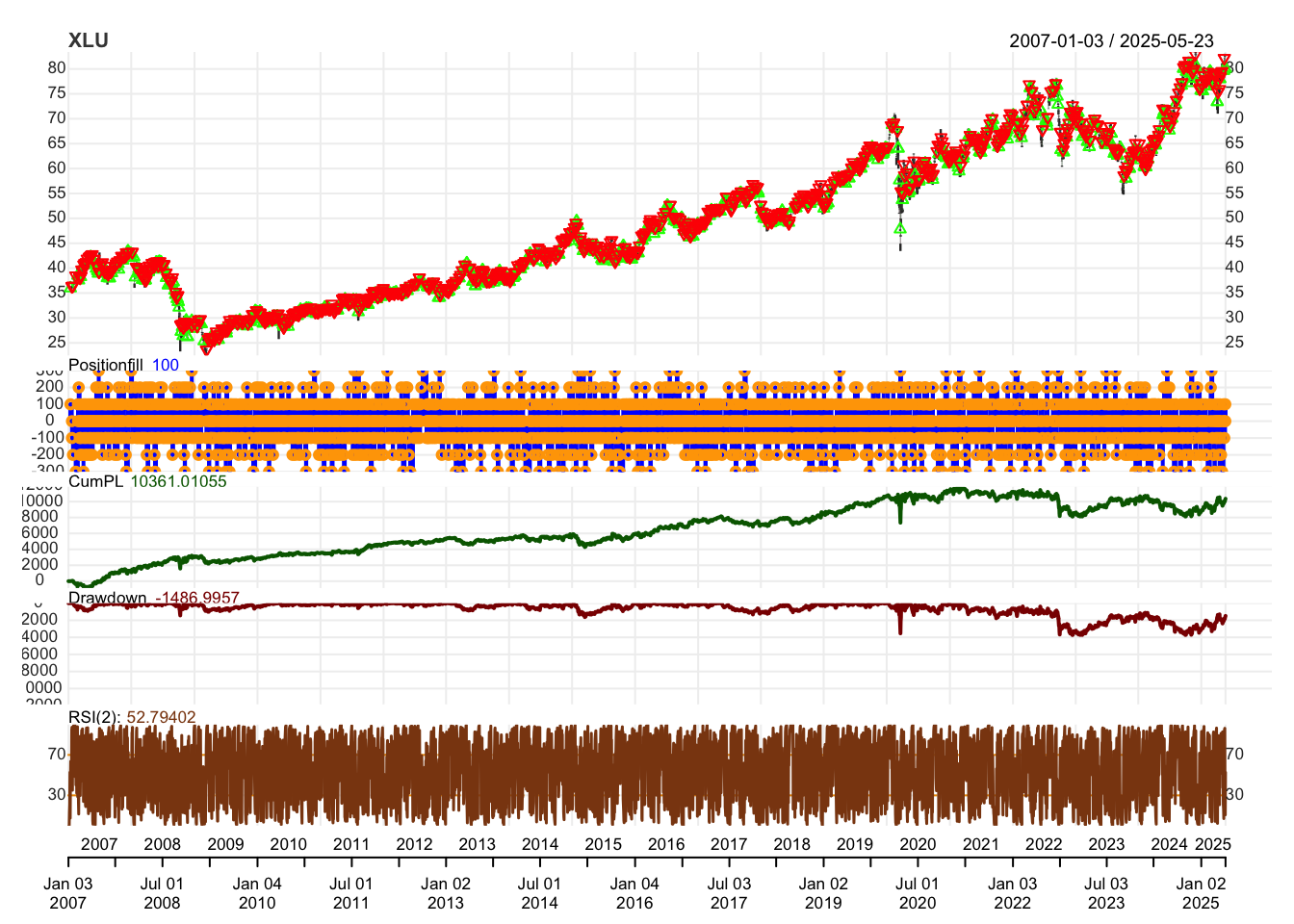

for(symbol in symbols){

# dev.new()

chart.Posn(Portfolio=port.st,Symbol=symbol,theme=themelist) # 绘制持仓图

plot(add_RSI(n=2))

print(paste0(symbol,"仓位图"))

}

## [1] "XLF仓位图"

## [1] "XLP仓位图"

## [1] "XLE仓位图"

## [1] "XLY仓位图"

## [1] "XLV仓位图"

## [1] "XLI仓位图"

## [1] "XLB仓位图"

## [1] "XLK仓位图"

## [1] "XLU仓位图"

# 统计组合表现

ret1 <- PortfReturns(port.st)

ret1$total <- rowSums(ret1)

if("package:PerformanceAnalytics" %in% search() || require("PerformanceAnalytics",quietly=TRUE)) {

dev.new()

# 绘制收益率图

charts.PerformanceSummary(ret1$total,geometric=FALSE,wealth.index=TRUE)

print("策略总体表现")

}

## [1] "策略总体表现"

##### 查看交易统计信息 #########################################

# 查看交易单据

book = getOrderBook(port.st)

# 查看交易统计

stats = tradeStats(port.st)

# 查看组合收益率

rets = PortfReturns(port.st)

################################################################