## 正在从Yahoo Finance获取数据...

## [1] "513100.SS" "510300.SS" "518880.SS"

# 2. 计算指标:动量、波动率、调整动量

calculate_metrics <- function(price_series, window = 20) {

# 计算日收益率

returns <- dailyReturn(price_series, type = "arithmetic")

colnames(returns) <- "Return"

# 计算20日平均收益率(动量)

momentum <- rollapply(returns, width = window, FUN = mean, align = "right", fill = NA)

colnames(momentum) <- "Momentum"

# 计算20日收益率方差(波动率)

volatility <- rollapply(returns, width = window, FUN = var, align = "right", fill = NA)

colnames(volatility) <- "Volatility"

# 计算调整动量(动量/波动率)

# 注意:使用标准差进行标准化(方差的平方根)

adj_momentum <- momentum / sqrt(volatility)

colnames(adj_momentum) <- "Adj_Momentum"

return(list(returns = returns,

momentum = momentum,

volatility = volatility,

adj_momentum = adj_momentum))

}

# 为每个ETF计算指标

# cat("正在计算动量指标...\n")

metrics_list <- list()

for (etf in etf_names) {

metrics_list[[etf]] <- calculate_metrics(price_df[, etf])

}

## Warning in to_period(xx, period = on.opts[[period]], ...): missing values

## removed from data

## Warning in to_period(xx, period = on.opts[[period]], ...): missing values

## removed from data

## Warning in to_period(xx, period = on.opts[[period]], ...): missing values

## removed from data

# 3. 生成交易信号和权重

generate_weights <- function(adj_momentum_df) {

# 初始化权重数据框

weights_df <- as.data.frame(adj_momentum_df)

weights_df[] <- 0 # 所有值初始化为0

# 对每一行(每个交易日)计算权重

for (i in 1:nrow(adj_momentum_df)) {

# 获取当日的调整动量值

current_momentum <- as.numeric(adj_momentum_df[i, ])

# 筛选调整动量大于0的标的

positive_idx <- which(current_momentum > 0 & !is.na(current_momentum))

if (length(positive_idx) > 0) {

# 获取正的调整动量值

positive_momentum <- current_momentum[positive_idx]

# 按调整动量大小归一化计算权重

normalized_weights <- positive_momentum / sum(positive_momentum)

# 分配权重

weights_df[i, positive_idx] <- normalized_weights

}

}

# 转换为时间序列

weights_xts <- xts(weights_df, order.by = index(adj_momentum_df))

colnames(weights_xts) <- colnames(adj_momentum_df)

return(weights_xts)

}

# 提取所有ETF的调整动量

adj_momentum_all <- do.call(merge, lapply(metrics_list, function(x) x$adj_momentum))

colnames(adj_momentum_all) <- etf_names

# 生成权重序列

# cat("正在计算每日权重...\n")

weights <- generate_weights(adj_momentum_all)

# 4. 将权重数据整理到数据框中

# 创建每日权重数据框(包含日期)

daily_weights_df <- data.frame(Date = index(weights))

for (etf in etf_names) {

daily_weights_df[[etf]] <- as.numeric(weights[, etf])

}

# 计算每个交易日的权重合计(应为1或0)

daily_weights_df$权重合计 <- rowSums(daily_weights_df[, etf_names], na.rm = TRUE)

# 创建每个ETF的单独权重数据框

etf_weight_dfs <- list()

for (etf in etf_names) {

etf_weight_dfs[[etf]] <- data.frame(

Date = index(weights),

ETF = etf,

Weight = as.numeric(weights[, etf])

)

}

# 合并所有ETF权重数据框

all_etf_weights_df <- do.call(rbind, etf_weight_dfs)

# 5. 回测计算

# 计算每个ETF的日收益率

returns_all <- do.call(merge, lapply(metrics_list, function(x) x$returns))

colnames(returns_all) <- etf_names

# 调整权重的时间索引,确保与收益率对齐

# 使用T日的权重在T+1日交易

lagged_weights <- lag(weights, 1) # 权重滞后一天

lagged_weights <- lagged_weights[index(returns_all)] # 对齐索引

# 处理缺失值

lagged_weights[is.na(lagged_weights)] <- 0

# 计算策略日收益率(按T+1日开盘价计算,这里用平均价近似)

strategy_returns <- rowSums(returns_all * lagged_weights, na.rm = TRUE)

strategy_returns <- xts(strategy_returns, order.by = index(returns_all))

colnames(strategy_returns) <- "动量策略"

# 6. 绩效指标计算

# cat("正在计算绩效指标...\n")

# 策略绩效

strategy_perf <- table.AnnualizedReturns(strategy_returns)

strategy_dd <- table.DownsideRisk(strategy_returns)

max_dd <- maxDrawdown(strategy_returns)

strategy_calmar <- CalmarRatio(strategy_returns)

strategy_sortino <- SortinoRatio(strategy_returns)

strategy_positive_returns <- sum(strategy_returns > 0, na.rm = TRUE)

strategy_total_returns <- sum(!is.na(strategy_returns))

strategy_win_rate <- strategy_positive_returns / strategy_total_returns

# 基准绩效(沪深300ETF)

benchmark_returns <- returns_all[, "沪深300ETF"]

colnames(benchmark_returns) <- "沪深300ETF"

benchmark_perf <- table.AnnualizedReturns(benchmark_returns)

benchmark_dd <- table.DownsideRisk(benchmark_returns)

benchmark_max_dd <- maxDrawdown(benchmark_returns)

benchmark_calmar <- CalmarRatio(benchmark_returns)

benchmark_sortino <- SortinoRatio(benchmark_returns)

benchmark_positive_returns <- sum(benchmark_returns > 0, na.rm = TRUE)

benchmark_total_returns <- sum(!is.na(benchmark_returns))

benchmark_win_rate <- benchmark_positive_returns / benchmark_total_returns

# 等权重组合绩效

equal_weights <- matrix(1/3, nrow = nrow(returns_all), ncol = ncol(returns_all))

equal_weights <- xts(equal_weights, order.by = index(returns_all))

colnames(equal_weights) <- etf_names

equal_returns <- rowSums(returns_all * equal_weights, na.rm = TRUE)

equal_returns <- xts(equal_returns, order.by = index(returns_all))

colnames(equal_returns) <- "等权重组合"

equal_perf <- table.AnnualizedReturns(equal_returns)

equal_max_dd <- maxDrawdown(equal_returns)

equal_calmar <- CalmarRatio(equal_returns)

equal_sortino <- SortinoRatio(equal_returns)

equal_positive_returns <- sum(equal_returns > 0, na.rm = TRUE)

equal_total_returns <- sum(!is.na(equal_returns))

equal_win_rate <- equal_positive_returns / equal_total_returns

# 7. 创建绩效指标汇总数据框

# 格式化日期字符串

start_date_str <- format(start_date, "%Y-%m-%d")

end_date_str <- format(end_date, "%Y-%m-%d")

period_str <- paste(start_date_str, "至", end_date_str)

performance_metrics_df <- data.frame(

策略 = c("动量策略", "沪深300ETF", "等权重组合"),

年化收益率 = c(

round(strategy_perf[1, 1] * 100, 2),

round(benchmark_perf[1, 1] * 100, 2),

round(equal_perf[1, 1] * 100, 2)

),

年化波动率 = c(

round(strategy_perf[2, 1] * 100, 2),

round(benchmark_perf[2, 1] * 100, 2),

round(equal_perf[2, 1] * 100, 2)

),

夏普比率 = c(

round(strategy_perf[3, 1], 3),

round(benchmark_perf[3, 1], 3),

round(equal_perf[3, 1], 3)

),

最大回撤 = c(

round(max_dd * 100, 2),

round(benchmark_max_dd * 100, 2),

round(equal_max_dd * 100, 2)

),

卡尔马比率 = c(

round(strategy_calmar, 3),

round(benchmark_calmar, 3),

round(equal_calmar, 3)

),

索提诺比率 = c(

round(strategy_sortino, 3),

round(benchmark_sortino, 3),

round(equal_sortino, 3)

),

胜率 = c(

round(strategy_win_rate * 100, 2),

round(benchmark_win_rate * 100, 2),

round(equal_win_rate * 100, 2)

),

正收益天数 = c(

strategy_positive_returns,

benchmark_positive_returns,

equal_positive_returns

),

总交易天数 = c(

strategy_total_returns,

benchmark_total_returns,

equal_total_returns

),

回测期间 = c(period_str, period_str, period_str)

)

# 8. 绩效指标输出

# cat("==================== 绩效指标汇总数据框 ====================\n\n")

print(performance_metrics_df)

## 策略 年化收益率 年化波动率 夏普比率 最大回撤 卡尔马比率 索提诺比率

## 1 动量策略 45.13 17.08 2.643 8.72 5.178 0.227

## 2 沪深300ETF 20.31 19.27 1.054 16.25 1.250 0.103

## 3 等权重组合 31.84 12.89 2.470 9.29 3.429 0.201

## 胜率 正收益天数 总交易天数 回测期间

## 1 53.04 253 477 2024-01-01 至 2025-12-23

## 2 51.26 244 476 2024-01-01 至 2025-12-23

## 3 59.33 283 477 2024-01-01 至 2025-12-23

# cat("\n")

# 9. 输出权重数据

# cat("每日组合权重数据框(后10行):\n")

print(tail(daily_weights_df, 10))

## Date 纳指ETF 沪深300ETF 黄金ETF 权重合计

## 468 2025-12-08 0.09379501 0.00000000 0.9062050 1

## 469 2025-12-09 0.00000000 0.00000000 0.0000000 0

## 470 2025-12-10 0.00000000 0.00000000 1.0000000 1

## 471 2025-12-11 0.00000000 0.00000000 0.0000000 0

## 472 2025-12-12 0.05889600 0.00000000 0.9411040 1

## 473 2025-12-15 0.00000000 0.00000000 1.0000000 1

## 474 2025-12-16 0.16844695 0.00000000 0.8315530 1

## 475 2025-12-17 0.31823928 0.01791372 0.6638470 1

## 476 2025-12-18 0.00000000 0.00000000 1.0000000 1

## 477 2025-12-19 0.22970999 0.26353990 0.5067501 1

# cat("\n")

# 10. 绘制图表

# cat("正在生成图表...\n")

# 准备累计收益率数据

cumulative_returns <- merge(

cumprod(1 + na.fill(strategy_returns, 0)) - 1,

cumprod(1 + na.fill(benchmark_returns, 0)) - 1,

cumprod(1 + na.fill(equal_returns, 0)) - 1

)

colnames(cumulative_returns) <- c("动量策略", "沪深300ETF", "等权重组合")

# 转换为数据框用于ggplot

cumulative_df <- data.frame(

Date = index(cumulative_returns),

as.data.frame(cumulative_returns)

)

cumulative_long <- pivot_longer(cumulative_df,

cols = -Date,

names_to = "Portfolio",

values_to = "CumulativeReturn")

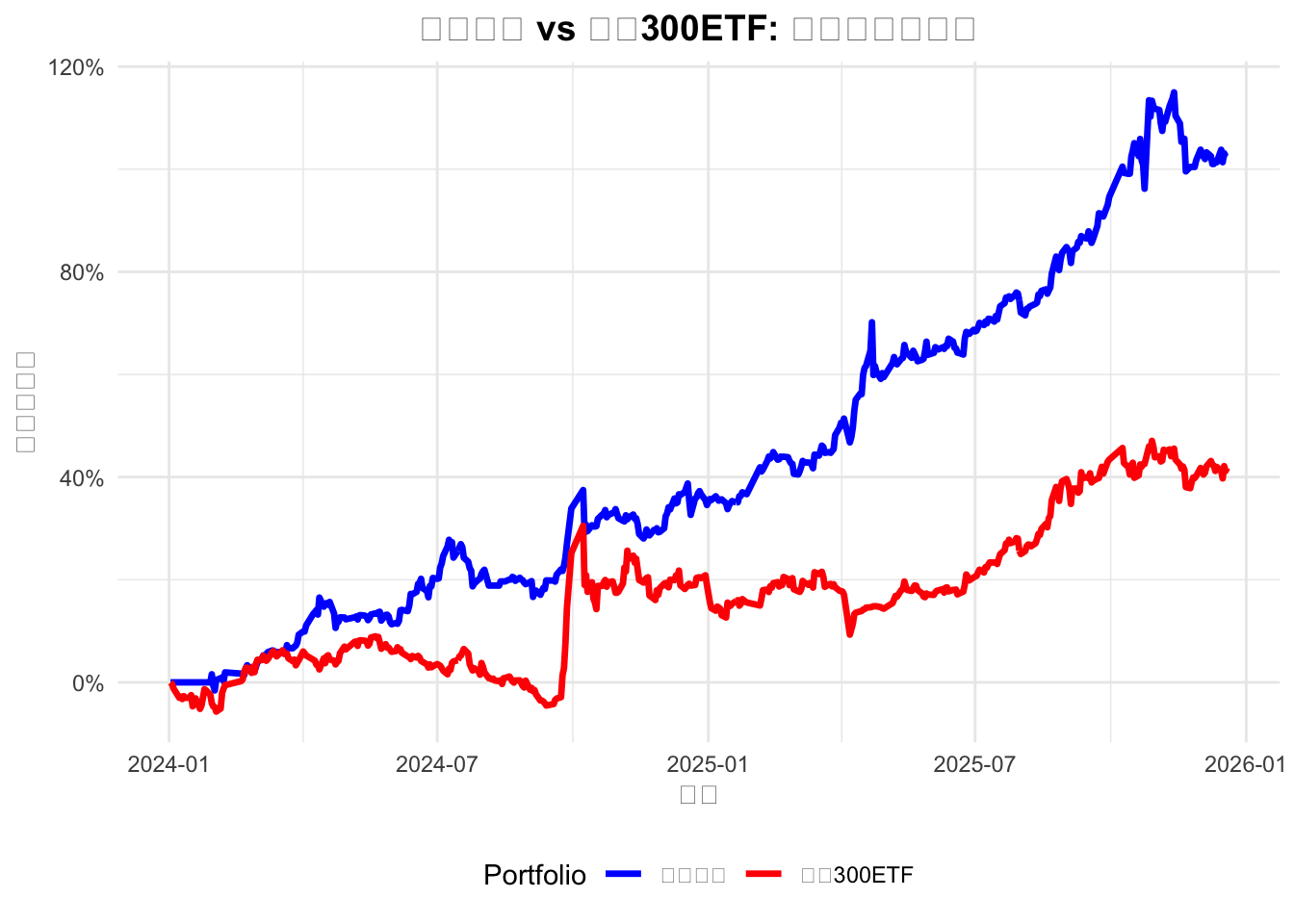

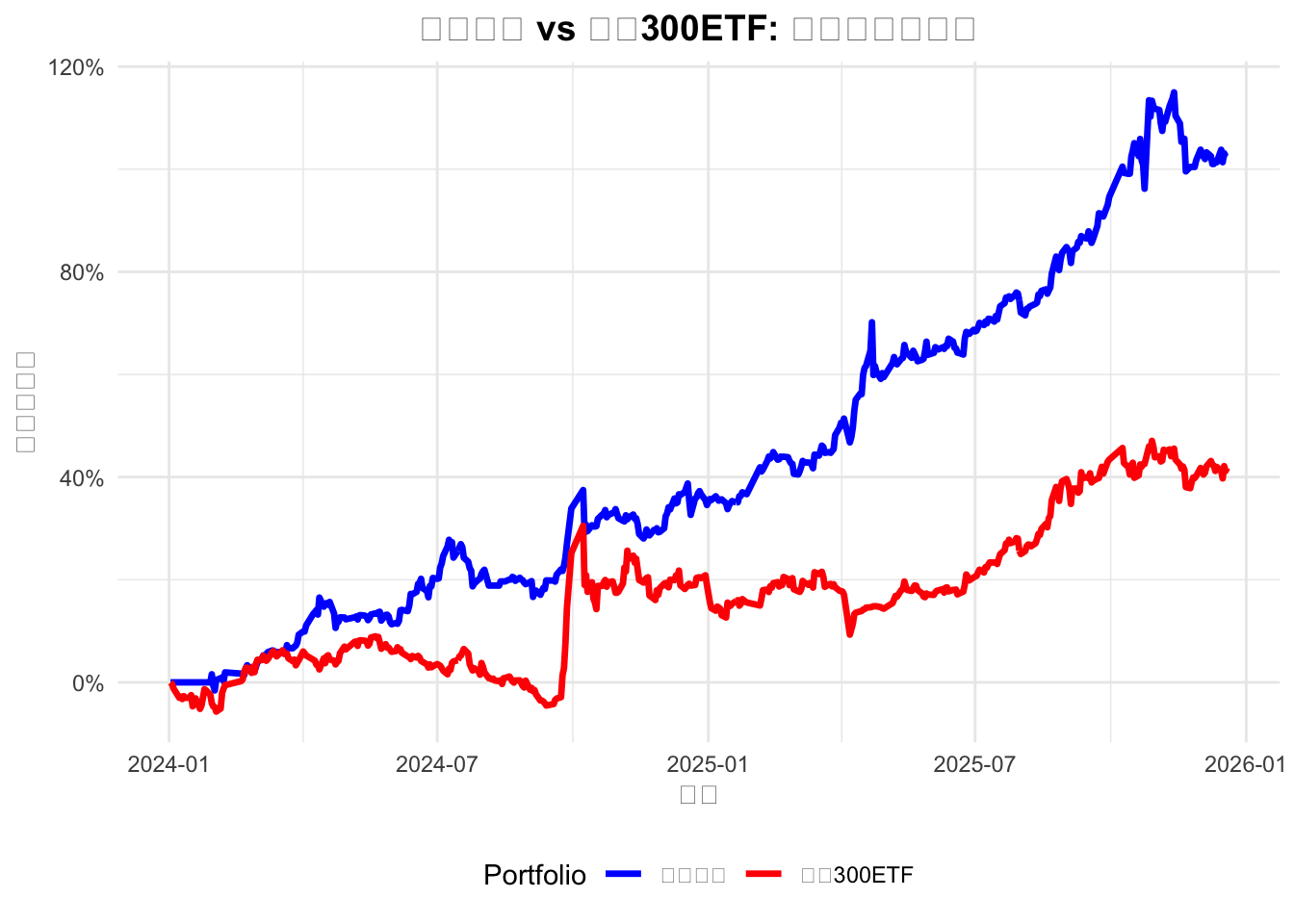

# 图表1:策略 vs 基准累计收益率和最大回撤对比

p1 <- ggplot(cumulative_long %>% filter(Portfolio %in% c("动量策略", "沪深300ETF")),

aes(x = Date, y = CumulativeReturn, color = Portfolio)) +

geom_line(size = 1.2) +

labs(title = "动量策略 vs 沪深300ETF: 累计收益率对比",

x = "日期", y = "累计收益率") +

scale_y_continuous(labels = percent_format()) +

scale_color_manual(values = c("动量策略" = "blue", "沪深300ETF" = "red")) +

theme_minimal() +

theme(legend.position = "bottom",

plot.title = element_text(hjust = 0.5, size = 14, face = "bold"))

## Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

## ℹ Please use `linewidth` instead.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

## generated.

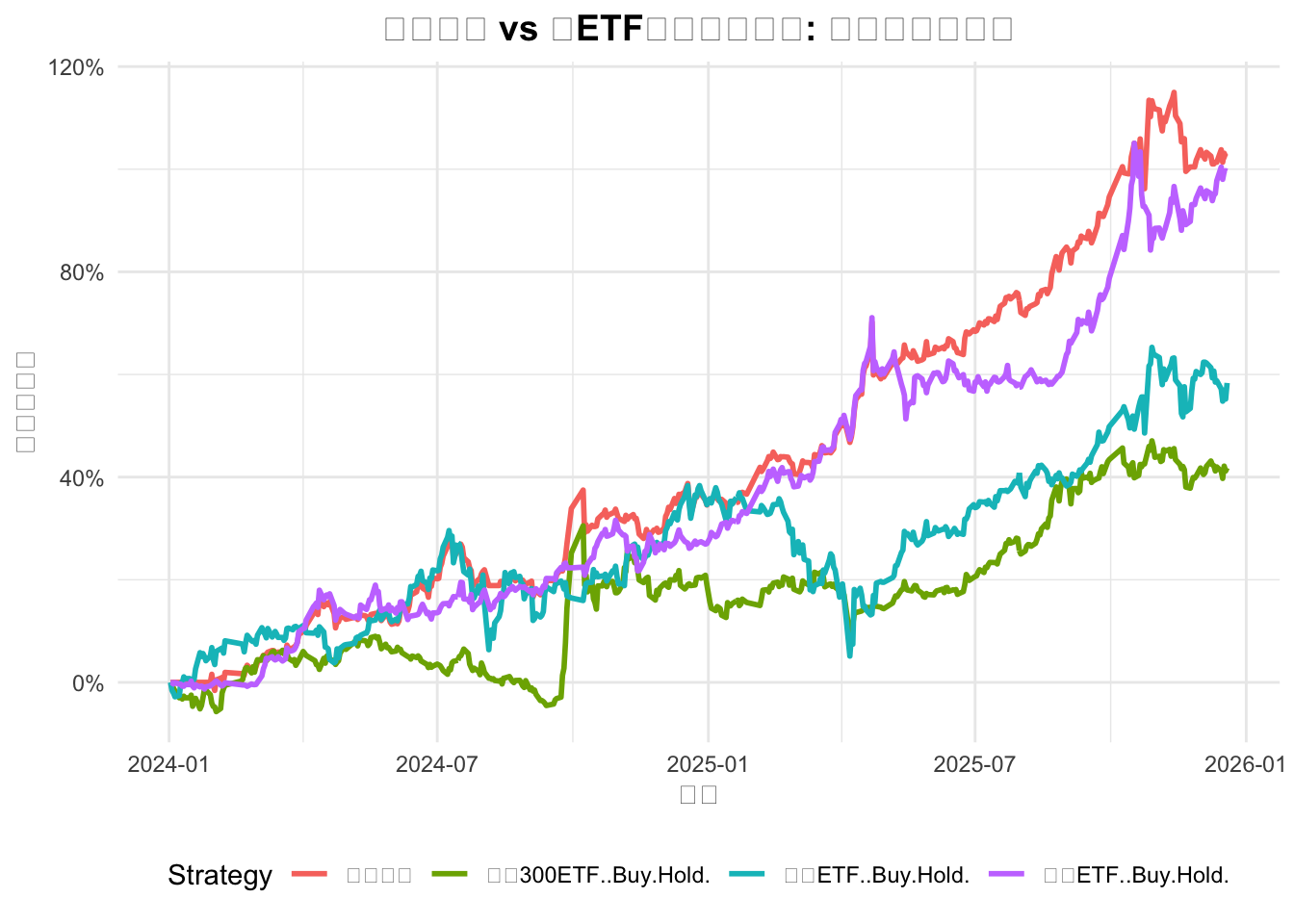

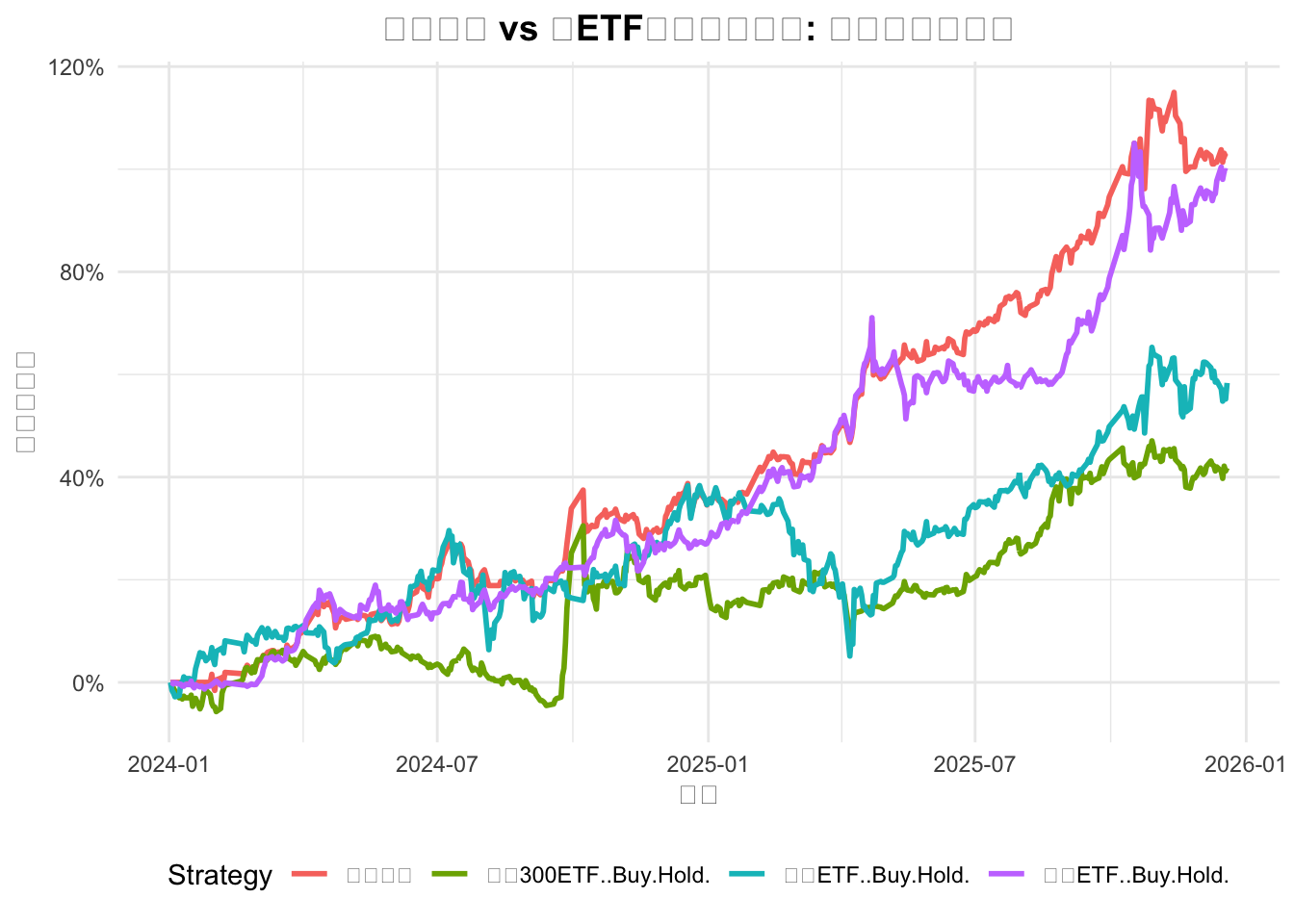

# 图表2:策略 vs 各ETF Buy & Hold对比

# 计算各ETF的累计收益率

etf_cumulative <- do.call(merge,

lapply(1:length(etf_names),

function(i) cumprod(1 + na.fill(returns_all[, i], 0)) - 1))

colnames(etf_cumulative) <- paste0(etf_names, " (Buy&Hold)")

all_cumulative <- merge(cumulative_returns[, "动量策略"], etf_cumulative)

all_cumulative_df <- data.frame(Date = index(all_cumulative),

as.data.frame(all_cumulative))

all_cumulative_long <- pivot_longer(all_cumulative_df,

cols = -Date,

names_to = "Strategy",

values_to = "CumulativeReturn")

p2 <- ggplot(all_cumulative_long, aes(x = Date, y = CumulativeReturn, color = Strategy)) +

geom_line(size = 1) +

labs(title = "动量策略 vs 各ETF买入持有策略: 累计收益率对比",

x = "日期", y = "累计收益率") +

scale_y_continuous(labels = percent_format()) +

theme_minimal() +

theme(legend.position = "bottom",

plot.title = element_text(hjust = 0.5, size = 14, face = "bold"))

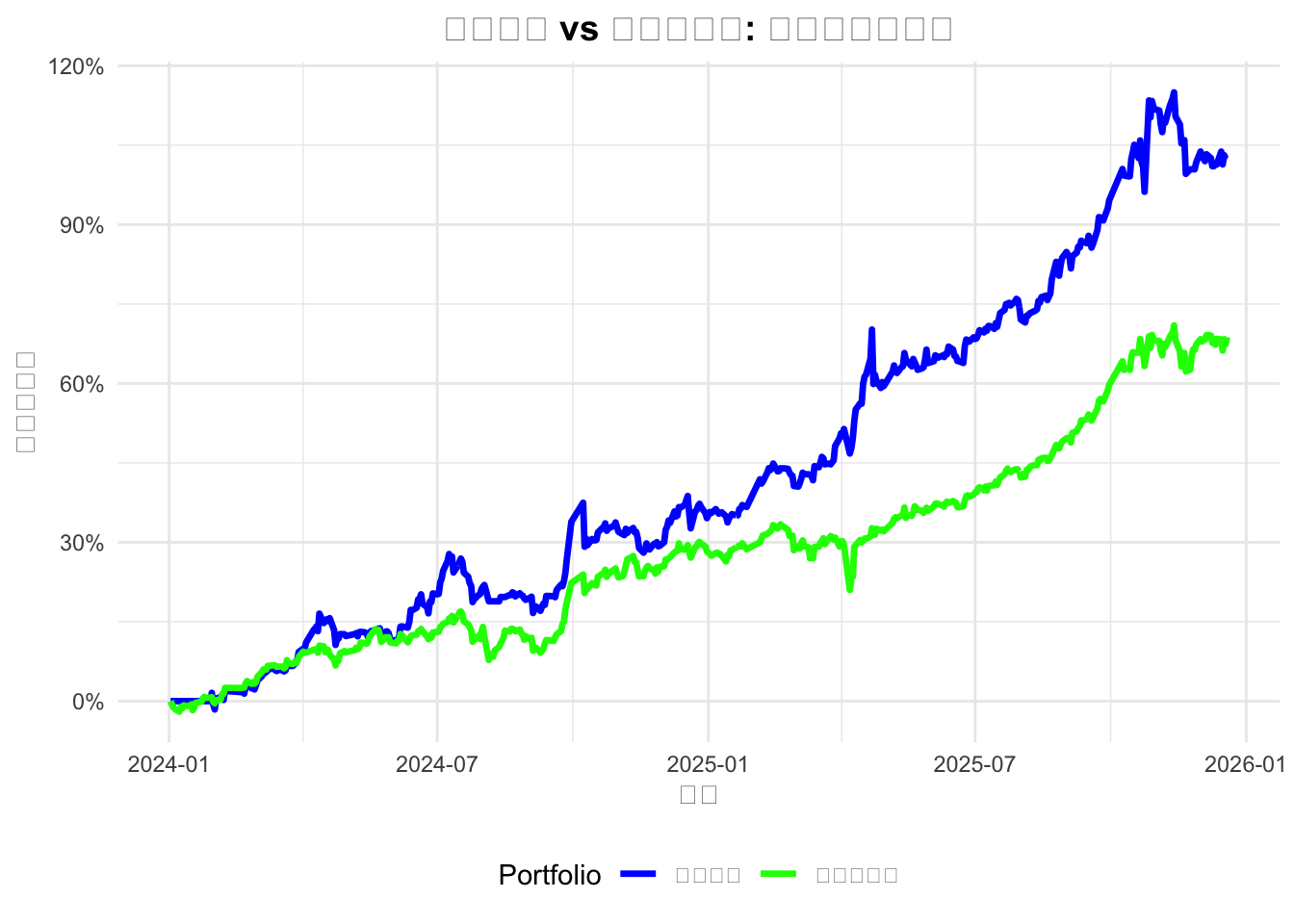

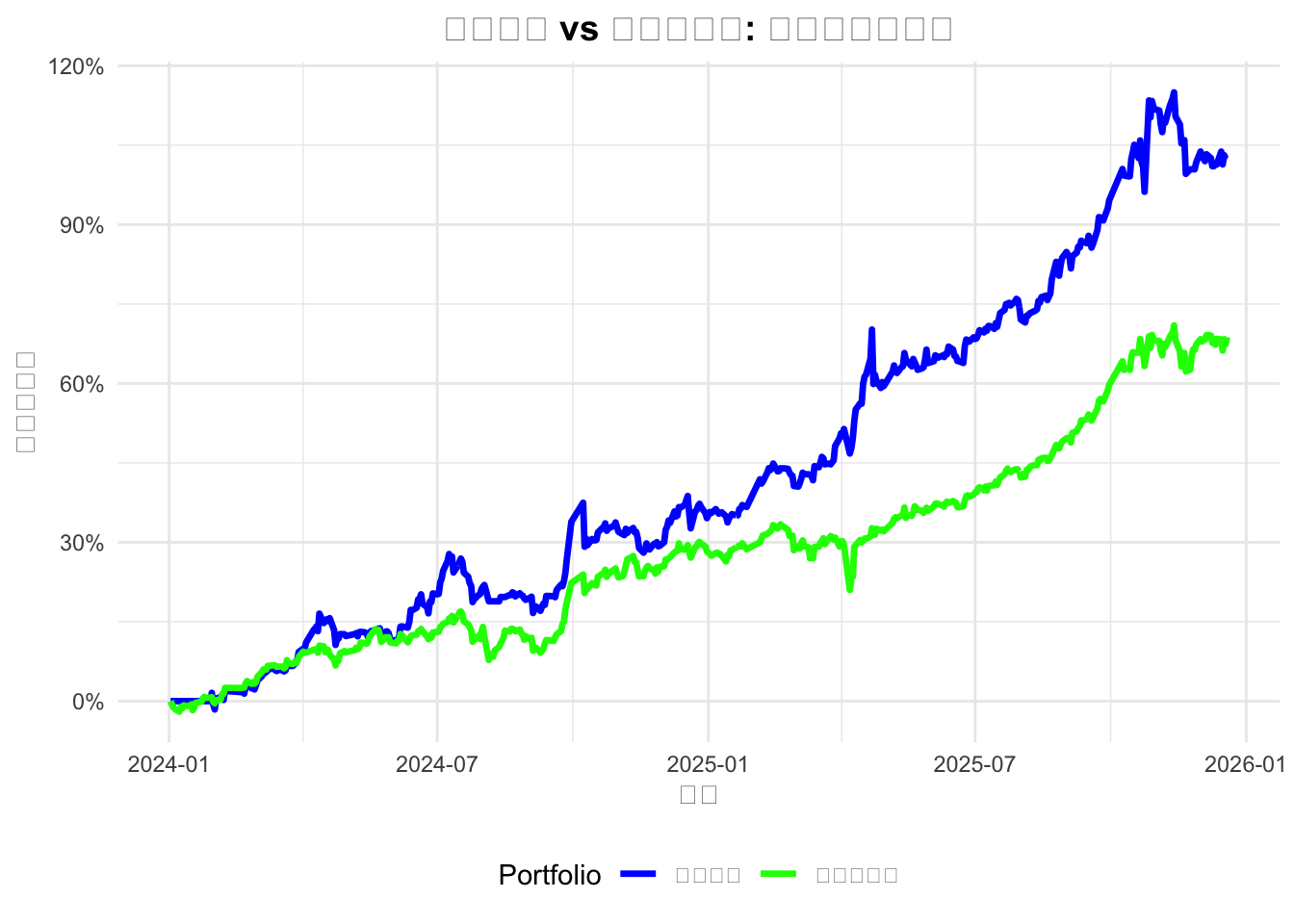

# 图表3:策略 vs 等权重组合对比

p3 <- ggplot(cumulative_long %>% filter(Portfolio %in% c("动量策略", "等权重组合")),

aes(x = Date, y = CumulativeReturn, color = Portfolio)) +

geom_line(size = 1.2) +

labs(title = "动量策略 vs 等权重组合: 累计收益率对比",

x = "日期", y = "累计收益率") +

scale_y_continuous(labels = percent_format()) +

scale_color_manual(values = c("动量策略" = "blue", "等权重组合" = "green")) +

theme_minimal() +

theme(legend.position = "bottom",

plot.title = element_text(hjust = 0.5, size = 14, face = "bold"))

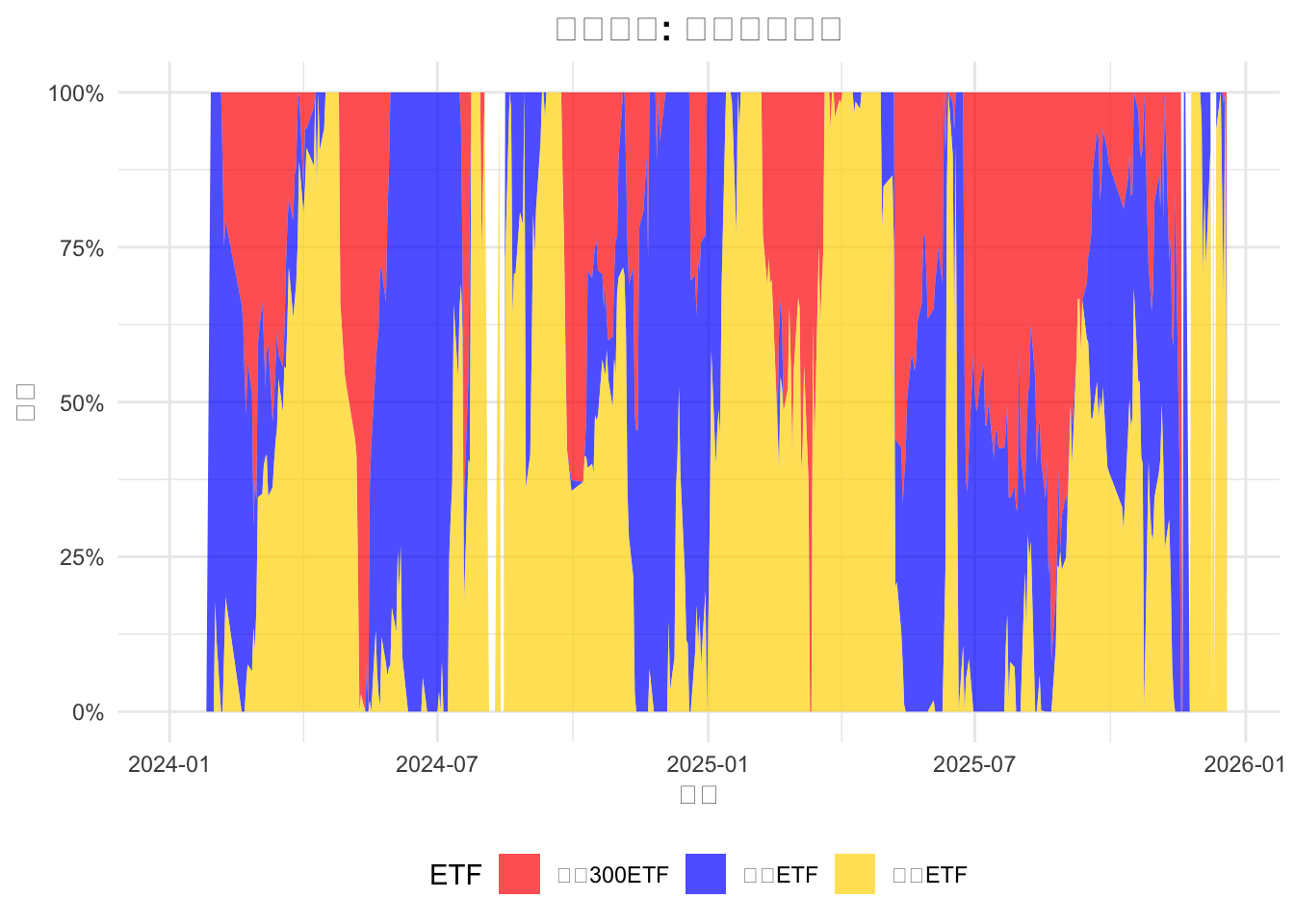

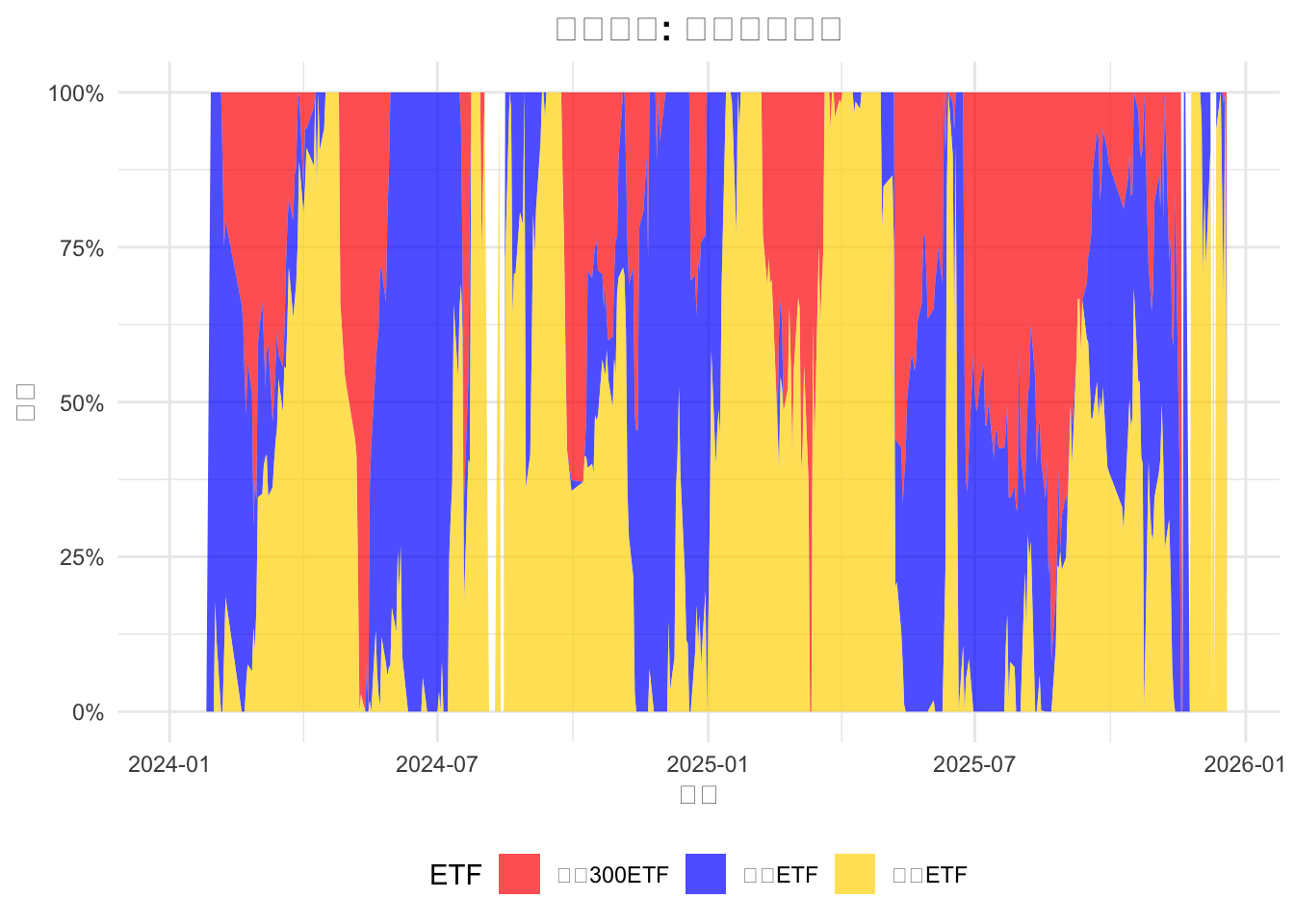

# 图表4:权重随时间变化图

# 准备权重数据

weights_long <- pivot_longer(daily_weights_df,

cols = all_of(etf_names),

names_to = "ETF",

values_to = "Weight")

p4 <- ggplot(weights_long, aes(x = Date, y = Weight, fill = ETF)) +

geom_area(position = "stack", alpha = 0.7) +

labs(title = "动量策略: 每日权重分配",

x = "日期", y = "权重") +

scale_y_continuous(labels = percent_format()) +

scale_fill_manual(values = c("纳指ETF" = "blue",

"沪深300ETF" = "red",

"黄金ETF" = "gold")) +

theme_minimal() +

theme(legend.position = "bottom",

plot.title = element_text(hjust = 0.5, size = 14, face = "bold"))

# 12. 显示图表

# cat("\n正在显示图表...\n")

print(p1)

# cat("\n\n")

print(p2)

# cat("\n\n")

print(p3)

# cat("\n\n")

print(p4)